Questions about market size are frequently asked in case interviews in consulting because they require a blend of logic, mathematics, and common sense. They can be asked as standalone questions or as part of a larger case. Applicants who are familiar with market sizing questions can really perform here.

What Are Market Sizing Cases?

If you're applying to top consulting firms like McKinsey, BCG, or Bain, you're unlikely to escape a market estimation case. Market sizing cases are considered "back-of-the-envelope" calculations because they can be done on the back of an envelope. Despite the name, it's not just about estimating market sizes; other estimations may also be asked for.

For example, if you're discussing a British clothing retailer's growth strategy, you could calculate on an envelope how large the online clothing market is and what percentage of the market the retailer already penetrates. If you perform these calculations quickly, the conversation with the client stays fluid, leaving a good impression.

You can receive the question about market size as a standalone case (although this is less common) or as part of a more comprehensive problem, such as market entry. The good news: There's no right or wrong answer when it comes to the question of market size. The interviewer is less concerned about the specific number you come up with for the market than the approach you took to arrive at that number.

Why Are Market Sizing Cases Commonly Used in Consulting Interviews?

Market Sizing Cases are used to test your quantitative and logical abilities. The interviewer wants to ascertain whether you work well with numbers and if you can make informed assumptions and deal with ambiguities. Questions about market size aren't just about the size of markets; they also involve other types of estimations, such as the number of golf balls in a jumbo jet. As you may have noticed, math is crucial in tackling these questions since you don't have a calculator to rely on. Most importantly, you need to be comfortable dealing with large numbers like millions and billions as well as percentages. More on that later.

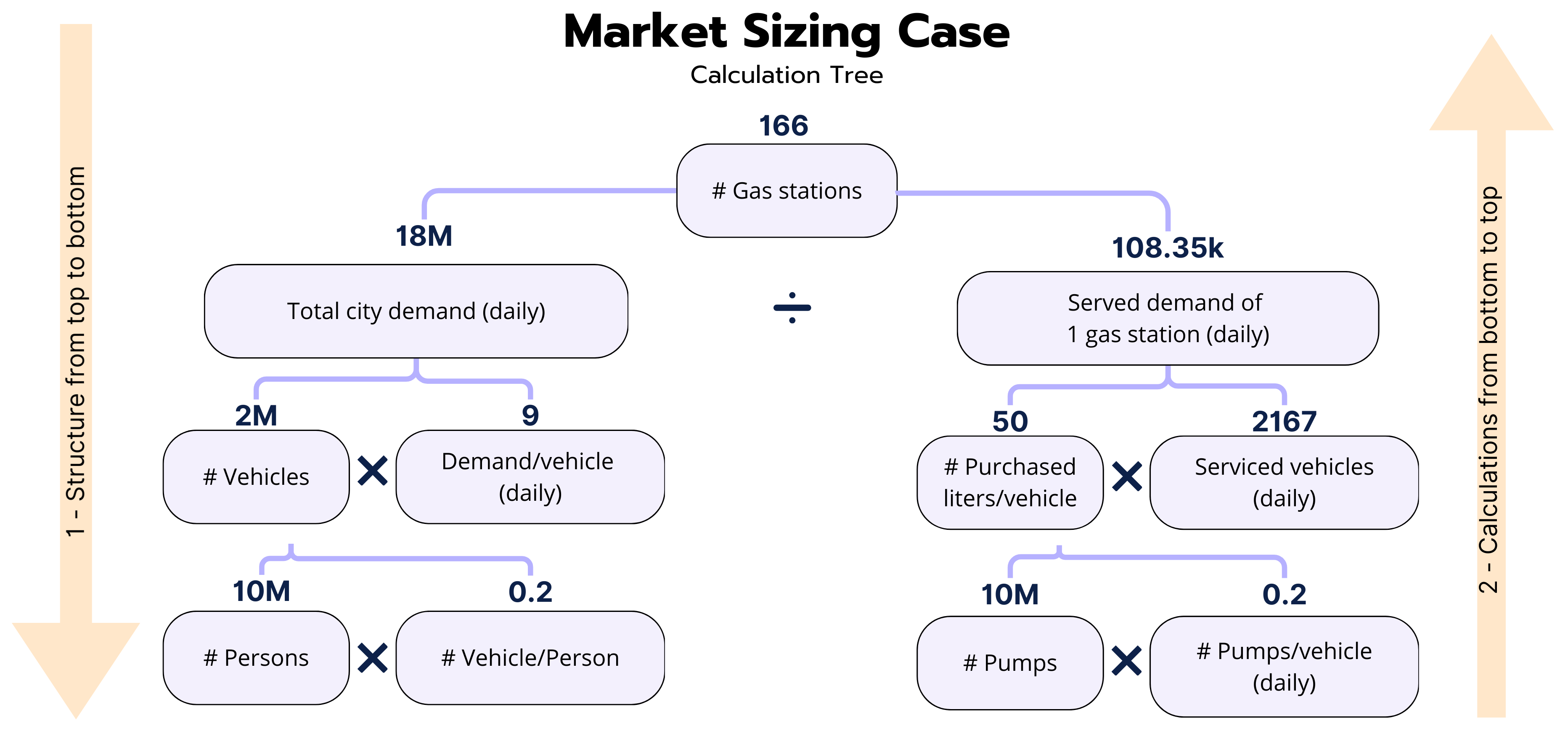

How Do You Best Approach Market Sizing Cases?

Now that we understand the theory behind Market Sizing Cases and their relevance to your case interview, let's take a closer look at the process.

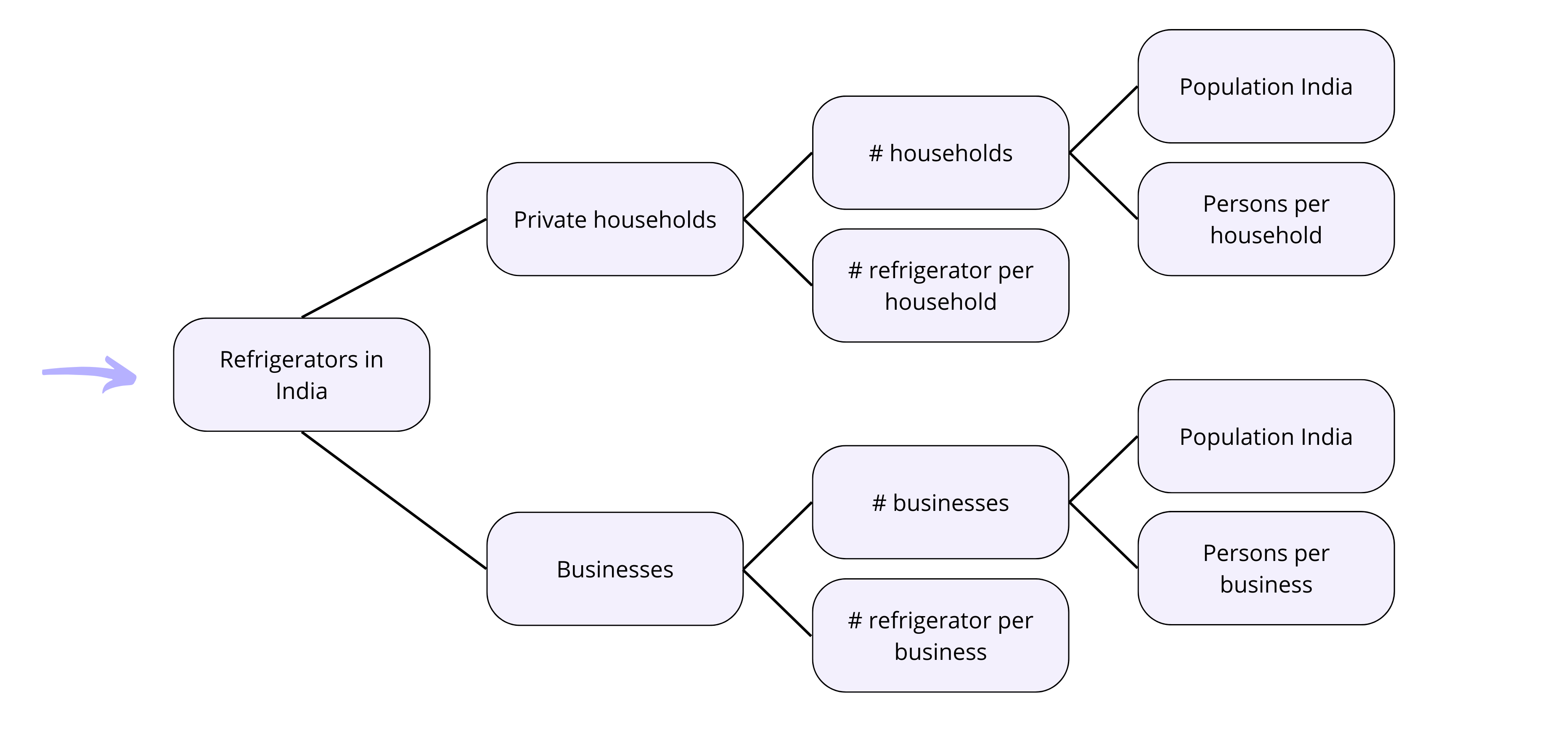

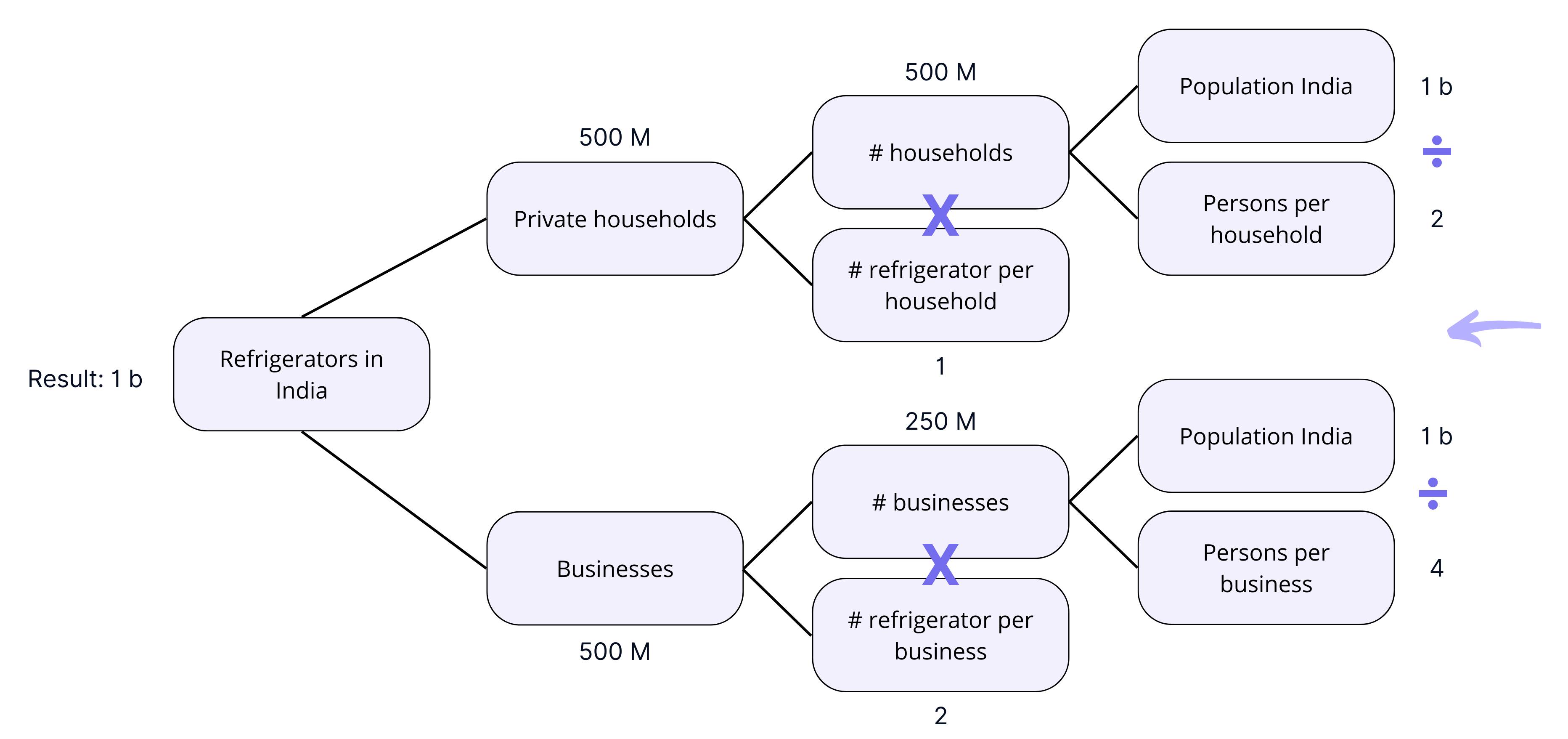

Segmentation – The Key to Market Sizing Cases

If you've done some reading on case interviews before delving into market sizing questions, you might have come across areas where segmentation is necessary. Segmenting data is a crucial skill you must master as both a candidate in a case interview and in your later career as a consultant. Segmentation generally refers to dividing a larger whole into smaller parts or segments. The principle you need to understand to do this correctly is the MECE principle.

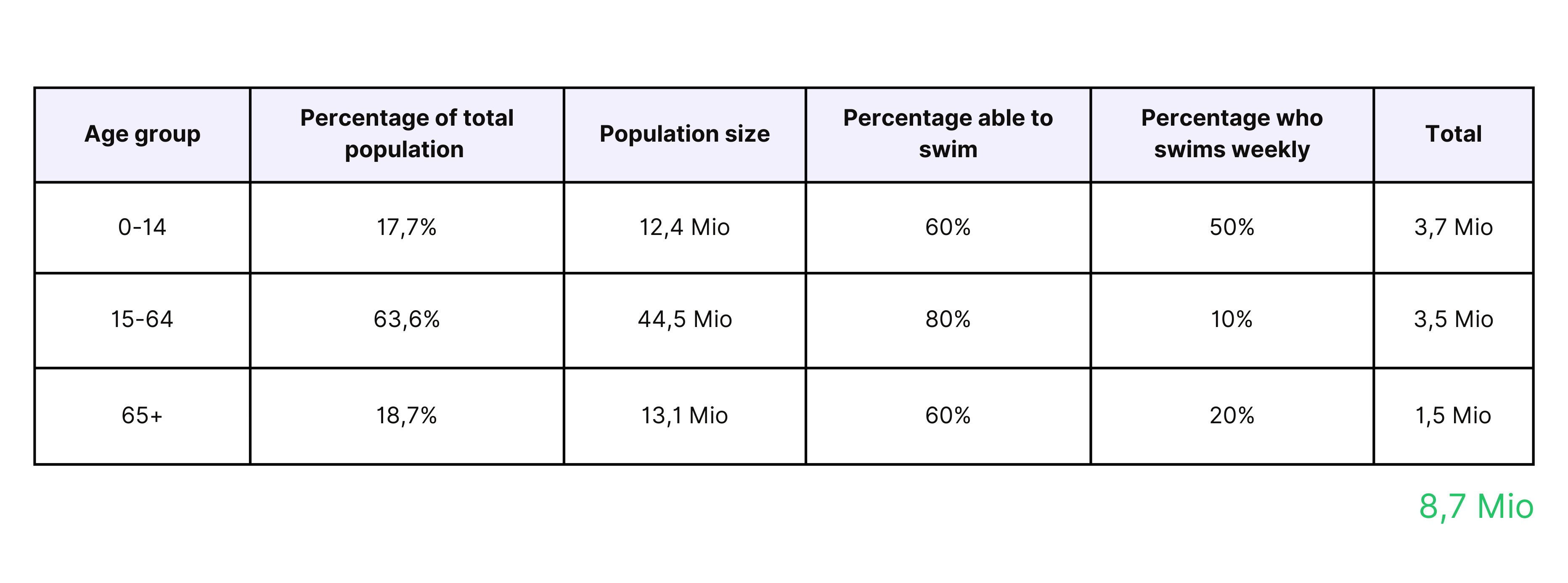

MECE stands for "mutually exclusive, collectively exhaustive." Simply put, segmenting a group of data according to the MECE principle means forming subgroups that do not overlap but collectively cover the entirety of the data, meaning no data is missing. An example useful for market sizing questions is dividing a country's population into age groups (as different age groups often behave differently).

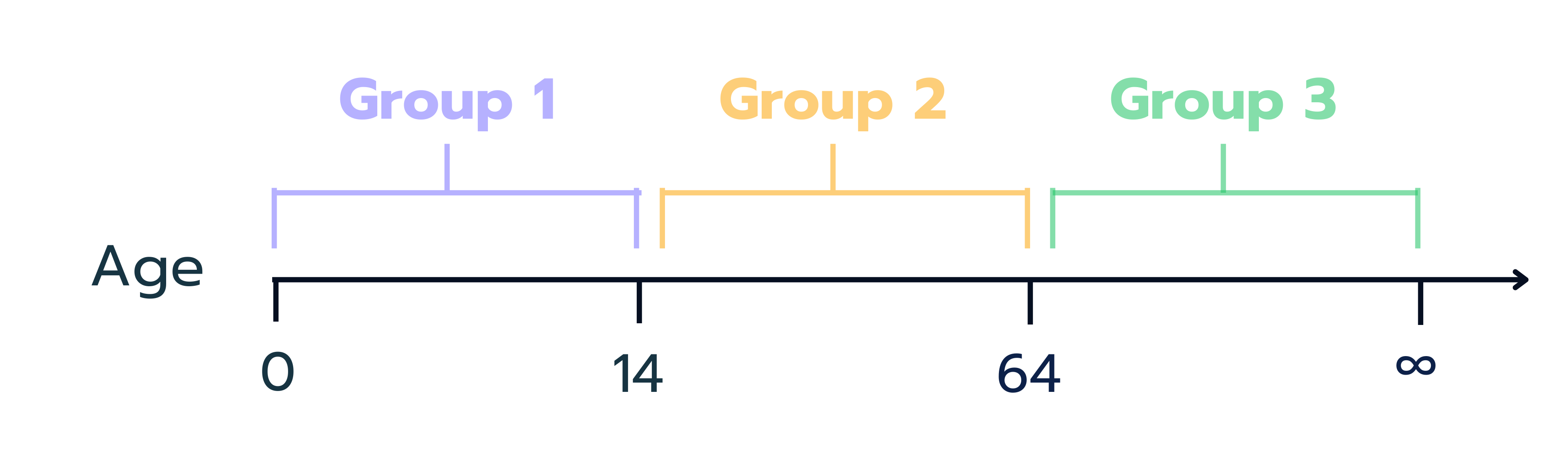

Below is a breakdown into Group 1 in the age range 0 to 14, Group 2 in the age range 15 to 64, and Group 3 for everyone over 65:

Note that none of the groups overlap, so no age is counted twice, but also no age is overlooked. Now that the population is correctly segmented, we can treat each group differently. If we had divided the population of the United Kingdom into the aforementioned groups, we could estimate clothing expenditures per person in these groups in online retail. Common sense suggests that expenditures per person in the 0-14 age group are lower than in the 15-64 age group. We can justify this estimation by noting that the majority of 0-14-year-olds do not purchase their clothing online.