Are you passionate about finance and eager to help turn big ideas into reality? Then a career in venture capital might be the perfect fit for you! This field is all about supporting young, innovative start-ups—companies with groundbreaking ideas and incredible potential. Let’s explore this exciting field together. Ready? Let’s go!

Your Guide to Starting a Career in Venture Capital

What Is Venture Capital?

Venture capital (VC), also known as risk capital, is funding provided to young, high-growth companies, often still in their early stages. These start-ups typically have innovative business ideas or technologies but lack an established market presence or steady profits.

Venture capital funds play a key role in this process. They pool resources from investors, such as institutional backers, wealthy individuals, or pension funds, and focus on investing in promising start-ups. Many funds specialize in specific industries—like technology, biotechnology, or sustainability—allowing them to identify and seize market opportunities more effectively.

The goal of these investments is to give start-ups the financial resources they need to develop their products or services, scale their operations, and succeed in the market. This drives innovation, creates jobs, and transforms entire industries.

Unlike private equity, which typically targets established companies, venture capital involves higher risks because the success of start-ups is often uncertain.

How the Selection and Investment Process in Venture Capital Works

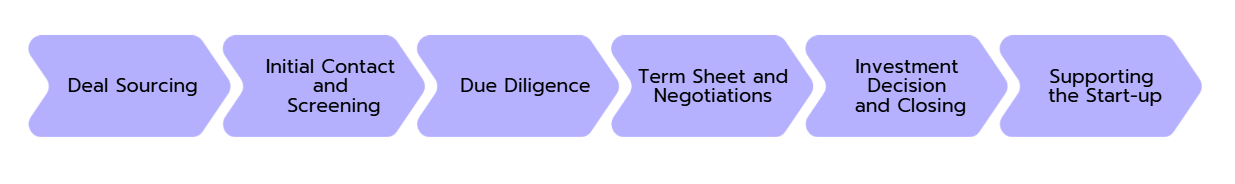

In venture capital, the journey from an idea to an investment in a start-up follows a well-structured process. In this process, choosing the right companies and timing the investment play a crucial role.

What Does a Typical Venture Capital Investment Process Look Like?

The venture capital investment process is designed to identify and support the most promising start-ups with high potential. It follows a clear sequence of steps:

- Deal Sourcing:

It starts with finding exciting start-ups. Venture capital firms use various channels for this purpose, including networks, pitch events, founder platforms, or direct applications from start-ups. The goal is to spot promising ideas as early as possible, ideally before other investors do.

- Initial Contact and Screening:

Once an interesting start-up is identified, the next step is the initial contact and evaluation. The team assesses whether the business model, idea, and market align with their investment strategy. This phase is primarily about the “first impression” of both the idea and the founding team.

- Due Diligence:

If the initial criteria are met, a thorough review process begins. This involves analyzing the viability of the business model, the size of the market potential, and the competence of the founding team. Legal, financial, and technological aspects are also closely examined during this phase.

- Term Sheet and Negotiations:

Following a successful due diligence process, a term sheet is prepared to outline the key investment terms. This includes the investment amount, the equity stake for investors, and potential decision-making rights. This step often involves detailed negotiations between both parties.

- Investment Decision and Closing:

Once the term sheet is finalized, the investment decision is officially made. The signing of contracts marks the conclusion of this phase. The capital is then provided, and the collaboration officially begins.

- Supporting the Start-up:

After the investment, venture capital firms actively support the start-ups. They contribute their expertise, assist with strategic decisions, and leverage their networks to accelerate growth. This guidance can be critical in achieving the goals set by the start-up.

What Makes a Start-up Attractive to Venture Capital Firms?

Several factors determine whether a start-up is a good fit for a venture capital investment:

- Innovative Business Ideas: Solutions that address problems effectively, create new markets, or disrupt existing structures offer significant potential for high returns.

- High Growth Potential: Start-ups with large market sizes, increasing demand, and rapid scalability are particularly appealing and promise long-term profitability.

- Scalable Business Models: Models that can expand into larger markets with minimal costs—such as software or digital platforms—are ideal for investors.

- Attractive Markets: Sectors like technology, biotechnology, renewable energy, or trends like sustainability and AI present exciting investment opportunities due to their strong growth and innovative capabilities.

At What Stage Does Venture Capital Come Into Play?

Venture capital is applied at different stages of a company's development, depending on the strategy of the VC firm. In the seed stage, start-ups are supported while they are still in the process of developing ideas or creating their products. In the start-up stage, companies receive funding to launch a market-ready product and acquire their first customers. In the expansion stage, the capital is used to enter new markets, accelerate growth, and increase market share. Each stage involves specific risks but also presents opportunities, making the choice of start-ups and the timing of investments especially important.

Typical Tasks and Responsibilities in Venture Capital

Working in venture capital is diverse, encompassing everything from analyzing promising start-ups to providing strategic support after an investment. The responsibilities can be broadly categorized into three main areas:

- Identifying and Evaluating Start-ups:

A key responsibility is deal sourcing, which involves identifying potential investment opportunities. This requires a strong network and in-depth industry knowledge. Once promising start-ups are identified, the next step is a detailed evaluation. - Investment Management:

After an investment is made, the focus shifts to collaborating with the start-up. This includes monitoring the company's development, participating in strategic decision-making and, if necessary, providing additional resources, such as capital or expertise. VC managers often serve on the start-up's advisory board and maintain close communication with the founding team. - Planning and Executing Exit Strategies:

A critical aspect of venture capital work is planning the “exit,” or the sale of equity stakes to generate a return on investment. This can take the form of an initial public offering (IPO) or a sale to another company (trade sale). The careful planning and execution of these exit strategies are essential to maximizing the financial success of the investment.

In addition to these core responsibilities, other tasks include building and maintaining networks, understanding current market trends, and refining investment strategies to stay competitive.

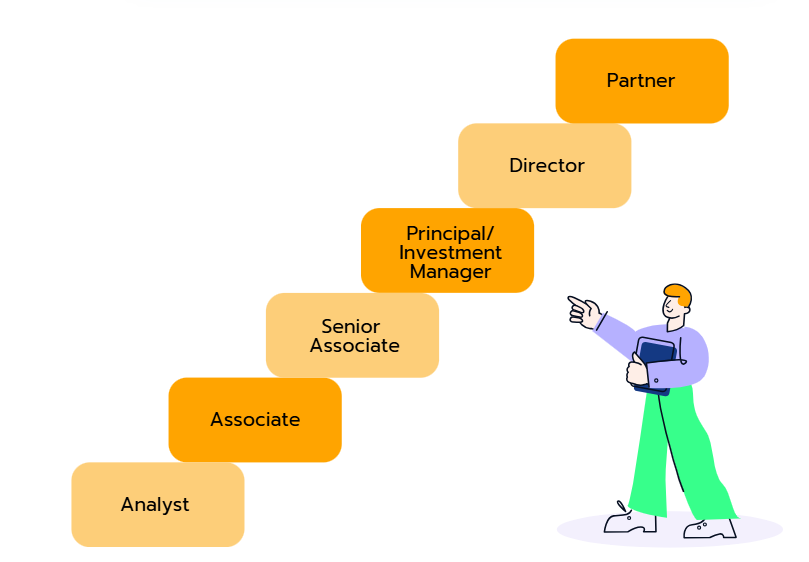

Career Paths in Venture Capital

A career in venture capital follows a clear and structured path, offering a variety of opportunities for growth. Typically, you start as an Analyst, where your responsibilities include analyzing markets, evaluating business models, and supporting the investment process, particularly during due diligence. As you gain experience, you can move up to Associate and later Senior Associate roles. In these positions, you take on more responsibility, especially in negotiations and managing portfolio companies. As a Senior Associate, you are also more deeply involved in strategic decisions and deal structuring.

The next step in your career is becoming a Principal or Investment Manager. At this level, you take full responsibility for investments, lead the entire investment process, and drive key strategic initiatives. From there, you can advance to the position of Director, where you manage larger portfolios, build networks, and actively contribute to refining the firm’s investment strategy.

The highest level of a venture capital career is the role of Partner. In this position, you play a key role in shaping the firm’s investment strategy, establishing critical networks, and focusing on raising capital for new funds. Each stage of this career path presents new challenges and opportunities, allowing you to develop your skills and make a meaningful impact on the future of the industry.

What Salary Can You Expect in Venture Capital?

Salaries in venture capital vary depending on your position, experience, and the size of the firm but are often above the average for the finance industry.

As an Analyst in the USA, you can expect an annual salary between $70,000 and $120,000, depending on location and company size. Associates, who take on more responsibility, typically earn between $100,000 and $150,000 per year, often supplemented by bonuses.

For more senior roles such as Principal or Investment Manager, salaries increase significantly, ranging from $150,000 to $300,000, including variable compensation.

Partners are among the highest earners and benefit from "carried interest," a share in the fund's profits, which can significantly boost their income. Venture capital, therefore, offers highly attractive financial opportunities.

Key Skills and Qualifications for a Career in Venture Capital

Success in venture capital requires a diverse mix of technical and interpersonal skills, all of which must work together to be successful in this competitive field:

- Analytical Skills: The ability to process and interpret large amounts of data quickly is essential. This includes evaluating financial metrics, conducting market analyses, and identifying trends that could influence a start-up's potential.

- Knowledge of Finance and Business Valuation: A solid understanding of financial concepts, valuation methods and investment strategies is crucial. You need to critically assess business models, identify risks and evaluate opportunities objectively.

- Strategic Thinking: Venture capital isn’t just about analyzing numbers; it’s also about seeing the “big picture.” This involves anticipating market changes and planning how a start-up can leverage them to achieve long-term success.

- Strong Communication Skills: The success of an investment often depends on collaboration with founding teams. It’s necessary to clearly communicate complex ideas, build trust, and handle challenging situations with constructive communication.

- Negotiation Skills: Investment decisions often require intense negotiations, whether it’s about valuing a start-up, setting terms of agreements, or securing equity stakes. Strong negotiation skills can make a significant difference.

Relevant Degrees and Further Education for a Career in Venture Capital

A strong academic background is typically a prerequisite for entering the venture capital industry. Degrees in business, finance, engineering, or computer science are particularly in demand, as they provide the essential skills needed to analyze markets, evaluate business models, and understand innovative technologies. Graduates from technical fields also bring specialized knowledge in areas like artificial intelligence, biotechnology, or software development—sectors that are highly attractive to venture capital firms.

Further education, such as an MBA, can be highly beneficial, especially for individuals looking to advance their careers or transition into venture capital from other fields, such as consulting or investment banking. An MBA not only provides deeper insights into finance and management strategies but also helps build networks that are often critical in the industry. Additionally, there are specialized programs and certifications focused on venture capital or private equity, offering hands-on knowledge and skills tailored to the field.

Beyond theoretical qualifications, practical experience is equally important. Internships or part-time roles at venture capital firms, investment banks, or start-ups offer valuable insights into the industry. These experiences not only deepen your understanding of the field but also help you build connections that could be instrumental for your career in venture capital.

Key Takeaways

- Venture capital empowers young, high-growth companies to turn their innovative ideas into reality, driving transformation across entire industries.

- From sourcing start-ups to conducting due diligence and providing ongoing support after an investment, the process follows clear, structured steps to maximize opportunities and minimize risks.

- Promising start-ups stand out with innovative ideas, high growth potential, scalable business models, and strong founding teams. Sectors like technology, biotechnology, and sustainability are particularly in focus.

- Careers in venture capital typically start at the Analyst level, with clear pathways for advancement up to Partner. The salaries are competitive and increase with responsibility, while top earners benefit from fund profits through carried interest.

- In addition to a solid academic foundation—often in business, finance, or technical fields—analytical skills, strategic thinking, and strong communication are essential. Practical experience and further education, such as an MBA, can provide a significant advantage.

Venture capital is an exciting and challenging field that not only offers professional growth but also a real opportunity to shape the future of innovation and technology. So, what are you waiting for?

Continue to Learn