M&A stands for Mergers and Acquisitions, which basically means helping companies with buying, selling, or merging with other businesses. It’s a broad field that covers all sorts of exciting things – from company takeovers (using debt or equity) to mergers, spin-offs, carve-outs, and strategic partnerships.

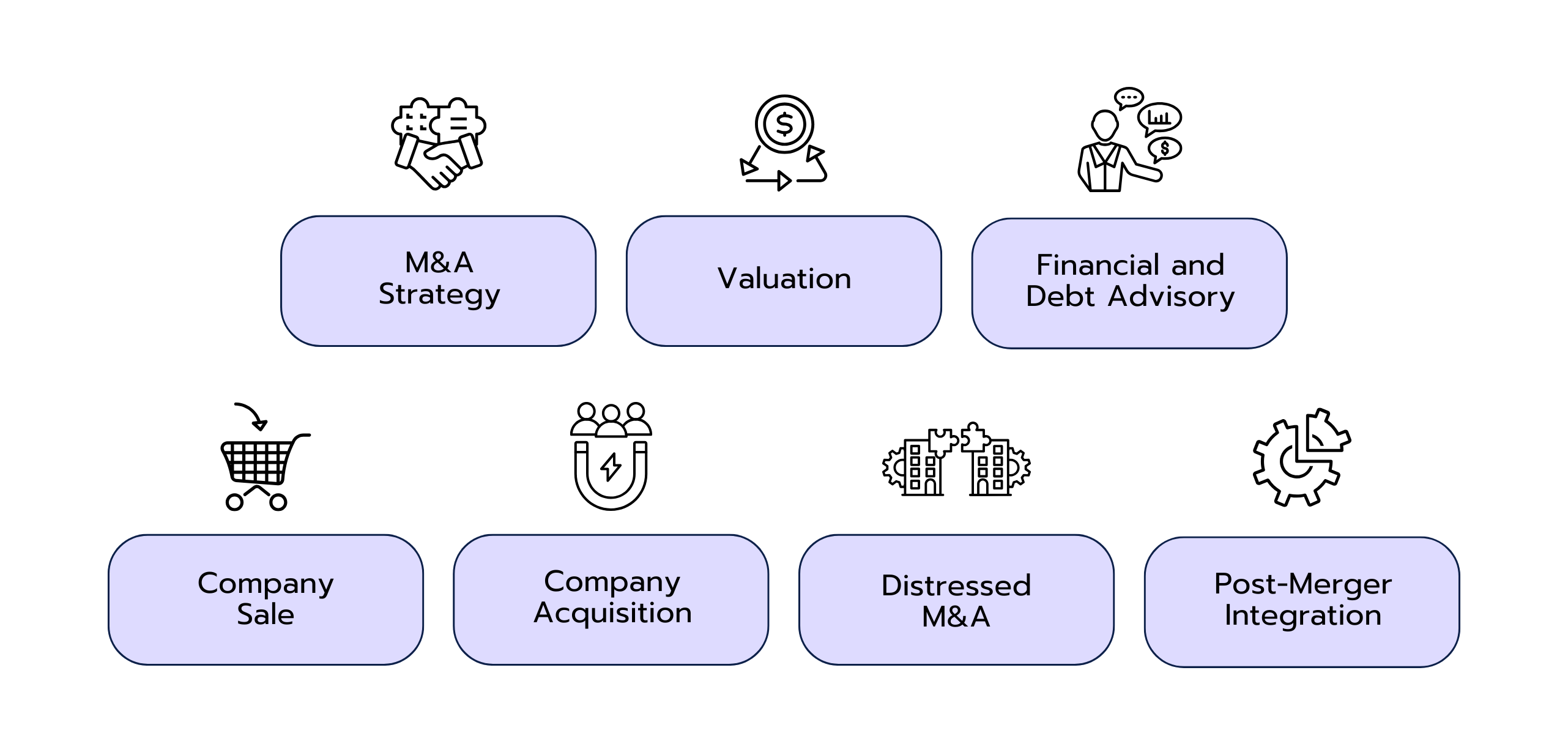

Our expert Lukasz breaks it all down: what the main goals and tasks are in M&A, how to make the most out of your deal, and what the typical process looks like. Plus, he explains the key services consultants usually provide in this space.