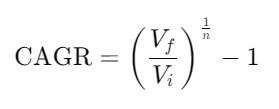

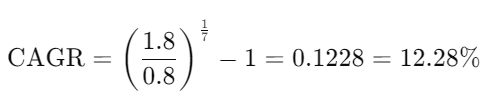

The Compound Annual Growth Rate (CAGR) is an essential metric for consultants, especially when comparing long-term growth scenarios. It represents the average annual rate at which a value (such as a business’s revenue or an investment’s value) grows over a certain period. For consultants, understanding and utilizing CAGR is crucial when projecting future business performance or comparing investments.

Why CAGR is Important for Consultants

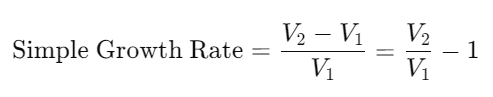

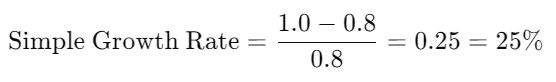

Consultants often work with long-term growth strategies, typically spanning over several years (e.g., five years). These strategies are based on a company’s goals and the measures implemented to achieve them. Since yearly growth rates can fluctuate due to one-off events or external factors, simply comparing year-on-year (YoY) growth rates does not give an accurate picture. The CAGR helps smooth out these fluctuations by assuming a steady growth rate over the entire period.

For example, a company may experience significant growth in some years and stagnation or decline in others. By using the CAGR, consultants can determine the average annual growth rate over the entire period, providing a clearer view of a company’s overall performance.

CAGR in Case Interviews

While it’s unlikely that you’ll be asked to calculate the CAGR during a case interview, understanding its meaning, calculation, and application is essential. Many case studies presented in interviews involve analyzing business performance over time. Knowing when and how to apply the CAGR will help you navigate these scenarios effectively. Case interviews often involve comparing growth rates or forecasting future revenue – both situations where CAGR becomes highly relevant.

💡 Check out our Case Library and try to use the CAGR in a real case study.