Opportunity costs are a fundamental concept in economics and play a key role in case interviews. Simply put, they refer to the cost of choosing one option and giving up the benefits of another. Sounds simple, right?

But how exactly can you apply this concept in a case interview? 🤔 Let's break it down step by step, and by the end, we’ll show you an example of how it works in practice.

What are Opportunity Costs?

Imagine you have two options: either go to the movies with friends, or spend the same time working on your business case. If you choose the movie, you lose the chance to make valuable progress on your project. What you lose by making that choice are your opportunity costs.

In economics, it means that whenever resources like time, money, or labor are used for one option, the benefits of the alternatives not chosen must be considered as costs. So, decisions are not just about making the “right” choice, but also about understanding what you give up when choosing a specific option. In a case interview, demonstrating this concept shows that you can think critically and consider the consequences of decisions – a vital skill consultants use daily.

👉 Relevant: Decision-making frameworks

What Role Do Opportunity Costs Play in a Case Interview?

Opportunity costs often come up, either directly or indirectly, in case interviews:

- Directly: When evaluating alternative investments or decisions.

- Indirectly: In any decision-making situation where one option is chosen over another.

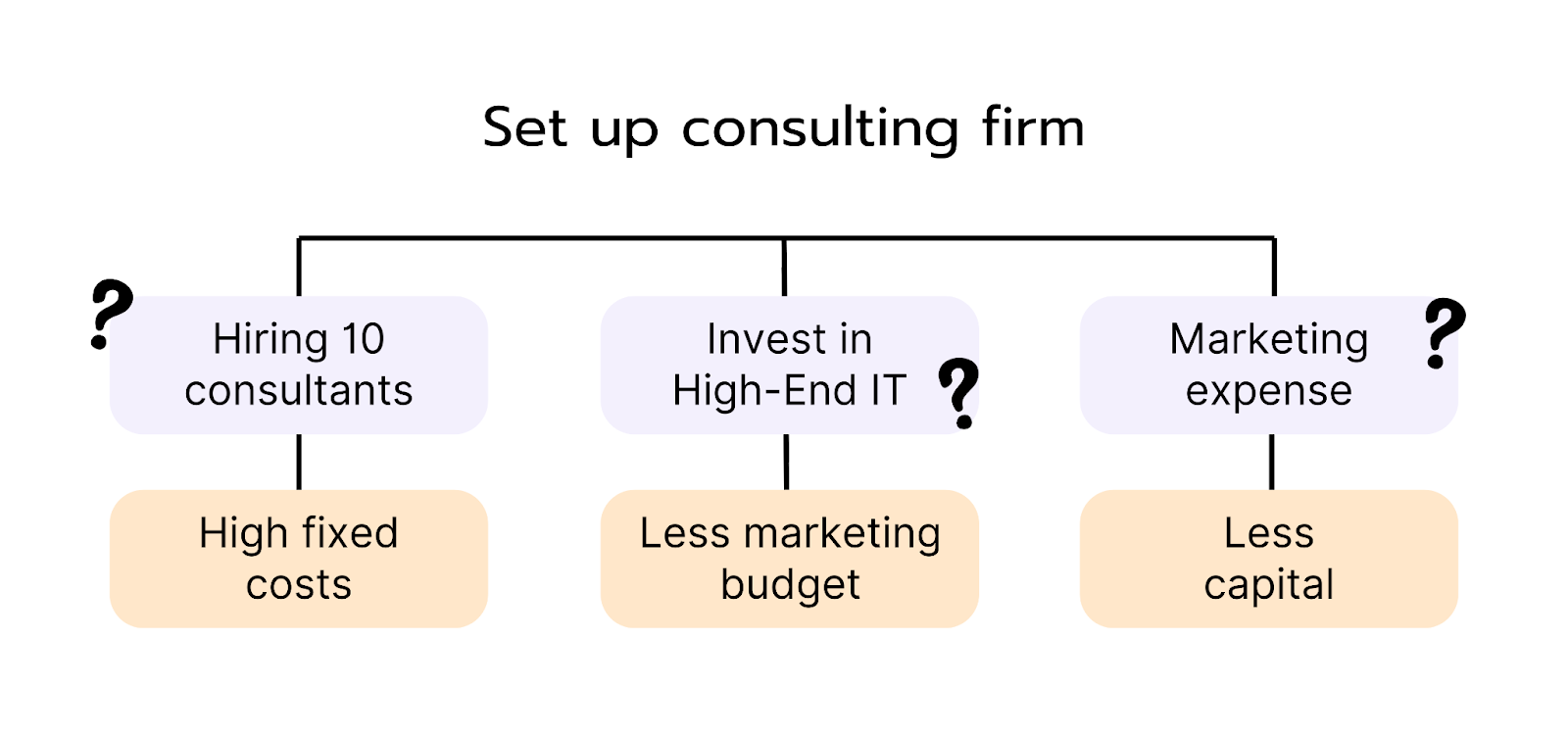

But why? Because most options are mutually exclusive (see MECE), and choosing one often means giving up another. The key principle is that you always consider the option with the highest opportunity cost. This means the option with the highest opportunity cost is the most “expensive” if ignored. If you show in a case interview that you understand opportunity costs, you demonstrate strategic thinking. Opportunity costs are closely related to discounting, a standard method in finance, where the discount rate represents the opportunity cost of investing money elsewhere at a certain interest rate.

💡 Pro tip: It’s not just about crunching numbers. Always ask yourself, “Which alternative am I not pursuing, and what am I losing by not choosing it?”.

Especially in complex cases where you need to choose between multiple options – like a market entry or product development – opportunity costs are key to making the best decision. This shows the interviewer that you have a broad view of the situation.

👉 Check out our case library and find cases on market entry or new products!