Are you interested in investments, finance, and business management? If so, private equity might be the perfect fit for you. In this article, we'll cover the basics of private equity, explain the investment process, explore various career paths, and highlight some of the top firms in the industry. Let’s take a closer look at this exciting field and see what private equity has to offer!

What Is Private Equity?

Basics of Private Equity

Private equity involves investing in private, non-publicly traded companies with the goal of increasing their value and eventually selling them for a profit. Private equity firms raise capital from investors like institutions and wealthy individuals. They use this capital to support promising companies, both financially and strategically.

Key players in the private equity world include PE firms, investors, and target companies. Private equity drives innovation, helps turn around struggling businesses, and contributes to job creation. At the same time, it offers investors the chance to diversify their portfolios and potentially earn higher returns.

The Investment Process in Private Equity

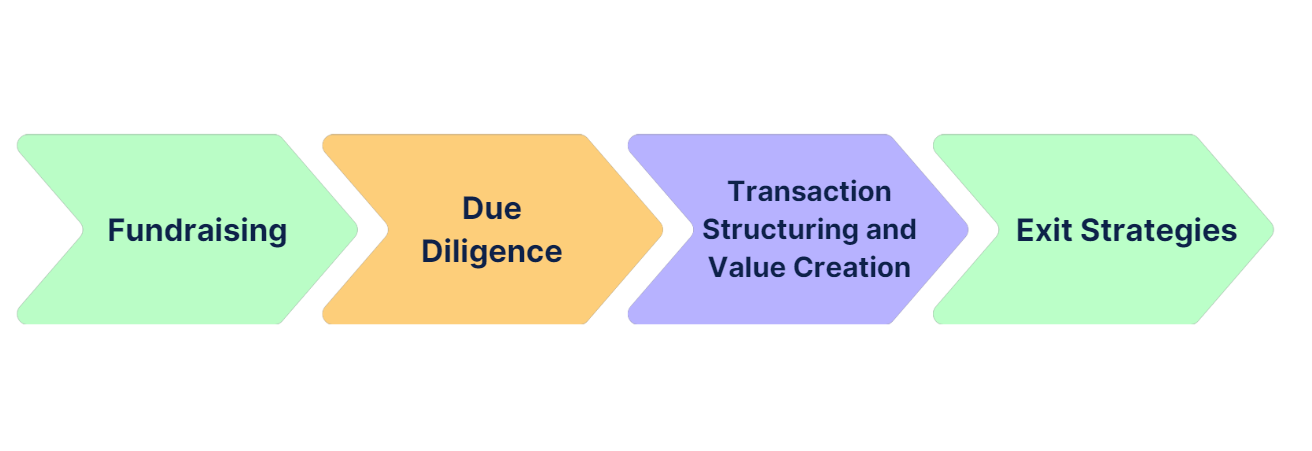

In private equity, the goal is to use capital to grow companies and then sell them profitably. The investment process typically involves four key steps:

- Fundraising: The first step is gathering money from investors. Private equity firms pitch to pension funds, insurance companies, and wealthy individuals to invest in their funds. This capital is then used to support promising companies.

- Due Diligence: Once the funds are raised, the next step is to thoroughly examine potential investments. This involves reviewing everything from financials and business strategies to legal issues, ensuring that only the best opportunities are selected.

- Transaction Structuring and Value Creation: After due diligence, the deal is structured. This includes setting the purchase price, arranging financing, and outlining the terms of acquiring company shares. Once the investment is made, the focus shifts to growing the company.

Exit Strategies: Finally, the exit phase involves selling the investment to provide returns to investors. Exit strategies can include selling to another company, taking the company public, or selling to another private equity firm.

Typical Tasks and Responsibilities in Private Equity

In addition to the investment process, private equity involves a range of other responsibilities. If you’re considering a career in private equity, you’ll have to handle various tasks that play a key role in the success of investments. Let’s take a look at some of the main responsibilities:

- Market Analysis and Research: Understanding the market is essential in private equity. This involves researching industry and market trends, identifying growth opportunities, and assessing the competitive landscape. The goal is to develop a deep understanding that helps you spot and evaluate the best investment opportunities.

- Financial Analysis and Modeling: A significant part of your role will involve creating and analyzing financial models. These models help determine the value of companies, forecast returns, and assess risks. It’s about making informed financial decisions and understanding the potential financial impact of an investment.

- Deal Structuring and Negotiation: Structuring and negotiating deals are key tasks in private equity. You’ll need to establish the financial and contractual terms for investments and negotiate with target companies and other parties. The aim is to secure the best terms for investments and ensure a successful transaction.

Portfolio Management: Once an investment is made, managing the portfolio company is crucial. This includes providing strategic advice, improving operations, and supporting the company’s growth. The goal is to increase the value of investments and enhance the overall performance of the portfolio companies.

Your Path in Private Equity: Career Paths and Advancement Opportunities

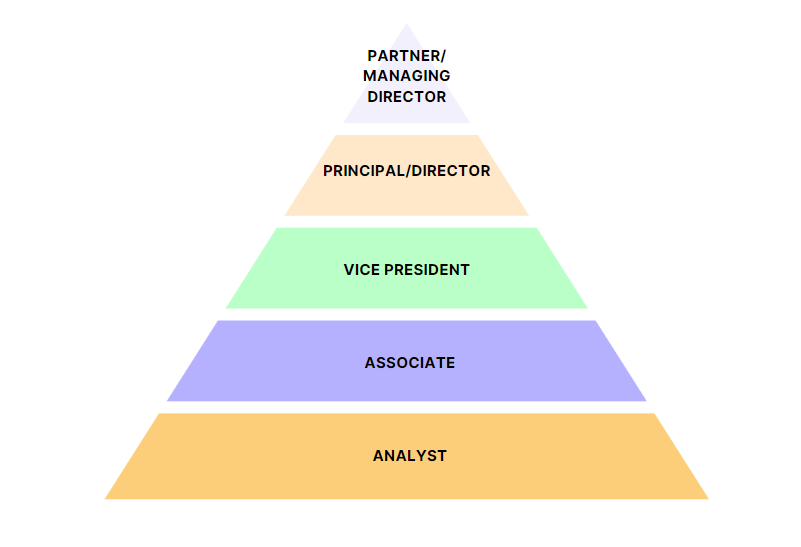

Most people who start in private equity have prior experience in investment banking or management consulting. Typically, new entrants begin as analysts or associates, where their responsibilities include analyzing potential investment opportunities, evaluating business models, and creating financial models. The aim is to identify companies that can enhance the private equity fund’s portfolio.

As you gain experience, you can advance from an analyst role to that of an associate. In this position, you’ll take on increased responsibilities in managing deals and working more closely with portfolio companies. You’ll become more involved in strategic decisions and may start leading a small team.

With further experience, you can move up to a vice president (VP) role. As a VP, your responsibilities expand to overseeing deal management and strategic planning, often involving leadership of larger teams and making significant decisions about portfolio companies. The next step up would be to become a principal or director. In these roles, you’ll play a crucial part in acquiring new deals, developing strategies for buying and selling companies, and negotiating terms. This stage demands not only strong financial expertise but also excellent leadership skills.

Reaching the top positions of partner or managing director (MD) involves making major decisions, managing key investor relationships, and implementing the fund’s long-term strategy. As a partner or MD, you’ll also share in the fund’s profits, making this role particularly rewarding.

In addition to these general career paths, private equity offers several key specializations. For instance, sector specialization allows you to focus on specific industries such as technology or healthcare, where you can build deep expertise and understand unique market dynamics. Another option is turnaround and restructuring, which involves helping companies in distress by working closely with management teams to improve performance and address financial challenges. Operational value creation is another area where you can concentrate on enhancing the efficiency and growth of portfolio companies through hands-on involvement. Additionally, if you have strong people skills, specializing in fundraising and investor relations could be a great fit, as it involves raising new funds and maintaining strong relationships with existing investors.

These specializations provide a range of opportunities to tailor your career to your interests and strengths, making private equity a field with diverse opportunities for growth and development.

What Salary Can You Expect in Private Equity?

If you’re considering a career in private equity, salary is likely a crucial factor. While compensation can vary depending on the firm and location, private equity is known for offering particularly attractive salaries. Let’s break down what you can expect at different levels in this field.

Entry-Level: Analyst and Associate

tarting your career in private equity as an analyst or associate comes with a solid salary. Analysts typically earn between $90,000 and $150,000 USD per year. Associates, who often have a few years of experience (such as in investment banking), can expect a base salary ranging from $120,000 to $180,000 USD. Bonuses, which are tied to the company’s performance, can significantly boost your earnings—often by 50-100% of the base salary or more.

Mid-Level: Vice President (VP)

After a few years on the job, if you advance to a vice president (VP) role, your salary becomes even more attractive. VPs usually earn between $200,000 and $300,000 USD annually. Bonuses play a significant role here as well, often equaling 100% or more of the base salary. In this position, you’ll have greater responsibilities, including leading deals and having a larger impact on the company's success, which is reflected in your compensation.

Senior-Level: Principal and Director

As a principal or director, base salaries range from $300,000 to $500,000 USD per year, depending on your experience and the size of the fund. Bonuses can be even higher, frequently between 100% and 200% of the base salary. In these roles, you have a key responsibility for sourcing and closing deals and are deeply involved in strategic decision-making.

Top-Level: Partner and Managing Director (MD)

Many in private equity aspire to become a partner or managing director (MD). In these top positions, salaries are highly attractive. As a partner, you can expect a base salary ranging from $500,000 to $1.5 million USD annually—this is just the starting point. With bonuses and profit-sharing, your total compensation can easily reach several million USD per year. Besides leading the fund, partners are responsible for fundraising, maintaining crucial relationships with investors, and setting the strategic direction of the company.

Top Firms in Private Equity

If you’re considering a career in private equity, it's valuable to be aware of the leading firms in the industry. Here are the top five companies that are at the forefront of the private equity world:

Blackstone Group

As the largest private equity fund in the world, Blackstone is renowned for its enormous deals and extensive portfolio, which spans from real estate to technology companies. Their influence and scale make them a key player in the industry.

KKR (Kohlberg Kravis Roberts & Co.)

KKR is one of the oldest and most prestigious private equity firms, known for its aggressive acquisitions and expertise across a wide range of sectors. Their reputation is built on a long history of successful investments and industry impact.

Carlyle Group

Carlyle is a global powerhouse with a strong focus on diverse sectors, from defense to healthcare. The firm has gained recognition for its strategic investments and its ability to navigate various market conditions effectively.

TPG Capital

TPG is especially noted for its investments in technology and healthcare companies. In recent years, they have executed some of the largest deals in these fields, showcasing their significant influence and expertise.

Apollo Global Management

Apollo is a leading firm in investing in distressed assets. They specialize in acquiring companies facing financial difficulties and have built an impressive portfolio through their strategic approach to turnaround investments.

👉 Interested in starting your career in Consulting first? Check out our guides on the top consulting firms.

Essential Skills and Qualifications for a Career in Private Equity

To succeed in private equity, a mix of skills and qualifications is essential. The demands in this field are high, and both hard and soft skills play a crucial role. Here are the key attributes you should have to make a successful start in private equity:

Professional and Personal Skills in Private Equity

Analytical Skills: Private equity requires a deep understanding of financial metrics, company valuations, and market analysis. You need to interpret complex data and make well-informed decisions. A keen eye for detail and strong numerical ability are important.

Entrepreneurial Thinking: A strong sense of business strategies and market trends is also important. In private equity, it’s not just about evaluating companies but also about their long-term growth and value enhancement. You should be able to spot opportunities and think strategically.

Communication Skills: Whether negotiating, presenting, or communicating with investors and portfolio companies, excellent communication skills are essential. You must convey complex information clearly and persuasively.

Teamwork and Leadership: Private equity often involves working closely in teams and leading projects. You should be capable of working effectively within groups and taking on leadership responsibilities.

Education and Relevant Degrees for a Career in Private Equity

There’s no single path to a successful career in private equity—many routes can lead to success! However, certain educational backgrounds and degrees can give you a significant edge during the application process and in your career.

- Business Degree: A degree in business administration, finance, or a related field is often a solid foundation for a career in private equity. While a bachelor's degree is usually sufficient, a master's degree can enhance your competitiveness and deepen your knowledge.

- Additional Qualifications: An MBA or a similar advanced degree can boost your chances, especially with top private equity firms. These programs offer in-depth knowledge in strategic management, finance, and leadership.

- Certifications and Expertise:

- Work Experience: Practical experience in investment banking, consulting, or related fields can be very valuable. Candidates often bring relevant experience and skills from these areas, which can make transitioning into private equity easier.

Conclusion – How to Get Started in Private Equity!

To sum up: Private equity involves investing in private companies with the goal of increasing their value and later selling them for a profit. The process begins with raising capital from investors, followed by assessing investment opportunities. After completing the transaction, the focus shifts to enhancing the company's value before its eventual sale. There are several career paths to advance in this field, from analysts and associates to partners. Salaries in private equity, especially at top firms, are notably attractive.

In conclusion, a career in private equity is challenging yet highly rewarding. To succeed, you need not only strong expertise in financial analysis and deal structuring but also a genuine passion for the field. Be prepared to embrace challenges, continuously learn, and develop. Building a strong network and specializing in certain areas can further set you apart. With these attributes, you can not only enter the field of private equity but also excel in it. Good luck! ⭐

Continue to Learn