When preparing for case interviews, you'll quickly find that "fixed costs" and "variable costs" always come up. These concepts are important not only for financial analysis but also for strategic decision-making in companies. Let’s explore what these costs are and how you can skillfully use them in your cases. ✨

What are Fixed and Variable Costs?

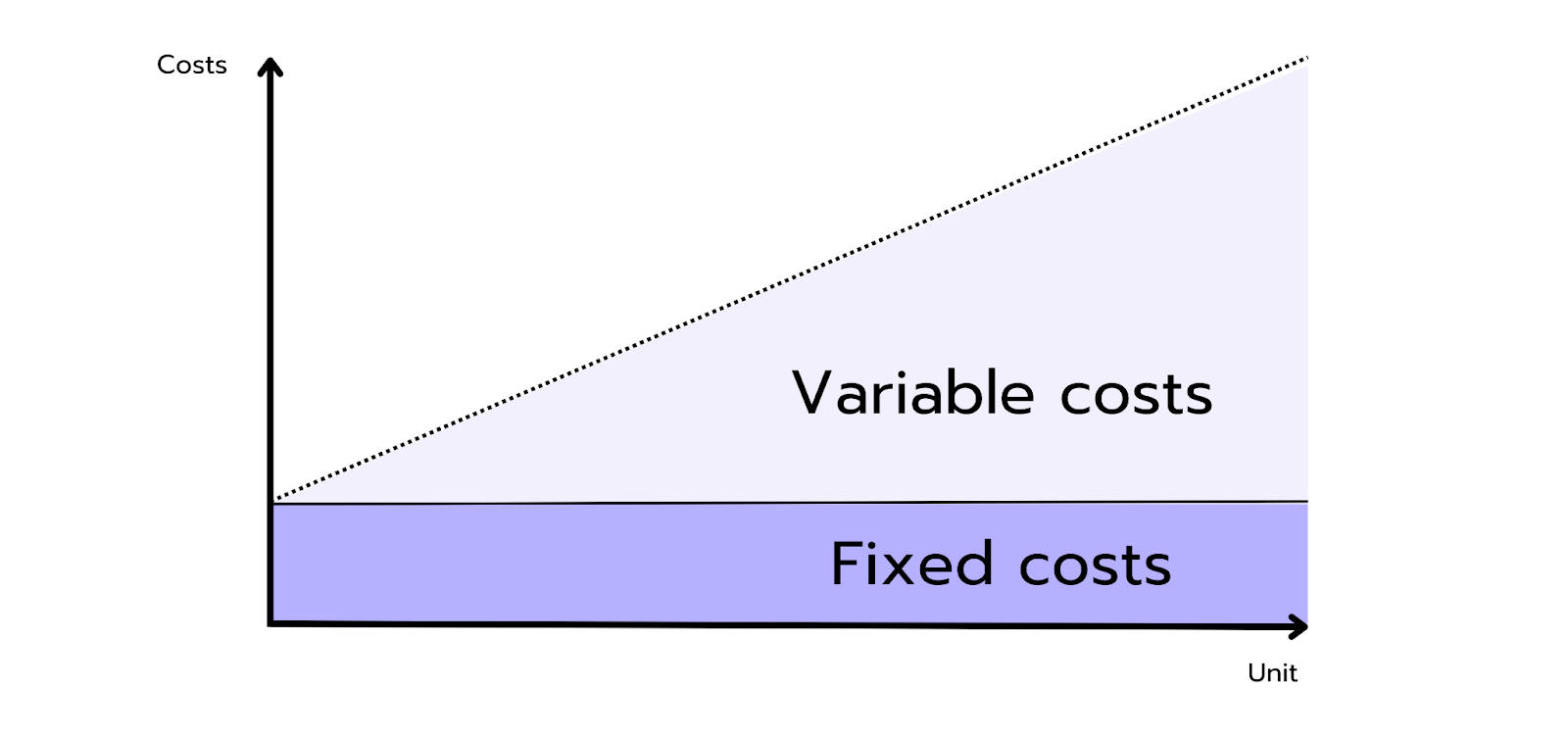

Fixed Costs are expenses a company incurs regularly, regardless of how much it produces or sells. These costs stay constant whether the company is active or not. Typical fixed costs include:

- Rent

- Salaries for full-time employees

- Administrative expenses

- Depreciation

Whether a company sells a lot or just a little, these fixed costs still need to be covered. They form the basis of a company’s cost structure and are crucial for long-term planning.

Variable Costs, however, directly depend on business activity and change with the production level. They increase as more is produced and decrease when production is reduced. Examples of variable costs include:

- Raw materials

- Energy costs

- Wages for temporary staff

An important point is that variable costs ideally drop to zero when there is no production. This makes them particularly flexible, as they can adapt to the current business situation.

Together, these two cost types – fixed and variable costs – form a company’s total costs. To get a complete picture of the company's financial position, it’s crucial to divide costs into these two categories.

At this point, be sure to check out the profitability framework. Profit is calculated by subtracting total costs from revenue. To understand cost behavior, it’s essential to segment them into fixed and variable costs – a perfect exercise!

You can find more frameworks in our Case Interview Basics. 🚀