What Is the Role of an Analyst in Investment Banking?

An investment banking analyst is an entry-level position for graduates seeking to break into IB. At the analyst position, you'll join a firm for two years with the possibility of getting an extra year if all goes well. You can progress to the associate level after completing the 2-3 years of an analyst.

Depending on the firm, analysts work in an industry group (technology, healthcare, industrials, etc.) or a product group like mergers and acquisitions, restructuring, leveraged finance, equity capital markets, or debt capital markets. In some firms, you can get rotated to another product group but in others you might remain in one throughout the entire period.

As an analyst, your work typically involves supporting associates and senior bankers to win and close deals. This means your daily duties can vary everyday depending on what your seniors need help with, including administrative duties. This support allows senior bankers to focus on strategic decision-making and client interactions while relying on analysts for the groundwork.

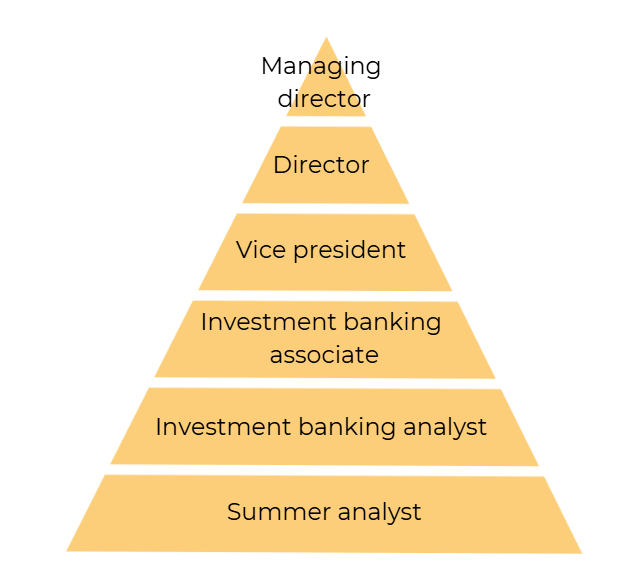

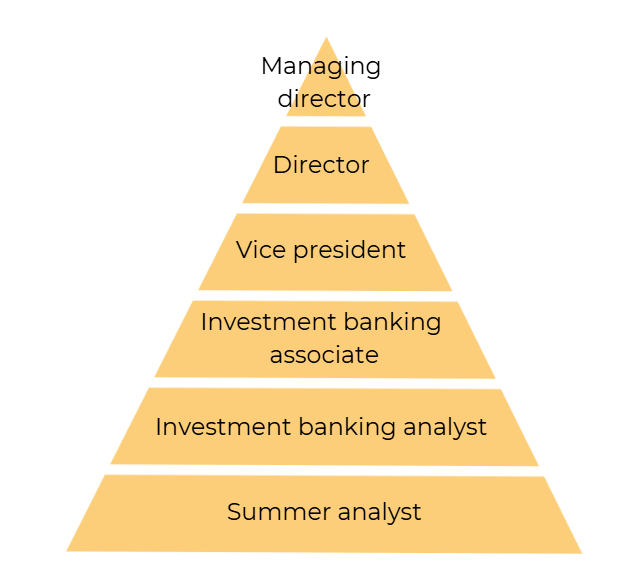

Career progression in investment banking follows a structured path:

You can decide to climb up the ladder or explore exit opportunities into private equity, hedge funds, or corporate finance roles. Reasons for transitioning may include seeking a better work-life balance, pursuing different interests within finance, or aiming for roles that offer more strategic responsibilities. It's helpful to understand these dynamics if you're considering a long-term career in investment banking.

Daily Tasks and Responsibilities of an Investment Banking Analyst

But what does an investment banking analyst do all day? You can summarize the duties of an analyst into gathering, analyzing, and presenting data to the team. However, a typical daily workload for an analyst can include:

- Conducting in-depth financial analyses and due diligence

- Building detailed financial models

- Researching, gathering, and presenting various types of information to the teams

- Creating pitch books

- Preparing presentations that communicate complex information clearly and effectively

- Preparing materials for meetings and ensuring that all necessary information is readily available for discussions

- Offering general and administrative support to the department like scheduling meetings and tracking project timelines

The work environment for investment banking analysts is typically fast-paced and high-pressure. The work culture generally emphasizes teamwork. So, analysts work in teams with other analysts and frequently collaborate with associates and senior bankers on projects.

Regarding hours, you can expect to work 70 to 100 hours per week as an investment banking analyst. This means you might have little downtime and less sleep especially in the first year.

While the workload can fluctuate based on project deadlines and deal activity, you should prepare for late nights and occasional weekend work. Despite such challenges, the invaluable exposure to high-stakes financial transactions and a solid foundation for future financial career advancement can make the experience rewarding.

What Is Expected of an Investment Banking Analyst?

Now let's look at what is expected of an investment banking analyst in terms of technical skills, soft skills, and academic qualifications.

Technical Skills

Some of the technical skills you need to be an investment analyst include proficiency in Excel and financial modeling. Other skills include a good understanding of valuation techniques, financial analysis, and a solid grasp of financial statements.

The expectation of having these skills as an investment banking analyst is understandable given the duties you'll perform. Excel is often the primary tool for creating complex financial models that help evaluate various financial scenarios. This means you must be able to use advanced functions and formulas to manipulate data effectively and ensure accurate forecasts and valuations. On the other hand, financial modeling skills will help you project a company's future performance based on historical data and market trends.

Soft Skills

The soft skills that are looked for in investment banking include strong communication skills, time management, analytical capabilities, and organization skills.

Educational Background

You don't really need an MBA for investment banking if you join the industry straight out of undergraduate as an analyst. But if you're pursuing an MBA program, you can join the investment banking industry as an associate.

But which degree is best for investment banking? Typically, IB analysts hold degrees in finance, economics, or related fields. Most firms prefer these educational qualifications because they provide a strong foundation in financial principles and analytical techniques. However, relevant coursework in accounting, statistics, and business are considered.

Besides the educational qualifications, internships and networking are invaluable for securing a position in investment banking.

How Much Do Investment Banking Analysts Earn?

Investment banking analysts are generally well-compensated. First year analysts in the US earn an average base salary range from $95,000 to $158,000. With additional pay of $94,000 to $175,000, analysts can take home an average total pay of $247,581 annually.

However, you can make less or more than the average salary depending on the firm, location, performance, overall industry conditions, and negotiation skills.

👉 Find out more about salaries in investment banking.

In addition to competitive salaries, investment banking analysts enjoy a range of benefits. Common perks include comprehensive health insurance, retirement plans, and performance bonuses. Many firms also offer professional development opportunities, such as sponsorship for advanced degrees or certifications like the CFA. These benefits enhance the overall compensation package and contribute to career growth and personal development.

What Are the Challenges and Realities of the Investment Banking Analyst Role?

Let’s take a look at common challenges you might experience in the investment banking career path.

Work-Life Balance as an Investment Banking Analyst

Working 70-100 hours a week means late nights and weekend work, especially during busy periods or when deals are closing. This intense schedule can lead to challenges in maintaining a healthy work-life balance.

However, many banks are increasingly recognizing the importance of employee well-being and are implementing initiatives aimed at improving work-life balance. These include “protected weekends”, flexible work arrangements, and mental health resources.

Also, the analyst position has the most intense work but it's not long-term. It's more of a two to three years sacrifice that can lead to rewarding opportunities if done right.

Job Stress and Pressure

The high-pressure environment of investment banking comes with its own set of challenges. As an analyst, you might face tight deadlines, high expectations, and the need to deliver accurate work under stress. This pressure can lead to burnout if not managed effectively.

To cope with the demands of the job, you'll need to develop strategies such as prioritizing tasks, seeking support from colleagues, and engaging in stress-relief activities outside of work. Building resilience and maintaining a healthy perspective on work can also help you thrive in this fast-paced industry.

What is the Difference Between a Financial Analyst and an Investment Banker?

It's easy to think investment bankers and financial analysts are similar. However, their roles and responsibilities vary. Financial analysts focus on analyzing financial data, market trends, and economic conditions to guide investment decisions for companies or individuals. They often work in various sectors, including banks and corporations.

On the other hand, investment bankers specialize in raising capital for businesses, facilitating mergers and acquisitions, and advising on complex financial transactions. Their work is more transaction-oriented and involves direct client interaction

Wrapping It Up

The typical work of an investment banking analyst revolves around supporting the associates and senior bankers to execute their duties smoothly. The role is correspondingly both challenging and rewarding. Analysts often have longer work hours than other entry level positions. But they also get lucrative pay packages, great opportunities for advancement, and excellent exit opportunities that make it an attractive career choice for many.