The income statement, also known as the profit and loss statement (P&L), provides a summary of a company's annual revenues, costs, and profits/losses. It is one of the three key financial documents, alongside the balance sheet and cash flow statement.

The income statement records revenues and expenses at the time they are incurred (accrual accounting). For example, an invoice appears in a company's income statement on the day it is generated, regardless of when the payment is made. In contrast, in the cash flow statement, an expense is recorded only when the payment is actually made.

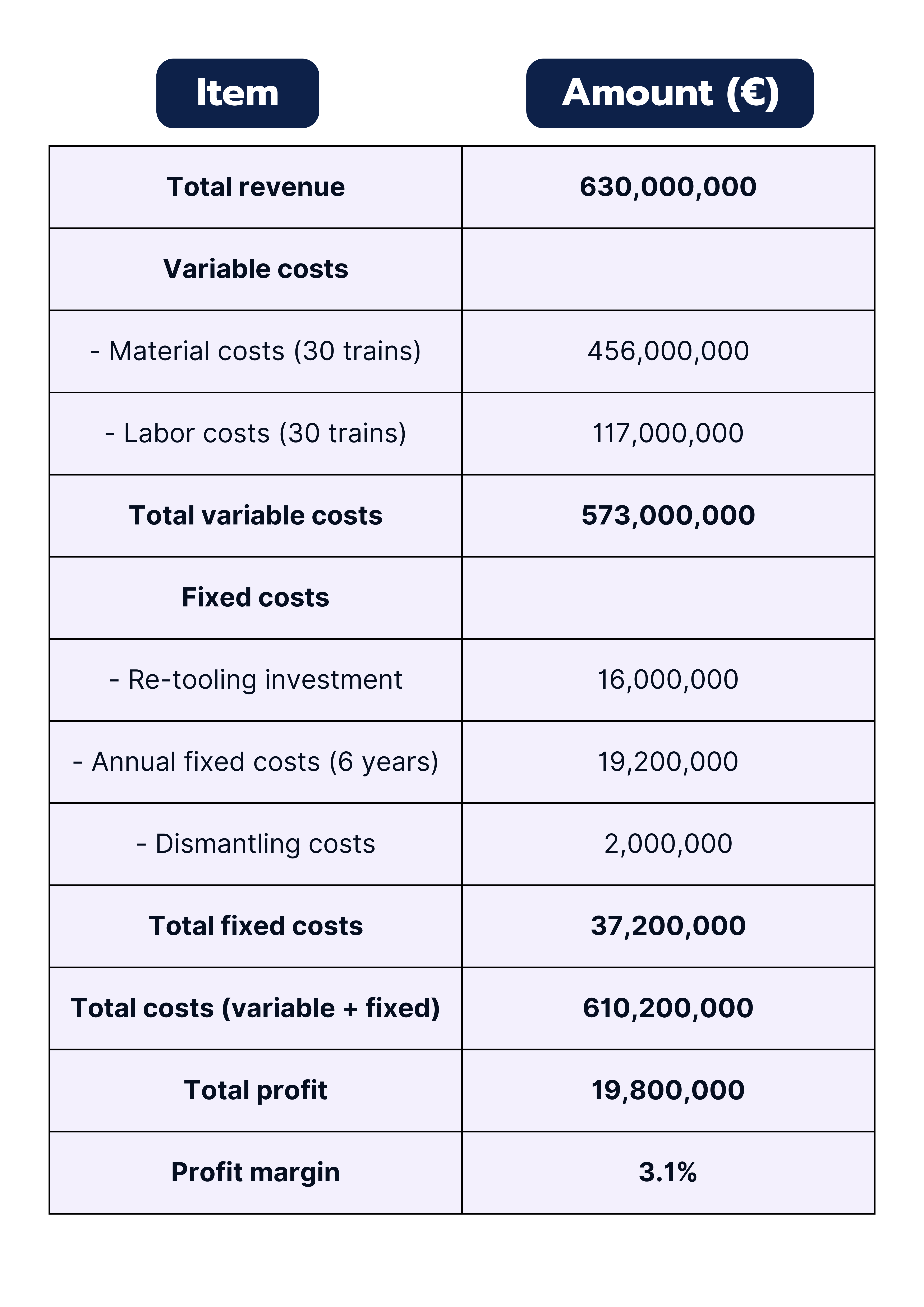

Example:

Suppose a company sells products worth €100,000 and receives a bill for material costs of €40,000. In the income statement, the revenue of €100,000 is recorded at the time of the sale, and the material costs of €40,000 appear simultaneously.

Key Terms in the Income Statement

- Operating revenue: All revenue generated from the regular business operations of a company.

- Operating costs: These are subdivided into:

- COGS (Cost of Goods Sold): Costs directly incurred from producing goods, such as material and labor costs.

- SGA (selling, general and administrative costs): Costs that cannot be easily attributed to a single product, such as general advertising expenses.

- Gross profit: Operating revenue minus operating costs.

- Non-operating revenue and costs: Income and expenses not related to the main business activity, such as revenue from selling real estate or legal costs.

- Depreciation: The reduction in value of assets, such as outdated machinery.

- Interest: Costs of debt, which are listed on the balance sheet.

- Taxes: Taxes paid on EBT (Earnings Before Tax).

💡Prep tip: Need to freshen up your mental math skills? Try out our Mental Math Tool.