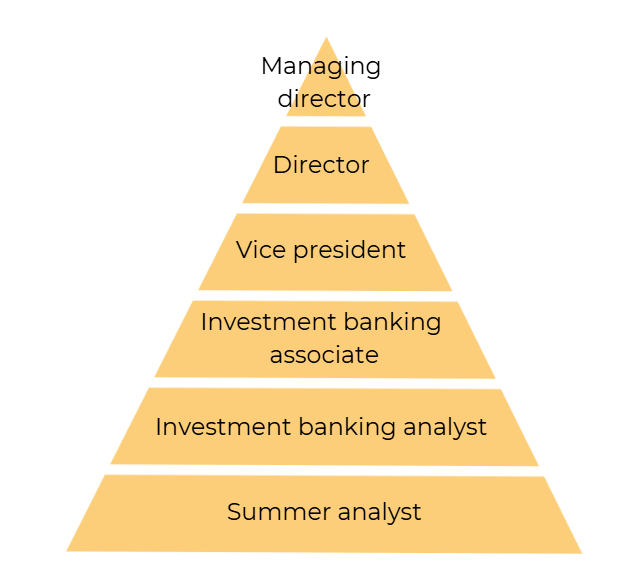

Are you curious about the role of an investment banking analyst? In the IB career path, analysts are at the bottom of the hierarchy, just above summer interns. But they're some of the most highly paid entry-level professionals.

This article will help you get a comprehensive understanding of the responsibilities, skills, salary, work-culture, and career advancement opportunities of an investment banking analyst. Keep reading to discover what makes this role both challenging and rewarding.