The break-even analysis helps you find the point at which a company’s total revenue equals its total costs. This analysis allows you to determine the number of product units that need to be sold to reach profitability, given the product’s price and costs.

🔎 In this article, we’ll show you how to tackle the break-even analysis in a case interview. Enjoy reading!

What is Break-Even Analysis?

A break-even analysis is crucial for assessing a company’s profitability. It illustrates the relationship between profit, revenue, and costs, helping to calculate the break-even point (BEP). It's essential to understand the concept of fixed and variable costs.

👉 Make sure to check out our article on fixed and variable costs!

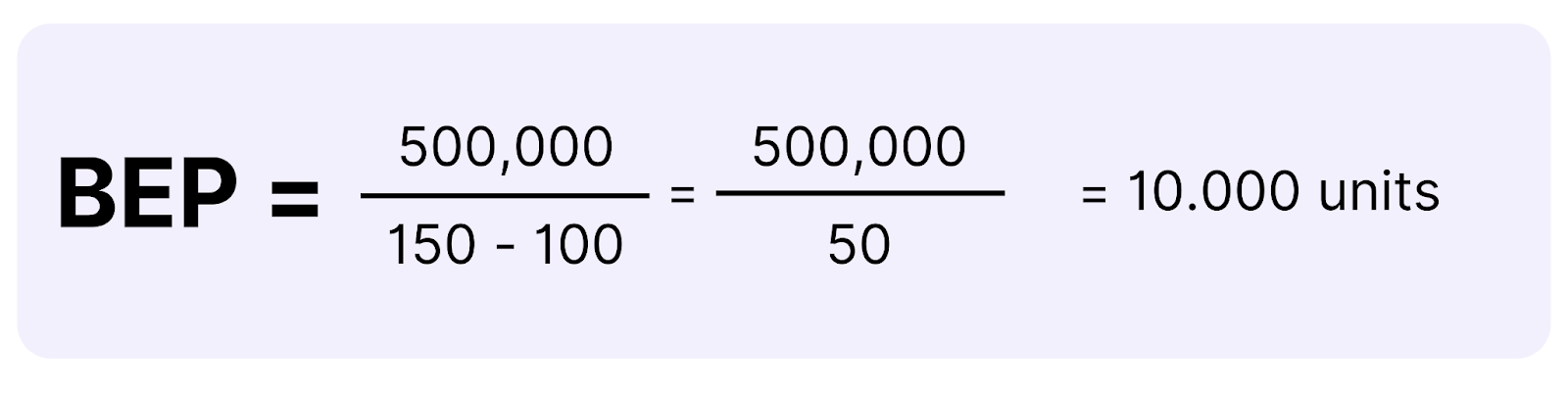

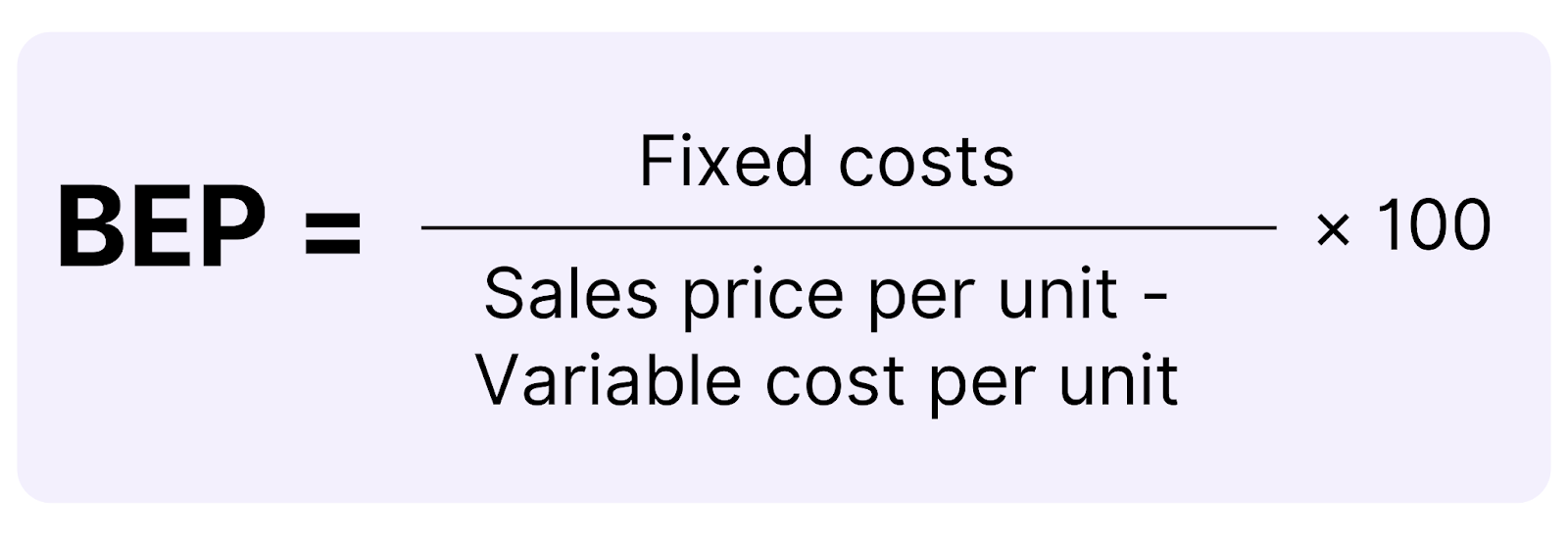

The formula for calculating the break-even point is:

When fixed costs are greater than zero, it’s critical to have a positive contribution margin per unit (i.e., the price must be higher than variable costs) to reach a break-even point.