M&A cases are quite common in management consulting, especially for candidates applying to firms with a focus on strategy, corporate finance, or (of course) mergers and acquisitions. While they don’t make up the majority of cases, they are frequently used to assess your strategic thinking, ability to analyze financial data, and understanding of the impact of complex business decisions.

What Are M&A Cases?

In an M&A case, you analyze whether a merger, acquisition, or divestiture makes sense for a company. To do this, you examine market conditions, financial metrics, competition, and strategic synergies to provide a well-founded recommendation.

Growth strategy cases often lead to M&A considerations. Companies with excess capital may seek acquisitions to expand—whether through vertical integration (suppliers or distributors), horizontal integration (competitors), or diversification. The key factors for a successful M&A deal are value creation and cultural fit.

A typical M&A case prompt:

"Your client, a mid-sized retail chain, is considering acquiring a smaller competitor to expand market reach and increase profitability. Analyze the strategic rationale, financial implications, and provide a recommendation. What factors would you consider?"

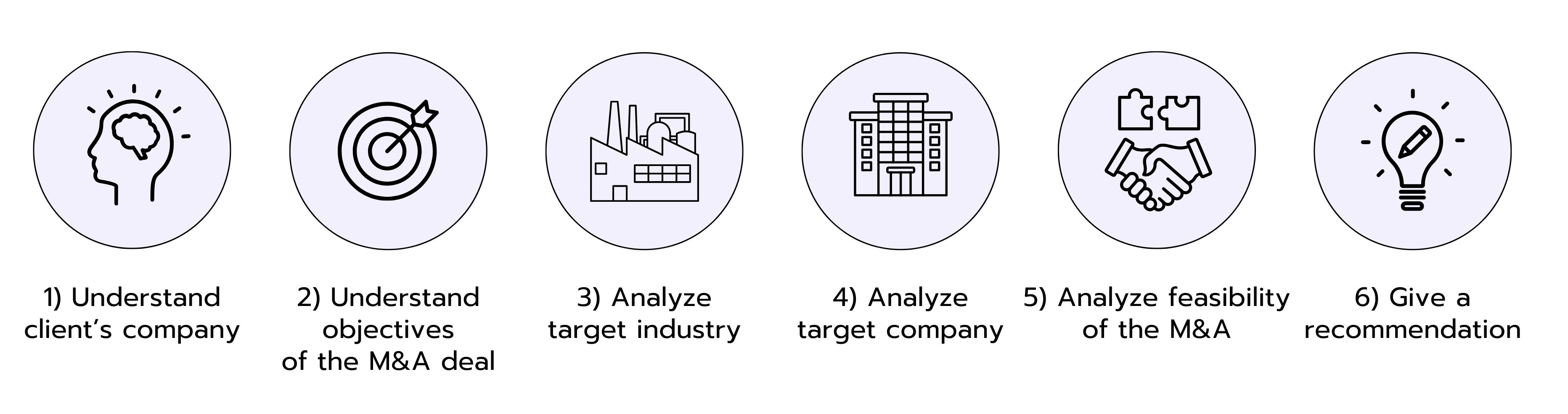

How Can You Approach an M&A Case – Key Areas to Analyze

First of all, there is no standardized approach or pre-made framework that you can use for all M&A cases (or cases in general). It is absolutely crucial that you understand your client’s unique situation and develop a tailored solution for the task at hand.

It is also possible that your M&A case does not resolve the question if a deal should be aimed for or not, but rather focuses on issues in the post merger integration process. Therefore, it is absolutely crucial that you listen carefully during the case prompt, reassure yourself that you understand the problem and objective of the client correctly and adjust your approach accordingly.

1. Understand Your Client’s Company.

Before you dive into your M&A analysis, you first need to understand your client’s company. In which industry does the client operate? What product or service do they offer? Who are the key customer segments, and how is the company structured? Does the client have other business units that could offer synergy potential in the context of an M&A deal?

Once you truly understand your client’s business model, it will be much easier to develop a structure for your M&A analysis. Even the simple question of whether you're advising a manufacturer or a service provider can help you form solid hypotheses about the deal’s objectives. For a service company, gaining access to talent may be an obvious reason for acquiring another firm, whereas a manufacturer might be more interested in creating cost synergies through vertical integration.

But be careful not to jump to conclusions too quickly. You need to understand your client’s specific situation in order to provide valuable, tailored advice.

2. Understand the Objectives of the M&A Deal.

Begin by clarifying the objectives of the M&A deal. Analogous to making a purchase at a grocery store, M&A can generally be viewed as a "buying decision". We know that a consumer first determines the "need" to buy a product. There are various objectives that a company may have for pursuing an M&A deal and understanding the strategic rationale behind the acquisition is crucial. Let’s take a look at potential reasons for M&A deals:

- Strategic acquisitions generally aim at improving the market position and realizing growth opportunities. Entering new geographic markets or industries, diversifying into new product lines, or reaching new customer segments are common ways to broaden market reach and strengthen the market position.

- Defensive acquisitions, also known as "defensive mergers" or "defensive takeovers," refer to strategic actions taken by a company to proactively protect itself against potential threats or risks. These acquisitions are typically pursued to secure the company's competitive position and reduce specific vulnerabilities. An example for a defensive acquisition would be purchasing or merging with competitors in the industry to consolidate market share and increase barriers to entry. By eliminating rivals or reducing competitive pressures, the acquiring company can protect its market dominance and pricing power.

- Synergies and value creation

Whilst most mergers and acquisitions are evaluated with mid- to long-term objectives, opportunity-driven M&A deals are also an option. If a company is undervalued due to ineffective management or an unfavorable market, it may become an attractive acquisition target for a buyer with the power to bring it back to its potential value.

It becomes clear that the reasons for M&A deals are diverse and it is impossible to list them all. So, when identifying the objectives of your client, start at a high level, dig deeper when you receive the feedback from your interviewer that you are on the right track and communicate your hypothesis and logical thinking very clearly.

3. Analyze the Target Industry.

Once it's clear why the client is interested in acquiring a particular company, start by looking at the industry the client wants to buy. This analysis is crucial since the outlook of the industry might overshadow the target's ability to play in it. For instance, small/unprofitable targets in a growing market can be attractive in the same way as great targets can be unattractive in a dying market.

Potential questions to assess are:

- How big is the market?

- What are the market’s growth figures?

- Can the market be segmented, and does the target only play in one of the segments of the market?

- What is the focus? Is it a high volume/low margin or a low volume/high margin market?

- Are there barriers to entry?

- Who are the key competitors in the market?

- How profitable are the competitors?

- What are possible threats?

Porter's Five Forces can be a good starting point for a structured market analysis, but don’t use this framework as it is (and absolutely never mention its name in the interview; just think of what would happen if a company paid McKinsey for a market analysis and the $4,000 daily rate consultant came back with Porter’s Five Forces). Understand the framework as a helpful tool and adjust it to the individual scenario and market conditions your client is facing.

4. Analyze the Target Company.

After analyzing the target industry, understand the target company. Try to determine its strengths and weaknesses (see SWOT analysis) and perform a financial valuation to determine the attractiveness of the potential target. You are technically calculating the NPV of the company, but this calculation is most likely not going to be asked for in the case interview. However, having the knowledge of when it is used (e.g., financial valuation) is crucial. The following information can be analyzed to determine the target attractiveness:

- The company’s market share

- The company’s growth figures as compared to that of competitors

- The company’s profitability as compared to that of competitors

- How can current businesses from the client leverage revenues and profitability from the business to be acquired (keyword synergies)?

- Does the company possess any relevant patents or other useful intangibles?

- Which parts of the company to be acquired can benefit from synergies?

- The company’s key customers

- Valuation

- How much is the target company asking for, and is the price fair (see cost-benefit analysis)?

- Can the acquiring company afford to pay the valuation?

- Financial valuation will generally include industry & company analysis.

5. Analyze the Feasibility of the M&A.

Finally, make sure to investigate the feasibility of the acquisition. Take a look at the challenges and risks associated with the deal and get a clearer picture of the concrete conditions for a potential acquisition or merger.

Important questions here are:

- Is the target open for an acquisition or merger in the first place? If not, can the competition acquire it?

- Are there enough funds available (have a look at the balance sheet or cash flow statement)? Is there a chance of raising funds in the case of insufficient funds through loans etc.?

- Is the client experienced in the integration of acquired companies? Could a merger pose organizational/management problems for the client?

Are there other risks associated with a merger? (For example, think of political implications and risks of failure, like with the failed merger of Daimler and Chrysler.)

6. Give a Recommendation.

At the end of your analysis, give your client a solid recommendation of what to do. Start with your answer first: Should the client acquire the target company or not? Should a merger be pursued or not? Then go on with the reasons behind and structure your recommendation logically. In most cases, three arguments to support your recommendation will be a good number. Prioritize them and communicate them on point.

But note: Even though you want to give a clear recommendation at the end of your case, answers to M&A questions are usually more complex than a simple “yes” or “no”. If you want to shine in your interview, demonstrate that you are aware of the risks and challenges the decision of your client may entail. Mention them shortly and give an outlook on further analysis you would conduct to confirm your recommendation.