Are you wondering what your responsibilities might look like if you secure an investment banking associate role? In most IB firms, you'll be more like a bridge between the analysts and the senior bankers. This means you'll break down the senior bankers' vision into actionable tasks, assign and review the analysts' work, and perform other duties that keep the deals moving forward.

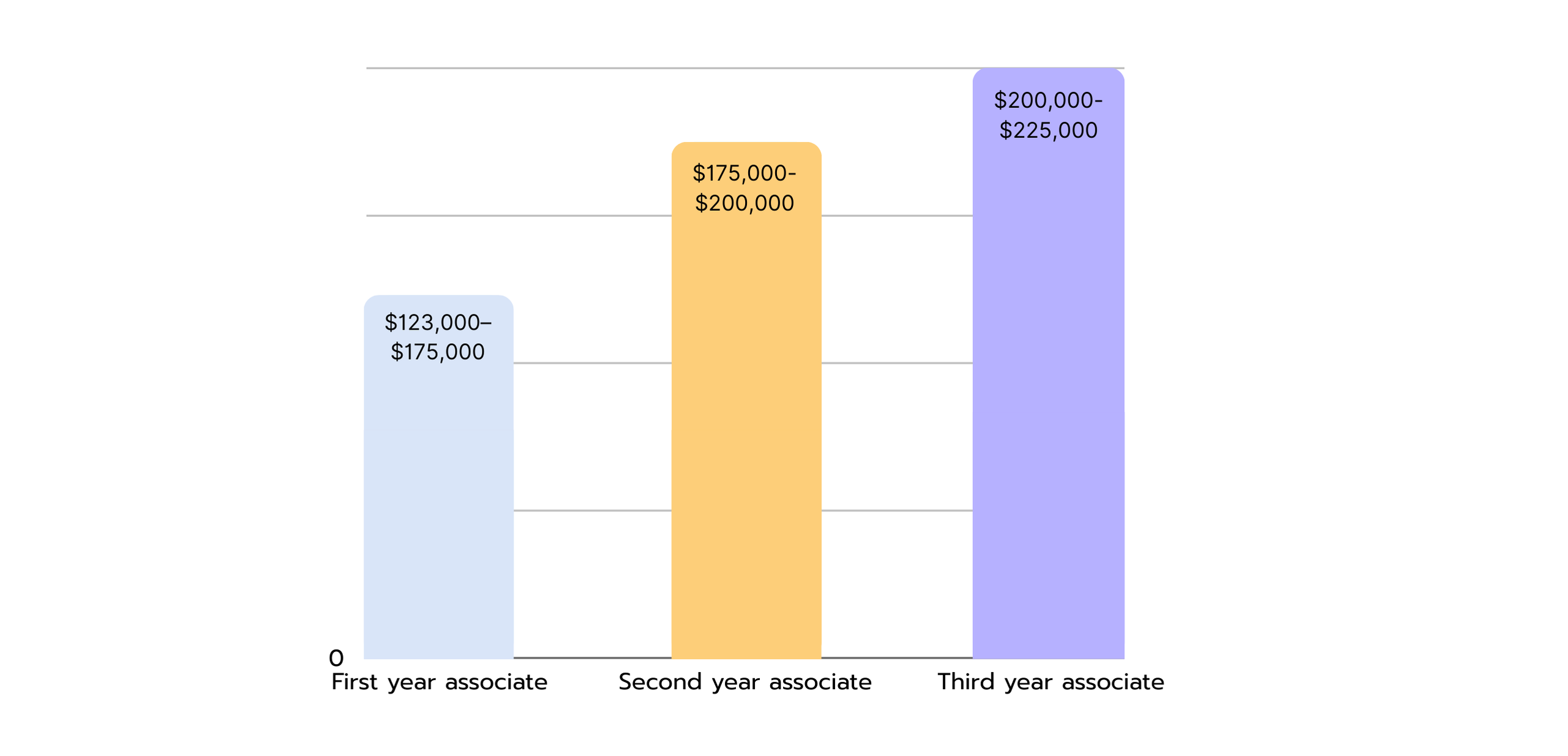

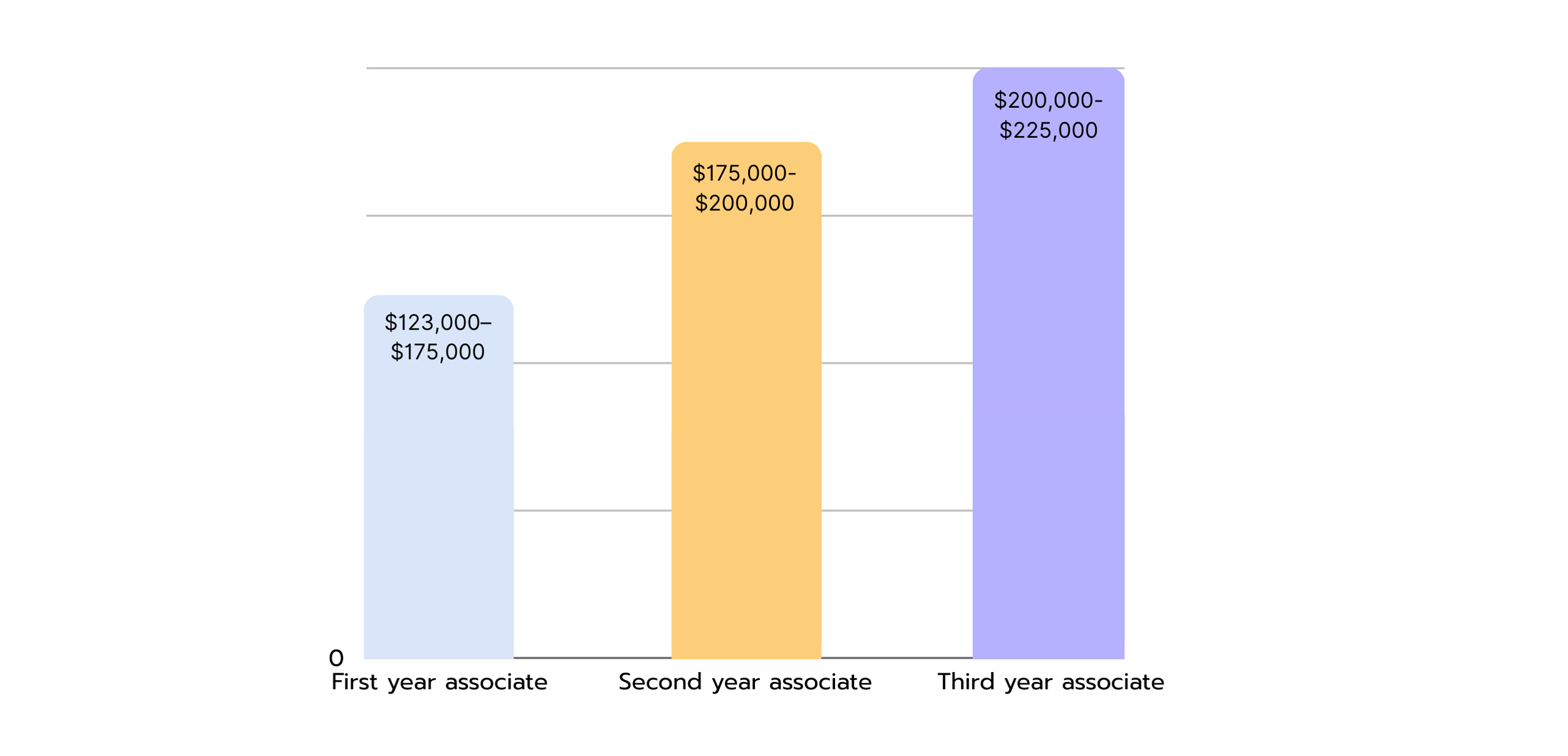

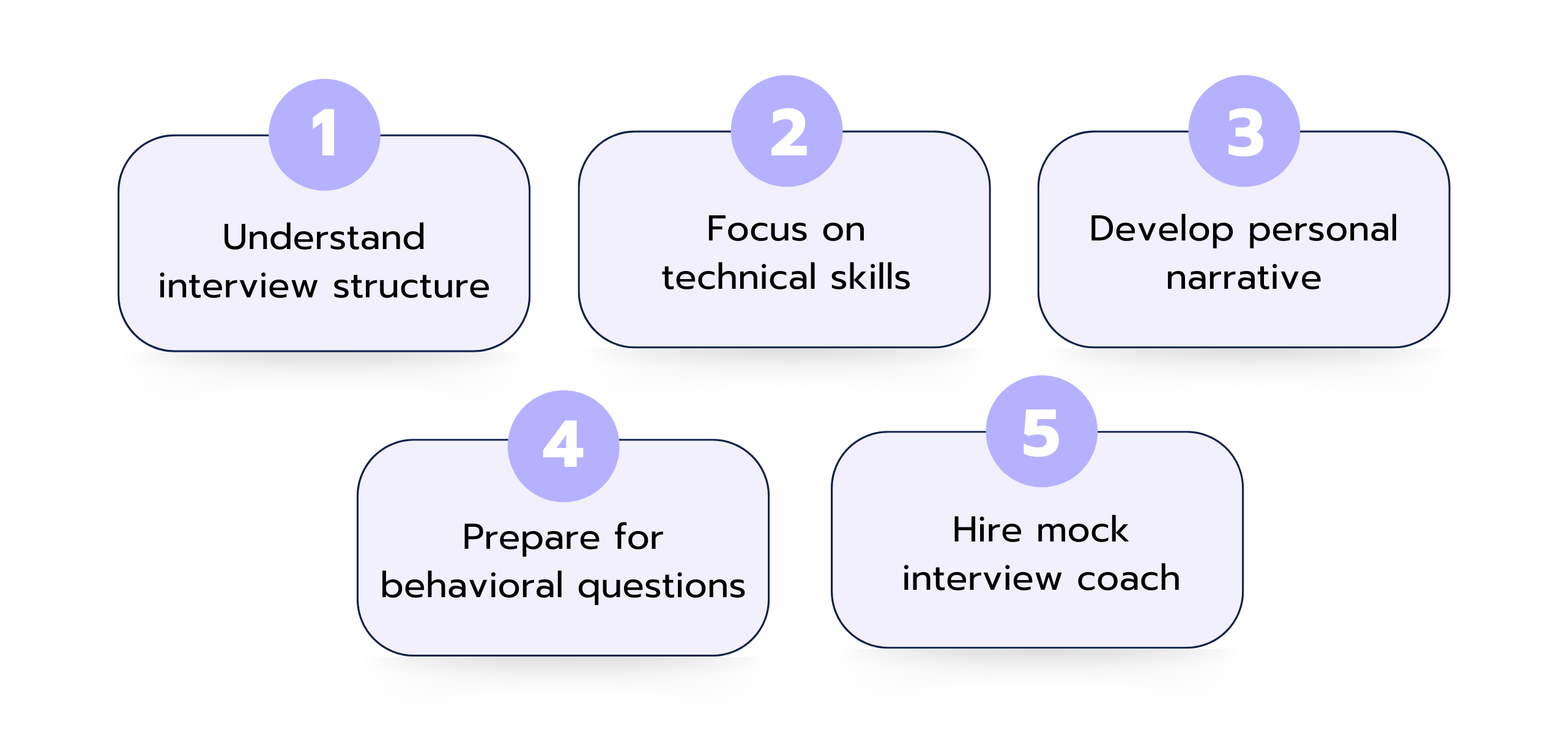

It's a demanding role. But it's also where you really start to get involved in the bigger picture of deals while still staying connected to the fundamental tasks like conducting research. 📊 In this article, we'll look at the role of an investment banking associate, how it compares to analyst and vice president positions, salary expectations, work-life balance, qualifications, and interview preparation tips.