The income statement, also known as the profit and loss statement (P&L), provides a summary of a company's annual revenues, costs, and profits/losses. It is one of the three key financial documents, alongside the balance sheet and cash flow statement.

The income statement records revenues and expenses at the time they are incurred (accrual accounting). For example, an invoice appears in a company's income statement on the day it is generated, regardless of when the payment is made. In contrast, in the cash flow statement, an expense is recorded only when the payment is actually made.

Example:

Suppose a company sells products worth €100,000 and receives a bill for material costs of €40,000. In the income statement, the revenue of €100,000 is recorded at the time of the sale, and the material costs of €40,000 appear simultaneously.

Key Terms in the Income Statement

- Operating revenue: All revenue generated from the regular business operations of a company.

- Operating costs: These are subdivided into:

- COGS (Cost of Goods Sold): Costs directly incurred from producing goods, such as material and labor costs.

- SGA (selling, general and administrative costs): Costs that cannot be easily attributed to a single product, such as general advertising expenses.

- Gross profit: Operating revenue minus operating costs.

- Non-operating revenue and costs: Income and expenses not related to the main business activity, such as revenue from selling real estate or legal costs.

- Depreciation: The reduction in value of assets, such as outdated machinery.

- Interest: Costs of debt, which are listed on the balance sheet.

- Taxes: Taxes paid on EBT (Earnings Before Tax).

💡Prep tip: Need to freshen up your mental math skills? Try out our Mental Math Tool.

Role of the Income Statement in Consulting and Case Interviews

The income statement is an important tool for analyzing a company’s profitability. In consulting projects and case interviews, various financial ratios play a crucial role in gaining deeper insights into a company's financial condition and performance.

Analysis of Financial Ratios:

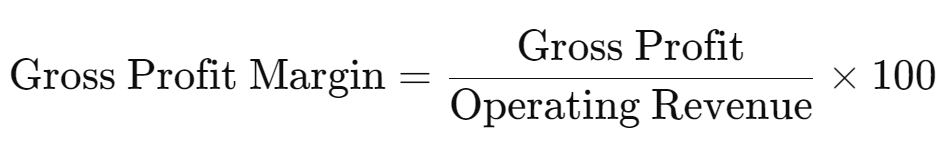

- Gross profit margin: This metric indicates the profitability of the core business by considering only operating revenue, COGS, and SGA. A high gross profit margin suggests that the company produces efficiently and manages its costs well.

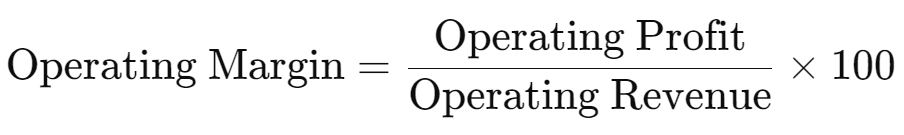

- Operating margin: This includes non-operating costs and revenues, as well as depreciation. This metric provides a more comprehensive view of the company’s profitability.

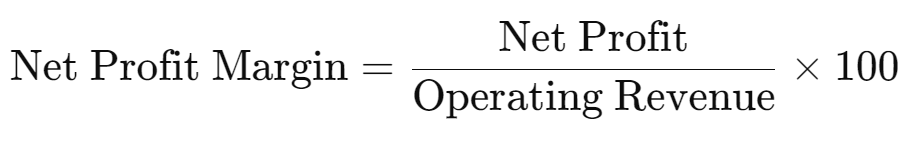

- Net profit margin: This metric takes into account all costs, including interest and taxes, and is an indicator of the overall profitability of the company.

By comparing the gross margin and the net profit margin, consultants can draw conclusions about the causes of variations. If the net profit margin differs while the operating margin remains stable, this indicates that differences in tax and interest payments are the cause.

Case Example

💡To make the whole process of presenting the income statement and its relevance for case interviews clearer, we illustrate this calculation using an example case from Oliver Wyman.

Case Prompt

TrainCo is a manufacturer of rolling stock, or trains, with production sites in three European countries. The company has seen declining profitability over the past years; however, they are currently in a very good position to bid for and win a big contract for regional trains for a Swiss national rail company. They have asked you advise to them on whether they should place a bid for the contract.

Given Information

- Selling price per train: €21.0 million

- Variable costs per train:

- Material costs: €15.2 million

- Labor costs: €3.9 million

- Fixed costs for the facility in Switzerland:

- Re-tooling investment: €16.0 million

- Annual fixed costs (20% of the investment): €3.2 million per year

- Dismantling costs: €2.0 million

- Production: 30 trains over 6 years (5 trains per year)

- Variable profit margin per train: €1.9 million

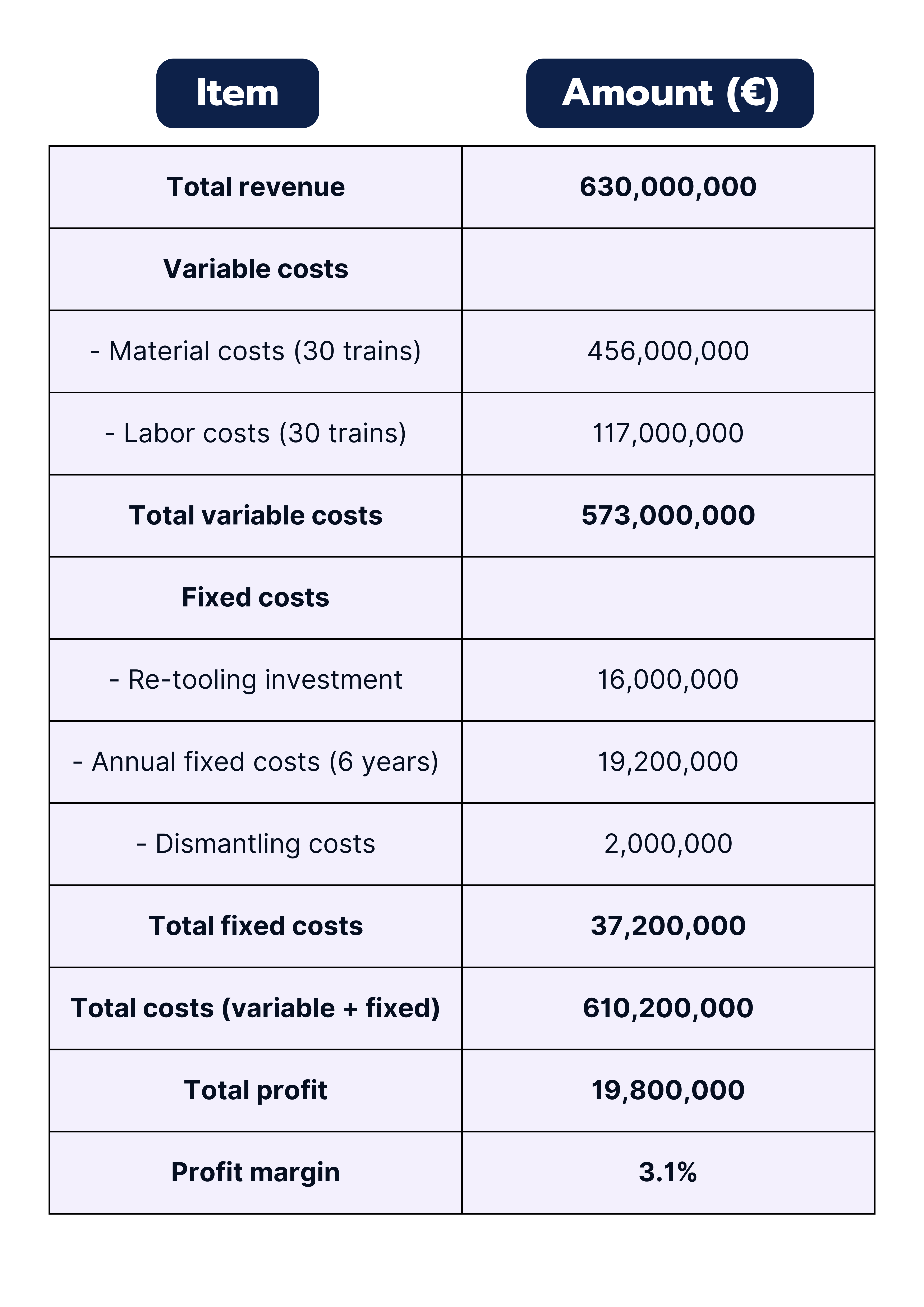

Now, let’s create an Income Statement for the entire project duration to calculate the total profit.

Calculations

1. Total Revenue:

- Revenue per train = €21.0 million

- Total revenue for 30 trains = 30 * €21.0 million = €630.0 million

2. Total Costs:

a. Variable Costs:

- Material costs for 30 trains = 30 * €15.2 million = €456.0 million

- Labor costs for 30 trains = 30 * €3.9 million = €117.0 million

- Total variable costs = €456.0 million + €117.0 million = €573.0 million

b. Fixed Costs:

- Re-tooling investment = €16.0 million (one-time)

- Fixed costs per year for 6 years = 6 * €3.2 million = €19.2 million

- Dismantling costs = €2.0 million (one-time)

- Total fixed costs = €16.0 million + €19.2 million + €2.0 million = €37.2 million

3. Total Costs (Variable + Fixed Costs):

- Total costs = €573.0 million + €37.2 million = €610.2 million

4. Profit:

- Total Revenue = €630.0 million

- Total Costs = €610.2 million

- Total Profit = €630.0 million - €610.2 million = €19.8 million

5. Profit Margin:

- Profit Margin = (Total Profit / Total Revenue) * 100 = (€19.8 million / €630.0 million) * 100 = 3.1%

Result

The calculated profit margin is 3.1%. However, the case specifies a minimum margin of 10%, which means that the current plan for production in Switzerland does not meet the profitability requirements.

The company must therefore reduce costs or increase revenue to achieve the 10% profit margin.

⚠️ We have simplified the case to illustrate the scheme. In the real case, other factors, such as the possibility of changing location, are also taken into account. Can you solve the entire case? Find out here!

Key Takeaways

- The income statement summarizes a company's revenues and expenses over a specific period, using accrual accounting to record transactions when incurred.

- Key components include operating revenue, operating costs (COGS and SGA), gross profit, and net profit, which together inform financial health and performance.

- Financial ratios derived from the income statement, such as gross profit margin and net profit margin, are critical for analyzing profitability and operational efficiency.

- Variations in these margins can indicate underlying issues, such as changes in tax strategies or interest expenses, making the income statement essential for strategic decision-making in consulting and case interviews.