If you're interested in a career in finance, you've probably come across the term Commercial Due Diligence. But what exactly does it mean?

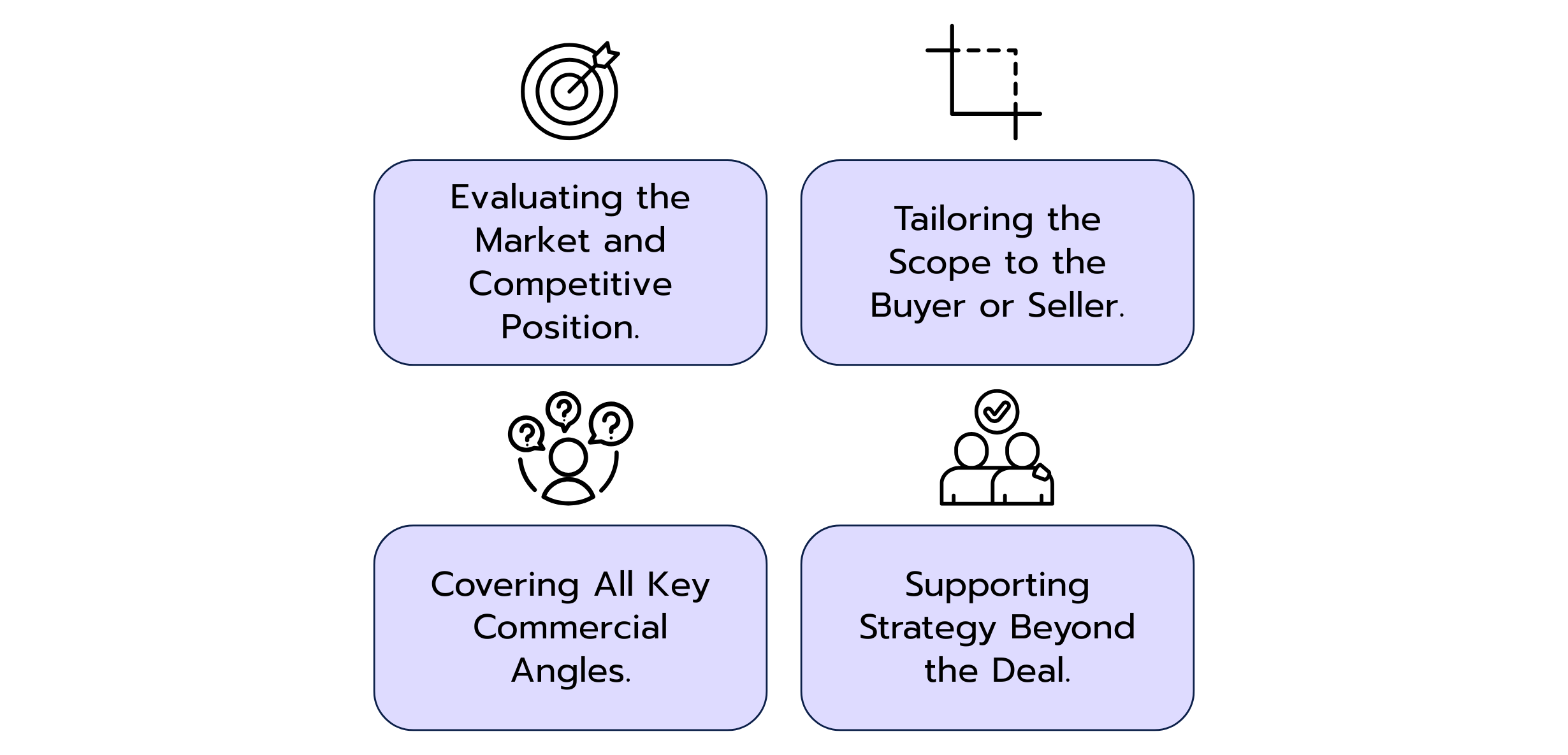

Commercial due diligence (CDD) is a key part of the M&A process. It's especially important in private equity, where investors need to understand whether a company is truly worth investing in before making a deal.

In this article, we’ll break down what CDD is, where it fits into the deal process, who conducts it, and what kind of work it involves. Whether you're preparing for interviews or are just curious about how investment decisions are made behind the scenes – this guide will give you an overview and help you understand how one of the most strategic areas of finance works.