There are several common case types that occur in case interviews for management consulting roles. Profitability cases are some of the most frequent ones. These cases require a structured approach, analytical thinking, and a deep understanding of business fundamentals. Let’s take a look at what profitability cases actually are and how you can approach them successfully.

Profitability Cases – The Number 1 Reason for Most Consulting Projects

One of the most common reasons why firms instruct consulting firms with their projects is that they struggle with their profitability. As a consultant you will have to diagnose the underlying issues, come up with potential solutions and recommend actions to improve profitability.

As a candidate in a case interview, the task is pretty much the same, but on a smaller scale. The good news is: Once you have understood the basic structure of profitability cases, you can solve them no matter the industry or concrete business scenario. The underlying concept is always the same and not very difficult.

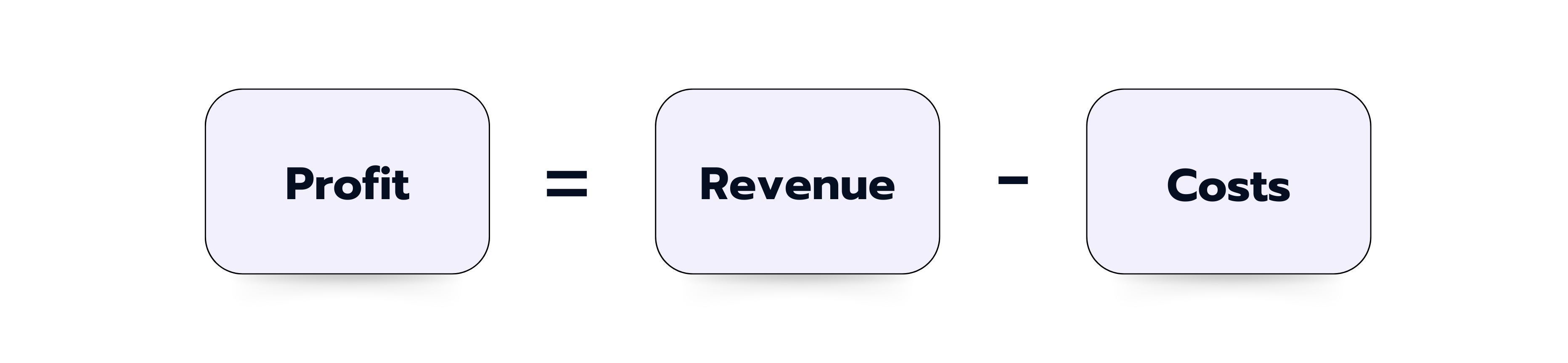

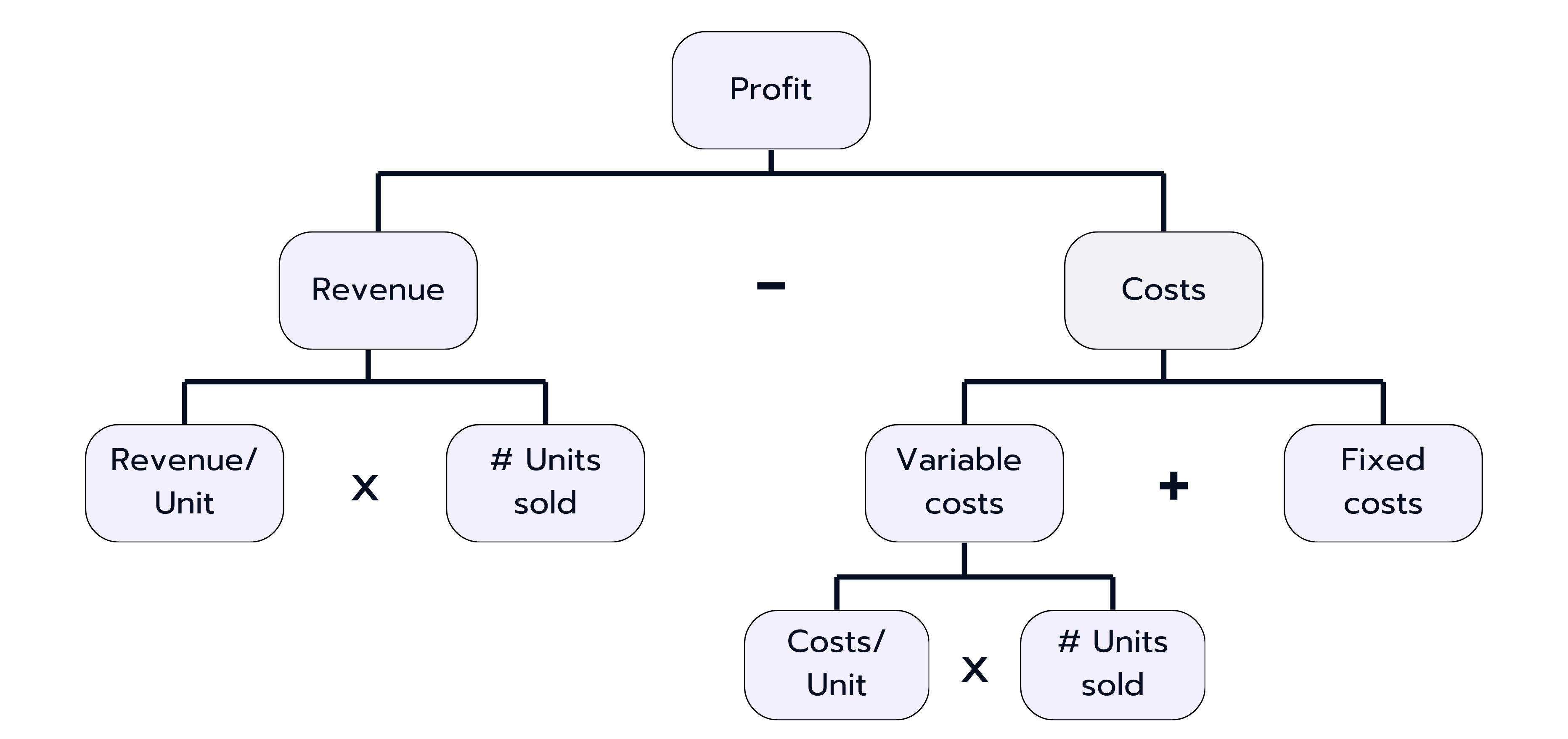

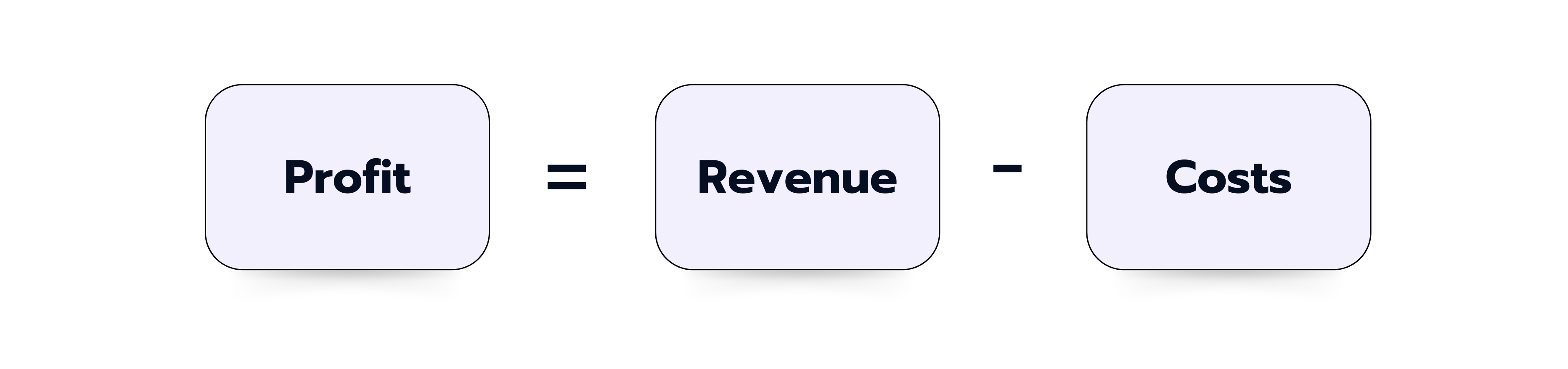

Profitability issues always stem from falling revenues, rising costs, or both. It is as simple as that. Your task will be two-fold: Perform a structured and quantitative analysis of the data to isolate the problem, and then find a promising solution. In most cases, you can use the profitability framework to structure the problem, but make sure to not blindly apply it, but to really understand the problem at hand and make adjustments as needed in the concrete business scenario.

The Profitability Framework – A Basic Tool to Structure Your Profitability Case

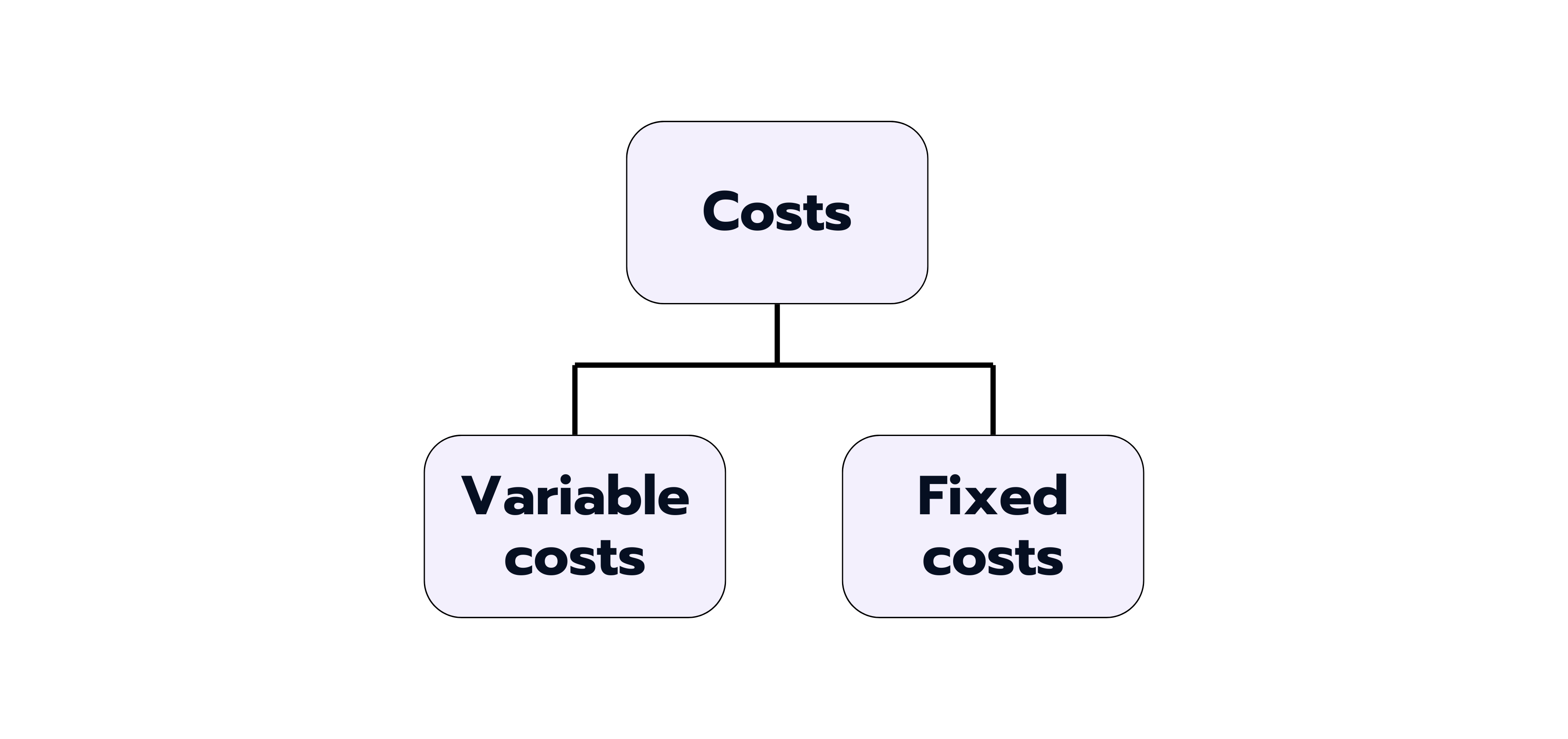

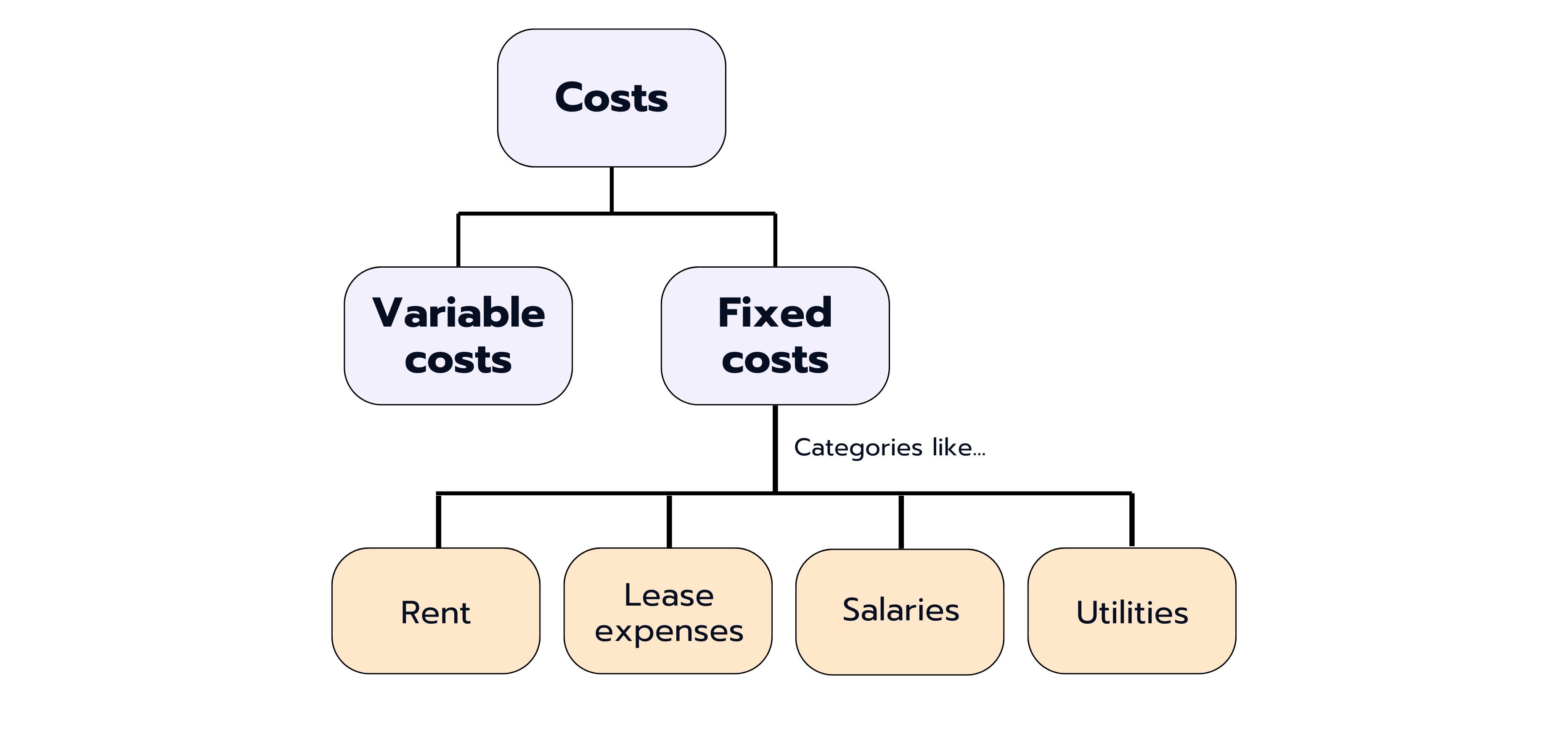

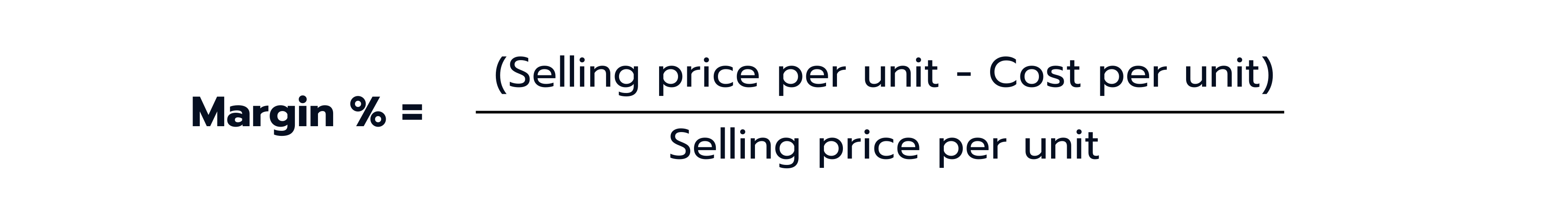

The Profitability Framework is a fundamental tool for approaching profitability cases. It is basically an issue tree that breaks down profitability into its key components: revenues and costs.

In the first place, this equation is pretty straightforward and not complicated at all. Next, it is your task to understand each side of the equation and identify the cause for declining profitability. There could be three reasons:

- Revenues have been declining.

- Costs have been increasing.

- Revenues have been declining and costs have been increasing.

(Always make sure to remember this option. It happens pretty easily that candidates identify either revenue or cost issues as the problem, completely focus on one side of the issue tree and forget to zoom out again, take a look at the big picture and consider the other side of the equation as well.)

So, the first question to get an answer to is “Have revenues been declining?”, “Have costs been increasing?”, or “Have revenues been declining and costs been increasing? And if so, which one is the bigger problem?”. Whenever you get the information that something has changed: quantify it! Ask by how much and in what time period. Depending on the answer, you will know on which side of your profitability tree you need to start your analysis. Always start with the most relevant driver (Pareto Principle).

💡 Pro Tip: When trying to find out where to start your analysis, keep in mind to communicate like a consultant. A Bainie would not go to the client and bluntly ask “Have your revenues been declining?”, but rather formulate a question like “How have your revenues been developing over the past five years?”. It may be possible that your interviewer will then share an exhibit with you that not only contains revenue information, but also valuable insights on product lines, geographies or other relevant data, which you can use throughout the case.

Scenario 1: Revenues Have Been Declining

Let’s assume, the profitability problem stems from declining revenues. There are many potential reasons for this and you need to find out which one applies in order to come up with a solution. Most important for your analysis is to stay structured at all times.

1. Understand How the Business Makes Revenue

To structure your analysis of declining revenues, you need to understand the business model of the company you advise. So basically answer the questions:

- How does this company make revenue?

- What does the revenue consist of?

- Which component of the revenue has been declining?

Understanding your client’s business model is absolutely crucial for your revenue analysis. Only when you know which products the company sells and which customers it serves, will you be able to give solid advice on how to solve profitability problems.

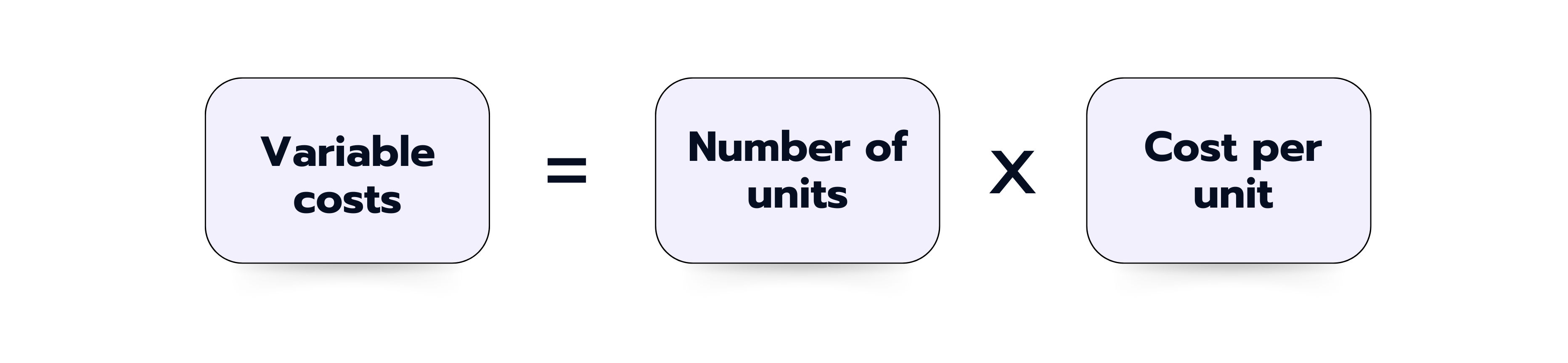

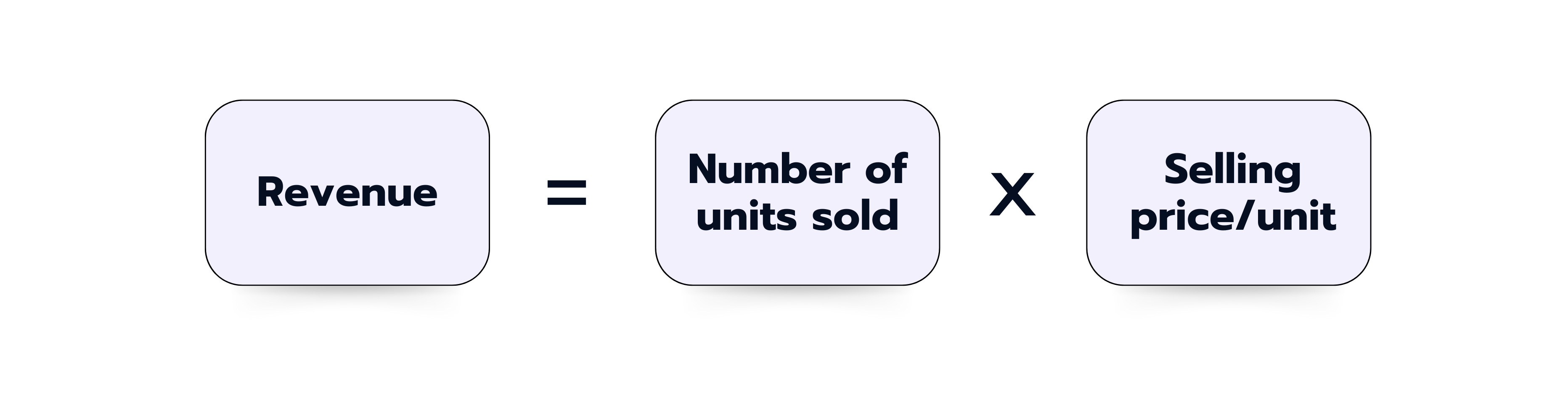

2. Break Down the Revenue into its Single Components

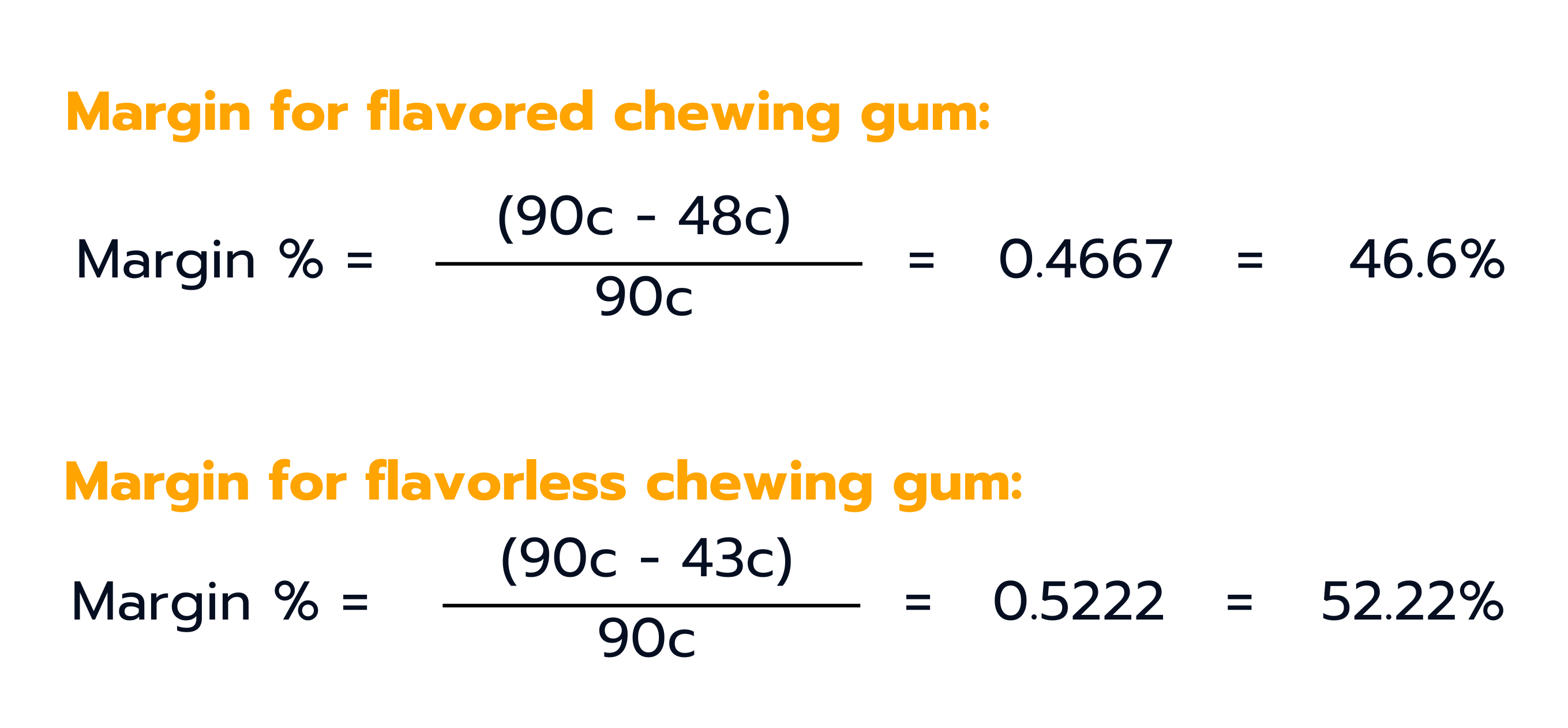

Once you have understood the general business model of your client, you can go on and break down the revenue into its components. Depending on the business model of the company, the equation can differ.

Let’s take a look at some examples depending on different industries:

Manufacturing and Retail Industry

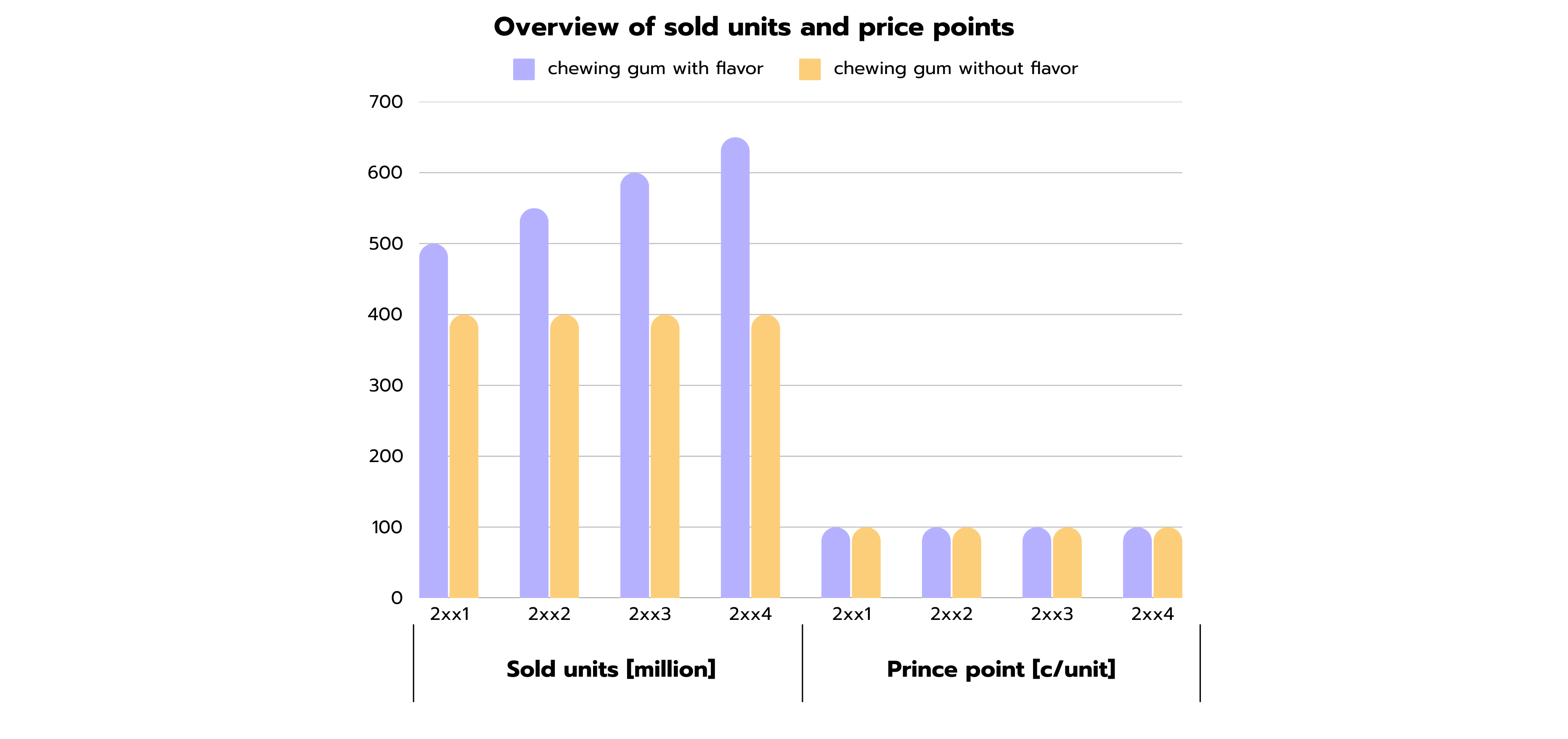

Revenue = Number of Units Sold × Selling Price per Unit

Number of Units Sold: The total quantity of products manufactured or sold to customers.

Selling Price per Unit: The price at which each unit of product is sold to distributors, retailers or customers.

Subscription-Based Services (e.g., Streaming Services, Software as a Service)

Revenue = Number of Subscribers × Monthly Subscription Fee

Number of Subscribers: The total number of customers who subscribe to the service.

Monthly Subscription Fee: The amount charged to each subscriber on a monthly basis.

E-commerce Industry

Revenue = Number of Transactions × Average Transaction Value

Number of Transactions: The total number of orders placed by customers.

Average Transaction Value: The average amount spent by customers per transaction.

Advertising Industry (e.g., Digital Advertising, Print Media)

Revenue = Impressions or Clicks × Cost per Impression or Click

Impressions or Clicks: The total number of times an ad is viewed or clicked by users.

Cost per Impression or Click: The cost charged to advertisers for each impression or click generated.

Hospitality Industry (e.g., Hotels, Restaurants)

Revenue = Number of Rooms or Seats Occupied × Average Room Rate or Meal Price

Number of Rooms or Seats Occupied: The total number of rooms booked or seats occupied by guests.

Average Room Rate or Meal Price: The average price charged per room or meal.

It becomes obvious that there is no one-size-fits-all-solution for a revenue analysis. You need to adjust your approach according to the client’s business model and needs.

3. Analyze the Single Components of the Revenue Model

Once you have a clear picture of what the revenue of your client is composed of, you can go on with your analysis by focusing on the component of the equation that appears to be the problem. For example, if your client is a manufacturer with declining revenues, you should find out if the number of units sold has been decreasing or the selling price per unit has been lowered (or a combination of both).

If the number of units sold has decreased, you go on with a further analysis on the reasons behind. These can be manifold, so make sure to stay structured and use segmentation to get to the root cause of the problem.

The segmentation you use needs to be customized to the case at hand. Make sure to let your interviewer know your thoughts and guide him or her through the case. That way, you will usually get valuable hints on which direction to go.

Examples for segmentations are:

- Product segmentation: Product types? Price ranges? Packaging sizes?

- Customer segmentation: Small / medium-sized / large businesses? Age groups? Sex? Income groups?

- Market segmentation: Geographies? Industry verticals?

- Channel segmentation: Distribution channels?

If you’ve found the biggest driver of the problem, you oftentimes have to switch to a more qualitative framework (for example the 4 Cs) to find the underlying root cause. For example: when you have less revenue, but the price is the same and units sold dropped, you have to find out why. Is there a new competitor on the market? Do you have quality problems, or did you just stop a marketing initiative that you ran for years prior to this drop?

The same procedure applies if pricing seems to be the issue for declining revenues. “Let’s increase prices” might be an easy recommendation to give, but most likely too easy to be valuable. It is crucial to understand first, why prices have decreased and again, the reasons might be diverse. Make sure to use a structured approach in order to pinpoint the exact problem.

Possible reasons and forces for decreasing prices may be:

- Internal:

- Increased Supply: Overproduction or excess inventory can lead to discounted pricing to clear out stock.

- Competitive Pricing: Aggressive pricing strategies by competitors can force companies to lower prices to remain competitive.

- External:

- Price Sensitivity of Customers: Changes in customer price sensitivity and purchasing behavior can influence demand and pricing strategies.

- Market Saturation: Increased competition and market saturation can lead to price wars and downward pressure on prices.

- Economic Conditions: Economic downturns or recessions can impact consumer purchasing power and demand for products.

- Exchange Rates: Fluctuations in exchange rates can affect import/export prices and overall cost structure.

It may not be surprising that when looking out for the reasons of the client’s revenue problem, staying structured is most important. Come up with solid hypotheses and validate or neglect them in the dialogue with your interviewer and based on the data that will be provided to you throughout the conversation. This requires flexibility and spontaneity, so learning frameworks by heart will not help you here. It is important to internalize the way of thinking a consultant uses and solve cases with peers to put it into practice.

👉 To find like-minded candidates for mock interviews, take a look at our Meeting Board and simply accept one of the open invitations.