Questions about market size are frequently asked in case interviews in consulting because they require a blend of logic, mathematics, and common sense. They can be asked as standalone questions or as part of a larger case. Applicants who are familiar with market sizing questions can really perform here.

Market Sizing

What Are Market Sizing Cases?

If you're applying to top consulting firms like McKinsey, BCG, or Bain, you're unlikely to escape a market estimation case. Market sizing cases are considered "back-of-the-envelope" calculations because they can be done on the back of an envelope. Despite the name, it's not just about estimating market sizes; other estimations may also be asked for.

For example, if you're discussing a British clothing retailer's growth strategy, you could calculate on an envelope how large the online clothing market is and what percentage of the market the retailer already penetrates. If you perform these calculations quickly, the conversation with the client stays fluid, leaving a good impression.

You can receive the question about market size as a standalone case (although this is less common) or as part of a more comprehensive problem, such as market entry. The good news: There's no right or wrong answer when it comes to the question of market size. The interviewer is less concerned about the specific number you come up with for the market than the approach you took to arrive at that number.

Why Are Market Sizing Cases Commonly Used in Consulting Interviews?

Market Sizing Cases are used to test your quantitative and logical abilities. The interviewer wants to ascertain whether you work well with numbers and if you can make informed assumptions and deal with ambiguities. Questions about market size aren't just about the size of markets; they also involve other types of estimations, such as the number of golf balls in a jumbo jet. As you may have noticed, math is crucial in tackling these questions since you don't have a calculator to rely on. Most importantly, you need to be comfortable dealing with large numbers like millions and billions as well as percentages. More on that later.

How Do You Best Approach Market Sizing Cases?

Now that we understand the theory behind Market Sizing Cases and their relevance to your case interview, let's take a closer look at the process.

Segmentation – The Key to Market Sizing Cases

If you've done some reading on case interviews before delving into market sizing questions, you might have come across areas where segmentation is necessary. Segmenting data is a crucial skill you must master as both a candidate in a case interview and in your later career as a consultant. Segmentation generally refers to dividing a larger whole into smaller parts or segments. The principle you need to understand to do this correctly is the MECE principle.

MECE stands for "mutually exclusive, collectively exhaustive." Simply put, segmenting a group of data according to the MECE principle means forming subgroups that do not overlap but collectively cover the entirety of the data, meaning no data is missing. An example useful for market sizing questions is dividing a country's population into age groups (as different age groups often behave differently).

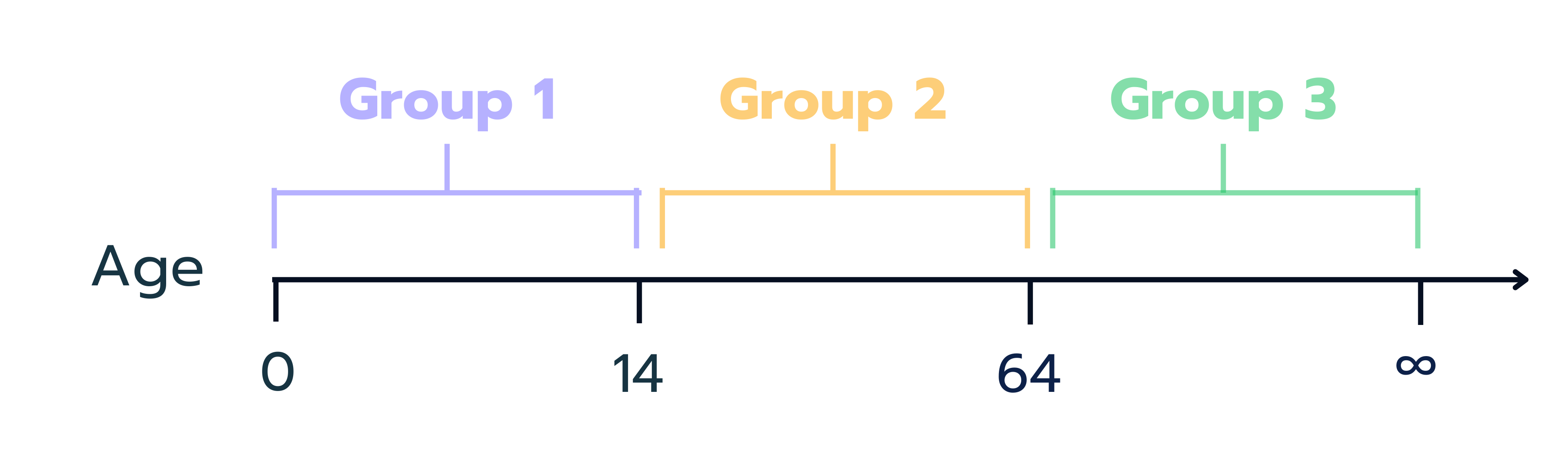

Below is a breakdown into Group 1 in the age range 0 to 14, Group 2 in the age range 15 to 64, and Group 3 for everyone over 65:

Note that none of the groups overlap, so no age is counted twice, but also no age is overlooked. Now that the population is correctly segmented, we can treat each group differently. If we had divided the population of the United Kingdom into the aforementioned groups, we could estimate clothing expenditures per person in these groups in online retail. Common sense suggests that expenditures per person in the 0-14 age group are lower than in the 15-64 age group. We can justify this estimation by noting that the majority of 0-14-year-olds do not purchase their clothing online.

The Two Essential Frameworks for Market Sizing Cases

The two frameworks most commonly used to answer questions about market size are the issue tree and the table. With either of these, you can typically find an answer to your question. So, if you're short on time, you should only learn one of them. However, mastering both will definitely make your life easier.

Issue Trees

An issue tree (sometimes also referred to as a logic tree or driver tree) is the visual breakdown of a question into its individual components.

Dividing the process into two steps, first the structure and then the calculation, significantly simplifies the problem. Why is this the case? Because your brain has two separate hemispheres: the right (creative) and the left (rational). While the right side is good at conceptually assembling all the factors needed for estimation, the left side is adept at computation.

If you mix up structure and calculations, you can't focus on one of the brain hemispheres, and you can't fully utilize your brain. That's why you should first create and validate a tree structure before focusing on computation.

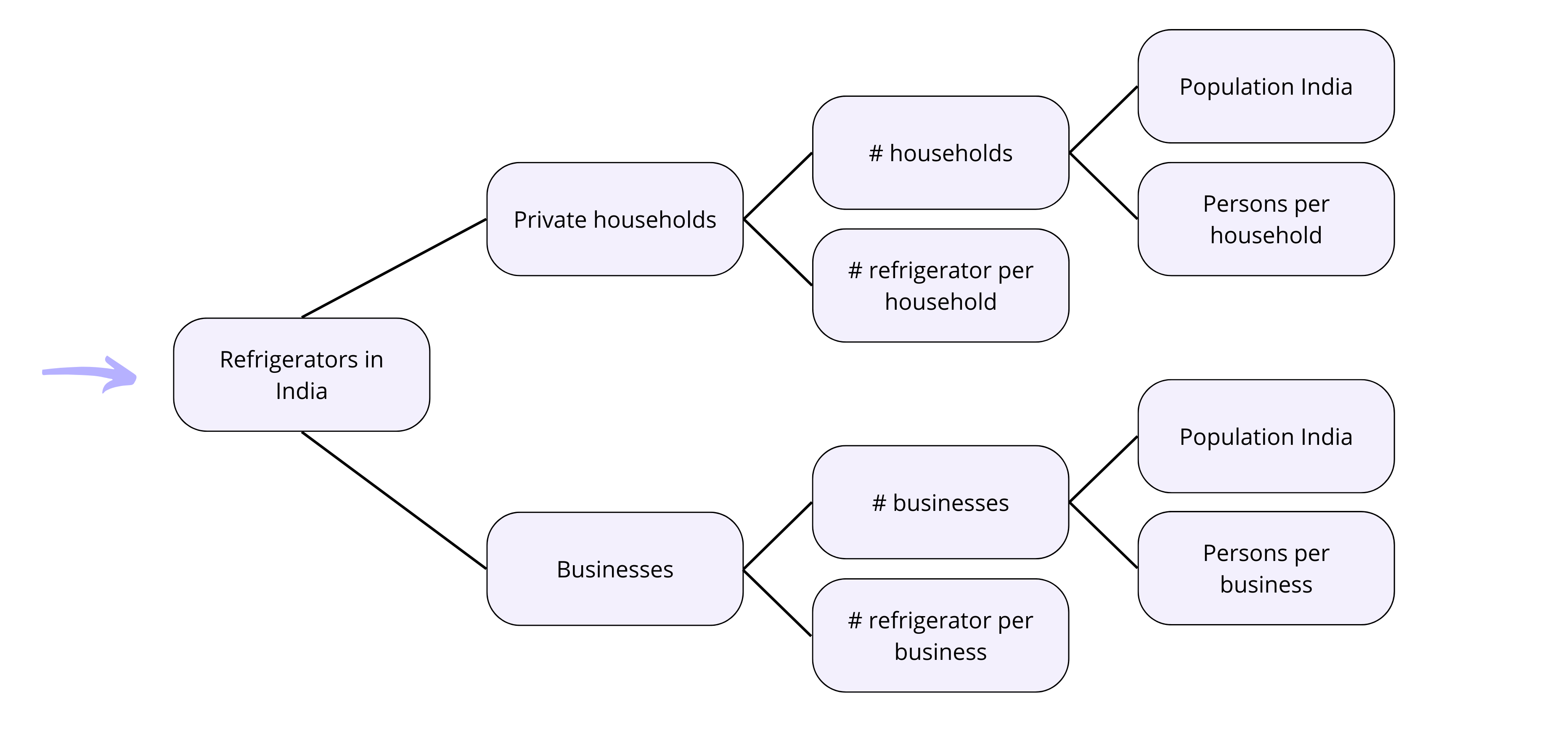

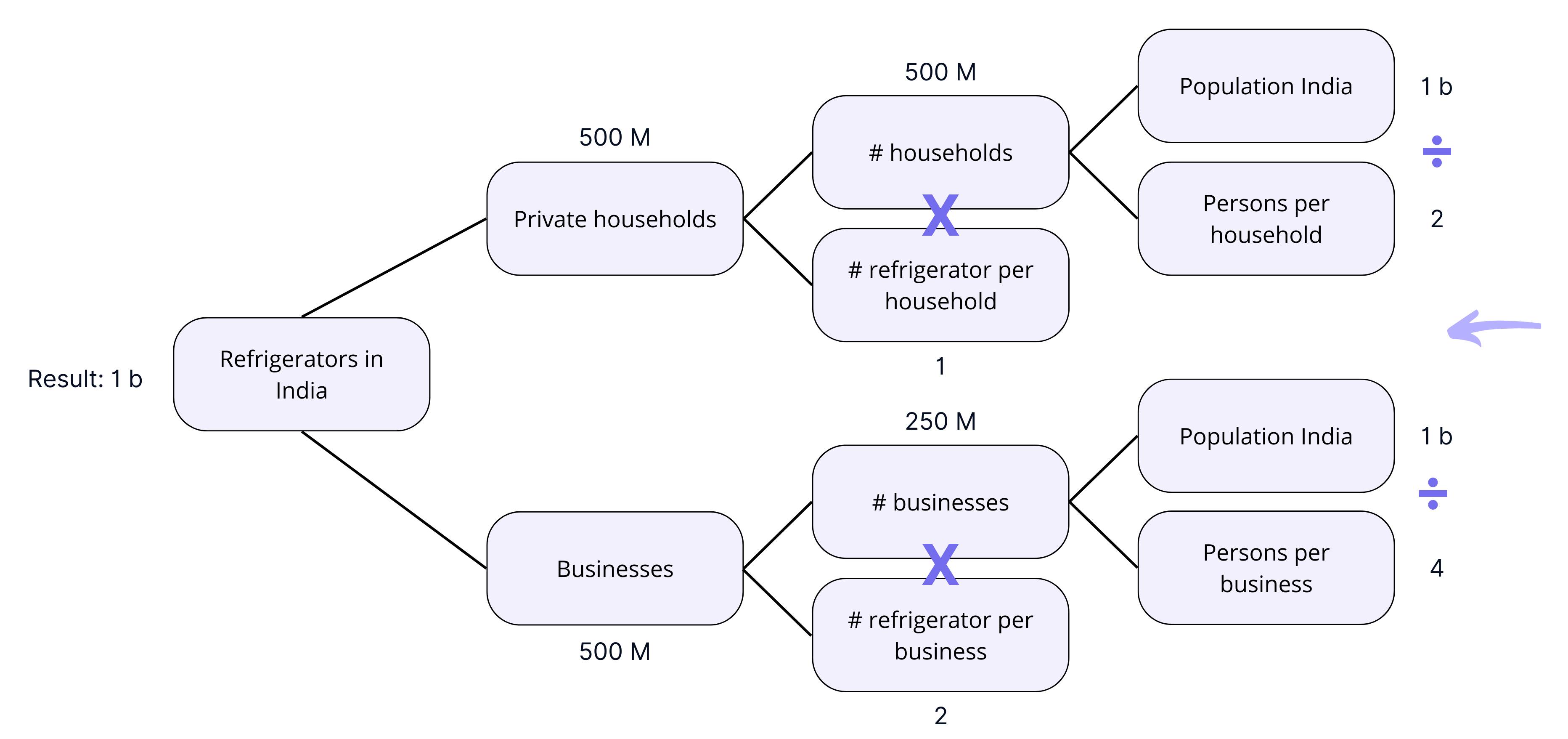

As you begin to further break down the question, it continues in the same format to the right or possibly downwards, ultimately leading to a single answer. If you were asked to estimate how many refrigerators there are in India, you could use an issue tree like the following:

Once you've cross-checked the structure with your interview partner(s), you can input and calculate the data from right to left.

Issue trees are a popular method for answering questions about market size because the applied logic is easy to follow, and the interviewer can physically see the steps you took to arrive at your answer. Additionally, they can be easily expanded as needed since you can insert other branches without disrupting the logic and simply adjust the required calculations.

When using an issue tree, we recommend maximizing the space on the page, starting with the first branch(es) on the left side, and then following these steps:

- Start with the general structure of your issue tree and sketch it out without inserting specific numbers or values. In the initial step, the logic and approach should be clear before you conduct concrete calculations.

- Show your structure to your interviewer and ensure that your approach is logical.

- Fill in the data you know. Here, you can start with the data at the bottom or right since these are usually the ones closest to everyday life and for which you can make plausible hypotheses.

- Stuck? Communication is key. Ask your counterpart if they can help you fill in gaps for data you don't know.

- Fill in the remaining gaps with reasonable estimations of your own and justify them to your conversation partner.

- Calculate the required tasks. Again, it's important to stay within the structure and calculate one branch at a time. Once you've completed the first main branch, move on to the second, and so on until you reach a final result.

- Review your answer with common sense and conduct a sanity check. Put your result into a broader context and consider whether it seems plausible. Don't panic if it doesn't. Proactively communicate your assessment and go through your issue tree step by step to check where you might have made false assumptions or incorrect calculations. Keep your interviewer updated on your thoughts throughout this process.

If you follow these seven steps, your conversation partner has the opportunity to correct you if you've overlooked something or formulated something too complicated. This way, you can demonstrate your logical, mathematical, and communicative skills.

The limitations of an issue tree lie in the degree of data segmentation. Highly segmented data are difficult to represent. Even though the logic is easy to follow, the calculations can become cluttered and harder for the reader to understand. For a question with many subdivisions, it's usually easier to use a table.

Tables

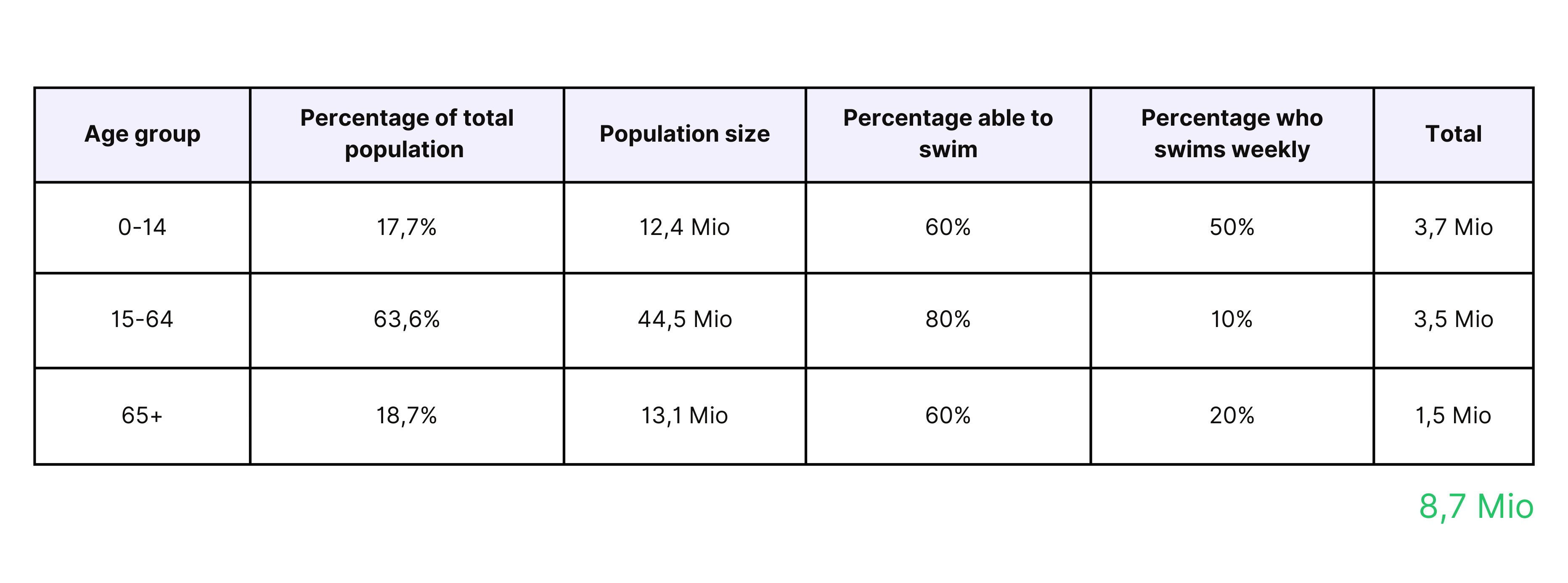

Using a table to structure your answer is a good alternative to an issue tree when you need to structure larger and more complex datasets. The table works in principle very similarly to the tree. When you segment a population into age groups, as shown in the "Segmentation" section, you have three different groups. In this case, it's advantageous to use a table to treat each group differently.

For example, if you're asked to estimate how many people in the UK go swimming every week, we can estimate the answer using the following table:

Each row of the table represents a different age group, and each column represents a different logical step.

It's helpful to use landscape-oriented lined paper so that the rows remain clear and readable. For the table framework, we recommend following the same steps as for the issue tree, with a slight change in structure:

- Start with the general structure of your table and begin without inserting specific numbers or values. In the initial step, focus on ensuring that the logic and approach are clear before conducting concrete calculations.

- Show your structure to your interviewer and ensure that your approach is logical.

- Fill in the data you know.

- Stuck? Communication is key. Ask your counterpart if they can help you fill in gaps for data you don't know.

- Fill in the remaining gaps with reasonable estimations of your own and justify them to your conversation partner.

- Calculate the required tasks in an organized manner.

- Review your answer with your logic (if it seems unreasonable, go back to step #5). Conduct a sanity check.

By following these steps, you can maintain an overview when working with multiple subgroups. Like with the issue tree, it's easy for the interviewer to understand your logic and correct the course if necessary. So, two things are essential: your structure and your communication. You can best practice these two steps to success by casing with like-minded individuals. Check out our meeting board and arrange practice sessions with other candidates!

Rounding and Estimating in Market Sizing Cases

In an ideal scenario, the result of your Market Sizing Case should be in the right ballpark, meaning the answer shouldn't deviate more than 20% from the actual answer. But not only the result, but also the approach, structure, and the way you've thought about the problem are crucial for problem-solving.

Always remember: If you don't share your thoughts, it's unlikely your counterpart will be able to read your mind or advance you to the next round. So, it's better to speak too much than too little about what's going on in your head.

It's recommended to round some numbers up and some numbers down to achieve the most accurate result in the end. Advanced practitioners (and those who have practiced with our Mental Math Tool will be advanced) also round not the numbers in the calculations, but only the result.

Useful Figures

A stumbling block in many market sizing questions is the starting figure. Often, the question asks for a subset of a larger group or a number in relation to the larger group, such as weekly swimmers in the UK or refrigerators in India. It's helpful to know the starting population, which in this case would be the population of the United Kingdom or India. The following figures are useful before answering market sizing questions:

- US population = 330 million

- Population of the United Kingdom = 67 million

- German population = 83 million

- French population = 68 million

- EU population = 450 million

- Chinese population = 1.4 billion

- Indian population = 1.4 billion

- Australian population = 26 million

- People per household (developed countries) = 3

- People per household (developing countries) = 4

Practice Questions for Market Sizing

With these practice questions, you can test your skills in Market Sizing Cases and develop the right mindset to solve the cases:

- How many mattresses are sold annually in the USA?

- What is the size of the US market for diapers?

- How many gas stations are there in Paris?

- How large will the market for 3D televisions be?

- What is the size of the European shoe market?

- How many fast-food meals are served annually in London?

- How many people go swimming each week in the UK?

- How many mobile phones are lost each year at music festivals in the UK?

- How many mobile phones are manufactured weekly in China?

- How many houses are sold annually in the United Kingdom?

- How many pretzels are needed to build a tower as tall as Big Ben?

- What is the sofa market size in the UK?

- Estimate the revenue generated annually from ticket sales in all US sports stadiums.

- How many people wear a tie on Mondays in the state of New York?

While some of these questions may seem strange, consultants are often asked by clients in brainstorming sessions or casually. A structured approach and the ability to analyze the underlying purpose of such estimation questions are essential for a useful and convincing response.

Although the approach you choose to arrive at the market size is much more important than the result itself, you should still be aware that your interviewer may intentionally provide assumptions that lead to a much larger or smaller market size than reasonable. In this case, you should object that the market seems much larger/smaller than you expected. Your interviewer may want to test your ability to question your results (AKA sanity checking).

The Biggest Challenges in Market Sizing Questions

Market Sizing Cases come with many challenges. Let's take a look at the perceived hurdles together and how you can overcome these challenges.

1) Structure

In Market Sizing Cases, structure is crucial. See a good structure as your guiding principle, helping you even when you lose focus – you can always orient yourself along it, reducing your nervousness.

👉 Prep Tip: Regularly applying the methods (issue tree and table) to examples can give you a lot of confidence here and thus also self-assurance for your case interview.

2) Calculations

Accurate calculations, alongside a structured approach, are one of the biggest challenges. Don't let larger values like billions or millions unsettle you! The challenge lies in calculating quickly but accurately.

👉 Prep Tip: Here, too, you have many opportunities to prepare ideally. Use mental math tools or review basic arithmetic and percentage calculations. So, make use of your preparation to handle numbers confidently.

3) Making Assumptions

Making assumptions will be one of the skills your interviewer will want to see. Convince them by making assumptions that are as reasonable as possible – based on all the facts you know.

👉 Prep Tip: Use your intuition and apply logic. "Moderate" your thoughts and talk to your counterpart about how you arrive at certain assumptions.

4) Finding the Right Balance

Find the right balance between being concise but not skipping any steps in the solution process. Time in the case interview is precious and passes quicker than you think.

👉 Prep Tip: Practice your cases with like-minded individuals and arrange meetings on our meeting board to learn how to articulate your thoughts without digressing. Follow the "Answer-first" principle.

The Three Golden Rules of Market Sizing

The three golden rules of Market Sizing help you structure and present your approach, prevent calculation errors, and verify whether you are correct in the end.

The three golden rules of Market Sizing are:

- Use the appropriate framework to structure your problem.

- Find the balance between pragmatism and accuracy.

- Verify your (interim) results with a sanity check.

Examples of Market Sizing Cases

Let's take a closer look at some examples of market sizing cases.

1. How many diapers are sold per year in the USA?

If you want to estimate the number of diapers sold in the USA per year, the assumptions for the first level might look something like this:

- # Number of babies in the USA on a given day multiplied by

- # Number of diapers a baby needs per day multiplied by

- # Number of days on average in a year

As you can imagine, the tree can have a different number of levels for each of its branches. While you can estimate the average number of days in a year fairly accurately, you may need to further break down this box to estimate the number of babies in the USA.

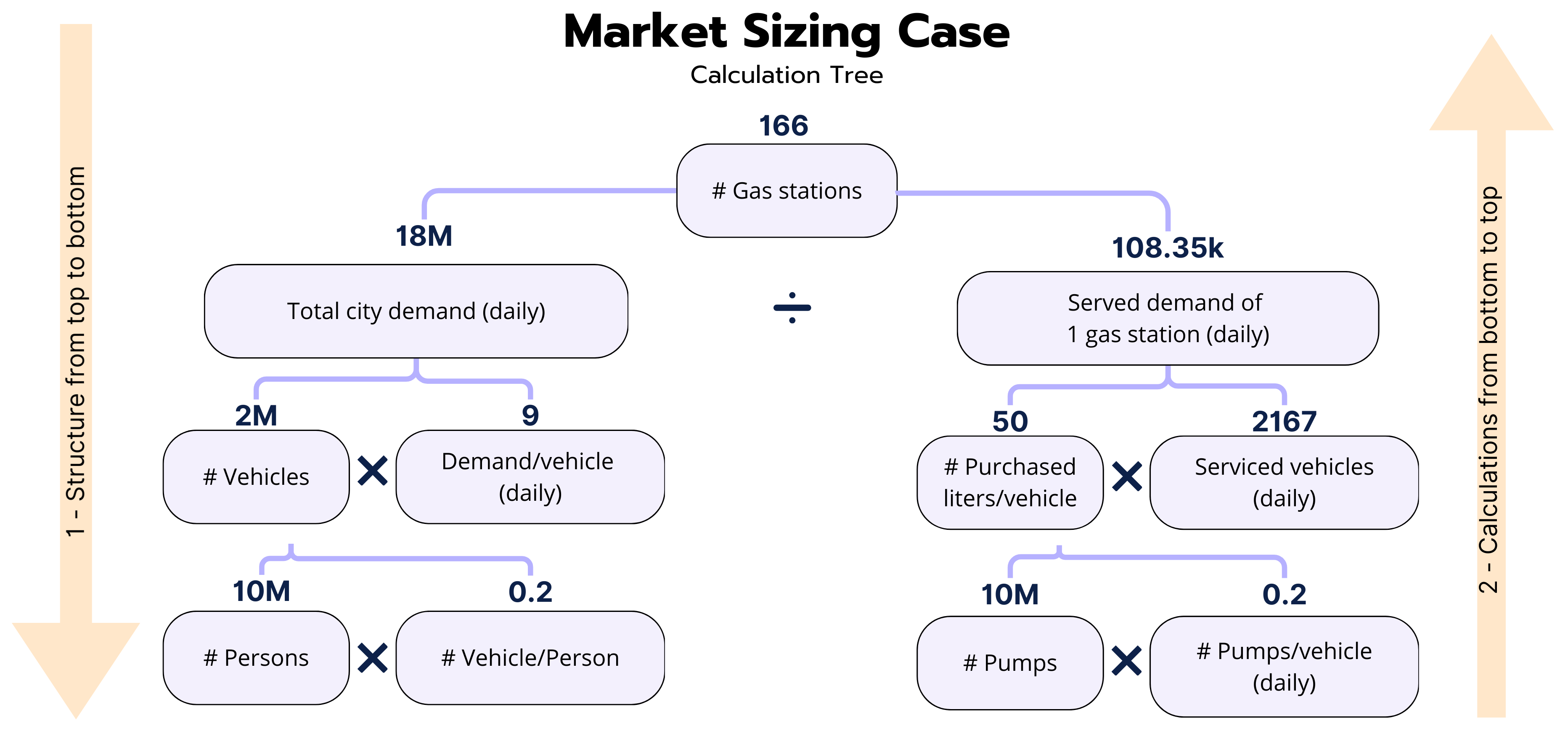

2. How many gas stations are there in Paris?

The following illustration shows how we can draw a tree to estimate the number of gas stations in Paris.

Also, here you should proceed in two steps: First, sketch the structure of the tree, and then enter and calculate the data. Always remember to discuss your intermediate steps with your counterpart.

You can find the full case here:

Key Takeaways

Market sizing cases showcase your quantitative skills and logical thinking. Seize the opportunity to convince your interviewer of your abilities! You can train these skills excellently, for example, with our Mental Math Tool. Additionally, when collecting numerical data, always ask if rounding is allowed.

Last but not least, always remember the three golden rules of market sizing: Structuring the problem using a tree diagram or table, finding a balance between pragmatism and accuracy, and continually verifying the correctness of the estimates.