Are you passionate about finance, math, and numbers? Are you good at advising others and solving problems? If so, a career in investment banking might be the perfect fit for you! This demanding job requires a lot of discipline and ambition, but it can be very rewarding. In this article, we provide you with key information about the job as an investment banker, including its tasks, focus areas, and possible career paths. We also highlight the top firms in investment banking and provide an overview of potential salaries.

What Is Investment Banking?

What Does an Investment Banker Do?

Investment banking is a sector of financial services that helps companies and institutions raise capital and execute strategic transactions. This includes services such as advising on mergers and acquisitions, issuing stocks and bonds, and conducting market analysis. Investment bankers act as intermediaries between banks and clients, plan investments, and assist companies in carrying out complex financial transactions.

A successful career in investment banking requires a great deal of patience and perseverance. The tasks of an investment banker can be highly demanding and varied. Let’s take a look at the most common areas of responsibility in investment banking:

- Support with Mergers and Acquisitions (M&A): Mergers & Acquisitions are processes where two companies merge into one, or one company buys another. These transactions help companies grow, gain market share, or create synergies. Investment bankers act as advisors and intermediaries in these transactions. They assist companies with strategic planning, evaluating target companies, and structuring transactions. They also help raise capital, whether through equity or debt, and conduct thorough due diligence to identify potential risks and opportunities. M&A is a crucial component of investment banking, influencing the development and growth of companies in the global economy

- Due Diligence: Investment bankers conduct thorough due diligence to identify potential risks and opportunities in a transaction. They analyze the financial, legal, and operational aspects of a company to ensure that their clients can make informed decisions.

- Advisory Services: Additionally, investment bankers offer strategic advice on corporate development. They assist their clients with long-term planning and investment decisions to promote sustainable growth and achieve corporate goals.

- Market Analysis: Investment bankers conduct comprehensive market analyses to examine current trends and identify relevant competitors. These analyses support data-driven decision-making and help evaluate strategic options.

- Negotiations: Investment bankers play a crucial role in negotiations with potential lenders and investors. They represent their clients' interests to secure the best terms. In transaction processes, they often act as a bridge between buyers and sellers to reach an agreement and ensure a smooth process.

- Raising Capital: Investment bankers perform market analyses to determine a company's capital needs and work closely with investors to secure the necessary funds. They support companies in issuing stocks and bonds or choosing the right financing options.

Key Players and Top Firms in Investment Banking

Investment bankers play an important role in the financial sector, collaborating with various stakeholders to successfully execute transactions. Key players include investment banks, investors, and regulatory authorities. In this section, you'll learn more about these important actors and the top firms operating in the industry.

Who Are The Key Players In Investment Banking?

In investment banking, several interest groups are essential for smooth operations. The most important are investment banks, investors, regulatory authorities, corporate clients, financial service providers, and advisors.

Investment Banks

Investors

Investors provide the capital necessary for transactions. This group includes institutional investors like pension funds, insurance companies, and mutual funds, as well as private investors. They invest in the financial instruments structured and offered by investment banks. Their engagement and trust are crucial for the success of capital raising and other financial transactions.

Regulatory Authorities

Regulatory authorities are ensuring that all transactions and activities comply with legal and regulatory requirements. They oversee the activities of investment banks, set standards for transparency and accountability, and protect the interests of investors and the public.

Corporate Clients

Corporate clients are companies that use the services of investment banks. They seek assistance with raising capital, M&A transactions, or strategic advice. These companies can come from various industries, including technology, healthcare, and manufacturing. Clients work closely with investment banks to achieve their financial and strategic goals.

Financial Service Providers and Advisors

In addition to investment banks and investors, financial service providers and advisors are important in investment banking as well. This group includes law firms, accounting firms, and consulting firms. They offer specialized services essential for the success of transactions, such as legal structuring, financial auditing, and strategic planning.

The Top 5 Firms in Investment Banking

Among the many players in investment banking, a few stand out due to their size, influence, and comprehensive services. Here are the top 5 investment banks worldwide:

- Goldman Sachs: Goldman Sachs is one of the most well-known investment banks worldwide, offering a wide range of services including investment banking, securities trading, and asset management.

- JPMorgan Chase: As a global financial services firm, JPMorgan Chase places a strong emphasis on investment banking, financial advisory, securities services, and wealth management.

- Morgan Stanley: Morgan Stanley is a globally recognized investment bank providing services in investment banking, securities trading, wealth management, and asset management.

- Bank of America Merrill Lynch (BofA Securities): Known today as BofA Securities, the investment banking division of Bank of America offers comprehensive services in capital markets, advisory, trading, and wealth management.

- Citi (Citigroup): Citigroup's investment banking unit provides a wide array of financial services, including investment banking, securities trading, and asset management. Citigroup has a robust global presence and operates in many markets.

Career Paths and Specializations in Investment Banking

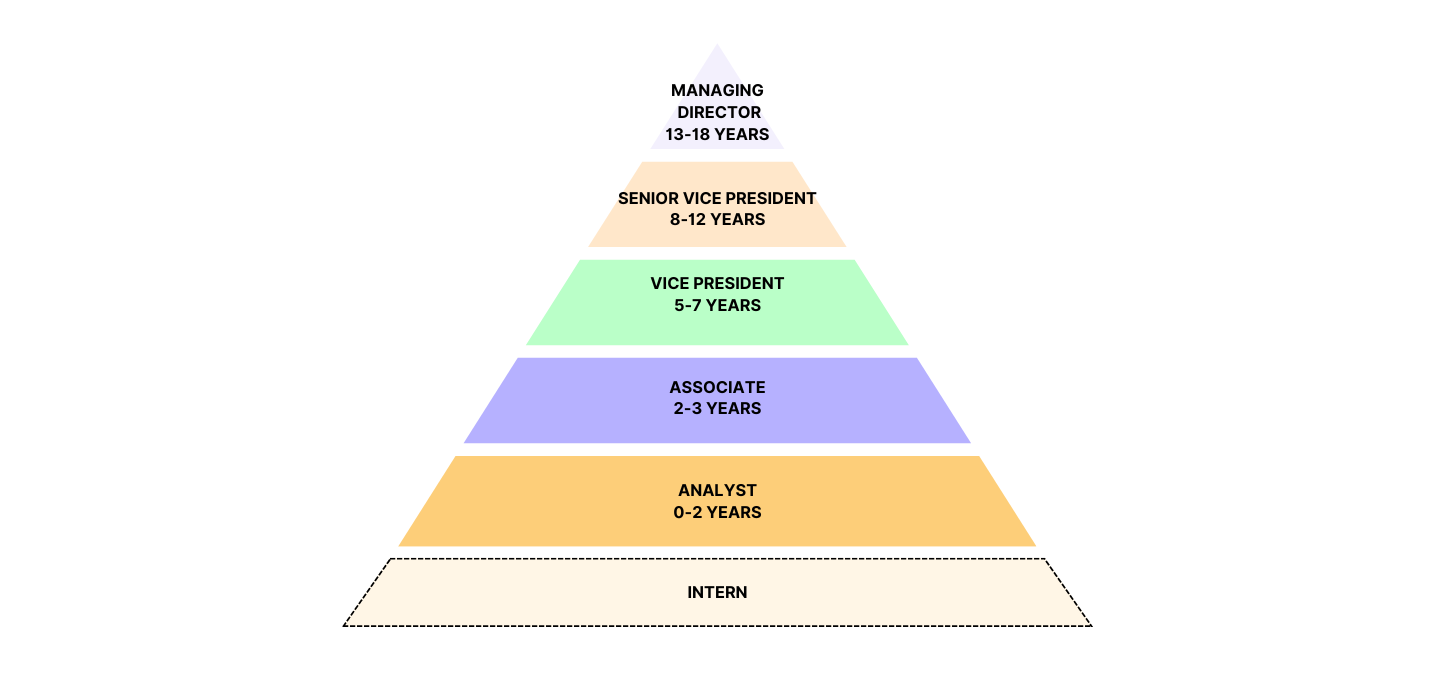

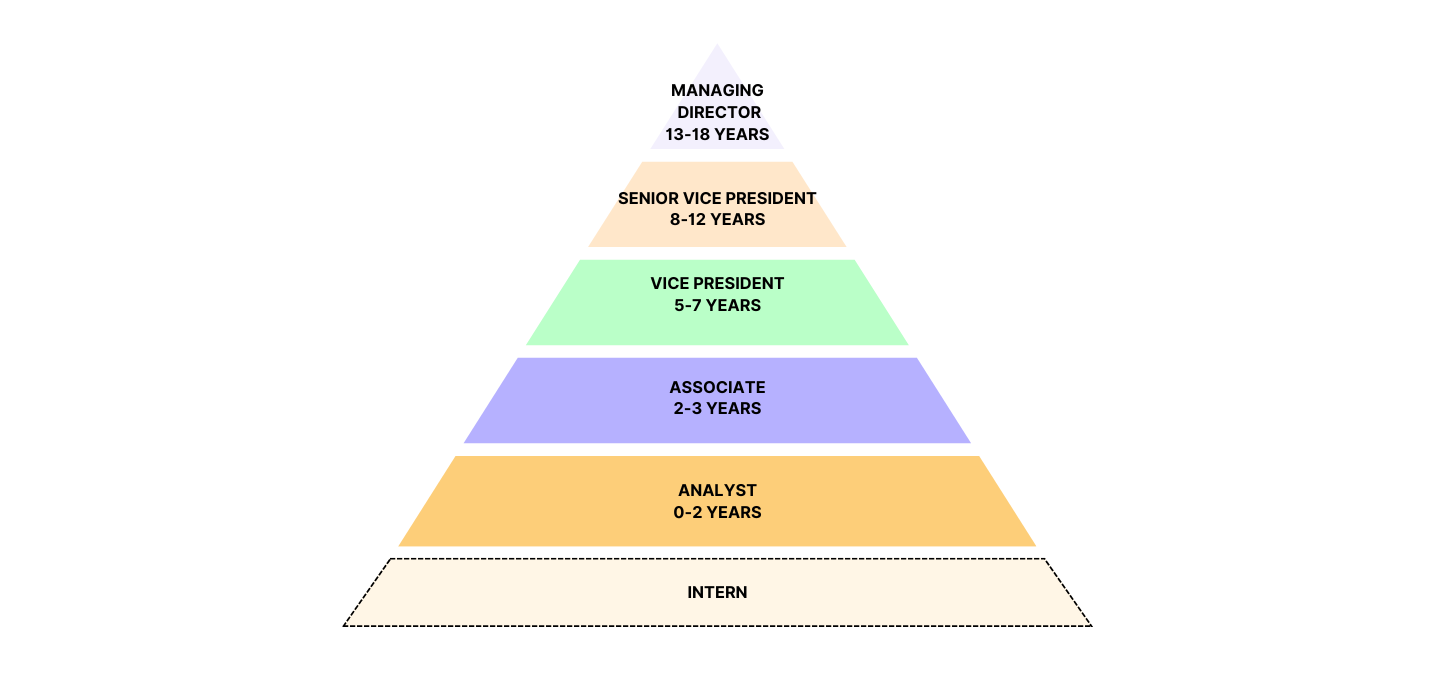

In investment banking, there are clearly defined career paths with established advancement opportunities. From Analysts to Managing Directors, there are various levels that can be reached through years of experience and strong performance. Additionally, experts in investment banking can further develop their careers by specializing in specific areas.

Career Levels in Investment Banking

If you choose a career in investment banking, there are numerous opportunities for professional growth and attractive promotions available for you. Building strong client relationships is crucial, as trust is essential for securing significant mandates, especially in M&A transactions. It takes years of precise work to gain the confidence of major clients.

Teamwork is equally important. The success of a project depends on collaboration within the team, with each member bringing different skills to the table. Even as an entry-level professional, you can take on responsibilities and significantly contribute to the quality of projects.

Interns: Interns in investment banking build financial models, conduct market research, and prepare presentations. They assist with due diligence, analyze financial statements, and support various financial deals.These internships offer valuable hands-on experience and help to build a solid foundation for a future career in finance.

Financial Analyst: After successfully completing a bachelor's or master’s degree, you typically start as an analyst. In this role, your main tasks involve data analysis, creating financial models, and preparing presentations. Analysts also actively assist with transactions. This position generally lasts 2 to 3 years.

Associate: With a few years of experience or an MBA, you can advance to an Associate position. Associates take on more responsibility, manage projects, and engage in more intensive client interactions. Their duties include overseeing the work of analysts and preparing and presenting strategic analyses. This role typically lasts 3 to 4 years and offers the opportunity for further development in investment banking.

Vice President: The Vice President (VP) role is a crucial management level in investment banking. VPs are responsible for larger projects and maintain extensive client relationships. Their tasks include project management, delivering client presentations, and supervising associates and analysts. This role requires both strategic thinking and leadership skills and typically lasts 3 to 5 years as the VP continues to establish themselves in the industry.

Senior Vice President: After several years of successful experience, bankers can be promoted to Senior Vice President (SVP). In this role, the focus is on acquiring new business and maintaining important client relationships. Duties include strategic planning, leading major transactions, and managing and developing teams. This position is key to the company's success and generally requires several years of professional experience.

Managing Director: With a successful career path and additional years of industry experience, investment bankers can advance to Managing Director. In this role, they are responsible for the strategic direction of the firm and managing significant business units. Managing Directors focus on securing major clients and executing substantial transactions. They play a crucial role in business growth and work closely with their teams to achieve long-term success.

Specializations in Investment Banking

Investment banking offers various career paths, not just within the internal hierarchy but also through specialization in areas such as private equity, venture capital, or asset management. Investment bankers also have the opportunity to work in different international offices of the bank.

Additionally, they can focus on specific fields such as Mergers & Acquisitions (M&A), where they support clients in issuing stocks and bonds, or Corporate Finance, which deals with corporate funding and strategic decisions. In Restructuring, bankers advise companies in financial distress, while Equity Research involves analyzing stocks and making recommendations for investors. Debt Advisory provides support with bonds and debt financing.

A specialization can offer several advantages. By focusing on a specific area, bankers gain deep expertise, which can lead to faster career progression as specialized professionals are in high demand and can build valuable networks within their industry. Specialization also helps differentiate oneself from competitors and offer specific services.

However, a strong focus on one area can limit flexibility to switch sectors or roles. Dependence on industry-specific trends can also be problematic. Therefore, it’s important to carefully weigh the benefits and risks of specialization.

Salaries in Investment Banking

Salaries in investment banking are heavily influenced by factors such as company size, region, and specific business unit. Large, renowned investment banks like Goldman Sachs, JPMorgan, or Morgan Stanley typically offer higher salaries and bonuses compared to smaller banks or boutiques.

Entry-level investment bankers usually earn between $70,000 and $140,000 annually, often with additional bonuses. Associates can expect $130,000 to $220,000. Vice Presidents earn approximately $200,000 to $400,000, while Senior Vice Presidents and Directors can make between $350,000 and $600,000 or more. Managing Directors may earn over $600,000 per year, often exceeding $1,000,000 with bonuses.

Salaries are often linked to performance-based bonuses, which can make up a significant portion of the total compensation.

Your Future in Investment Banking

If you're considering a career in investment banking, it’s important to look ahead. The field will be shaped by technological innovations such as AI and blockchain, which will make processes more efficient and transparent. Sustainable and ethical investing is also gaining importance, as investors increasingly focus on environmental and social issues. As an investment banker, you should engage with these topics and develop sustainable investment strategies.

Despite the challenges, the demand for specialized financial services remains high. By staying educated and adaptable, you can provide innovative solutions to your clients and guide them successfully through the ever-changing financial world.

Continue to Learn