Are you trying to weigh the options between working in venture capital and private equity? Both can offer a rewarding finance career, but one may be more suitable than the other depending on your goals.

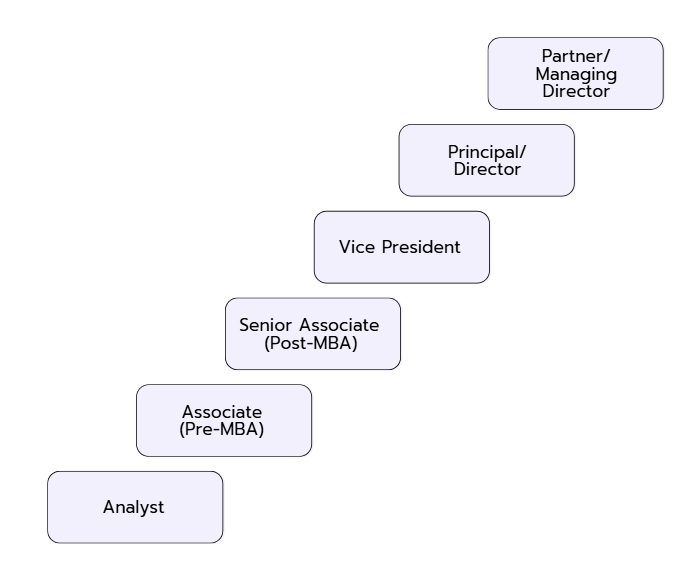

In this guide about private equity and venture capital, we will help you understand the differences between the two career progression paths, firm types, and salary. Read on to find out about the opportunities and challenges that await in each and select the right choice for you.