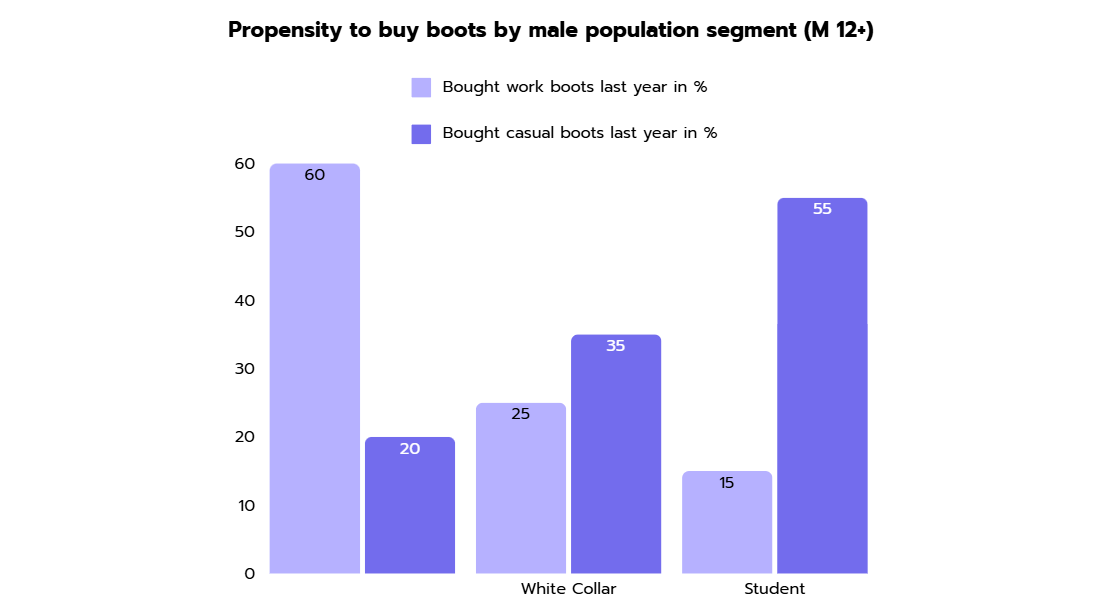

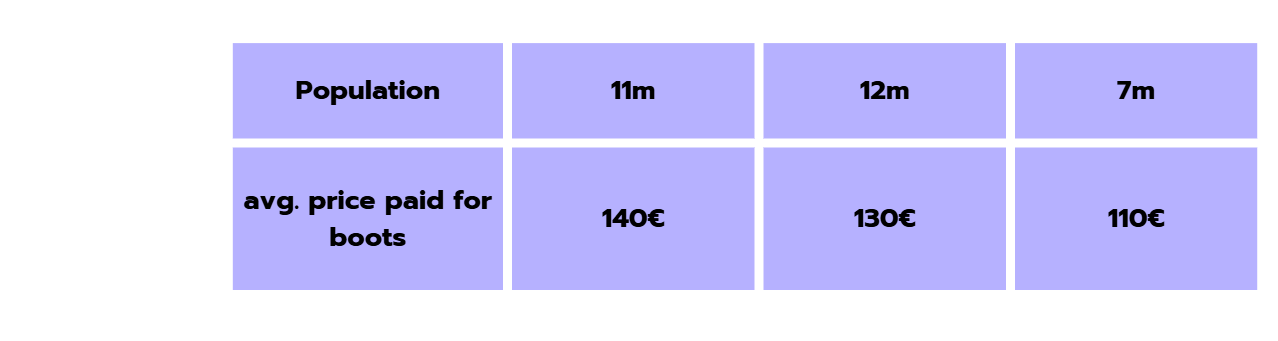

When it comes to case interviews, data interpretation is a crucial skill that sets top candidates apart. Whether you're analyzing market trends, customer segments, or financial figures, your ability to quickly understand and communicate data-driven insights can make or break your performance. In this guide, we'll break down the process into three simple steps to help you excel in reading and interpreting charts and data during your interviews.

Two Types of Data Interpretation in the Recruiting Process

When preparing for your career in consulting, you'll encounter two primary scenarios where data interpretation comes into play:

- Solving specific tests (like the McKinsey Solve Game): This requires precise calculations and often involves mental math.

- Analyzing and communicating business insights: This is the core of case interviews, where you’ll need to interpret data, connect it to the case context, and use it to drive the discussion.

This article will focus on the second aspect: how to analyze and communicate business insights in a case interview.