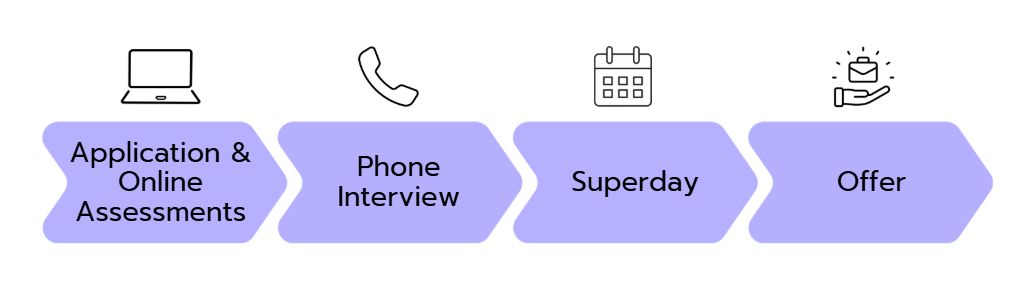

If you want to land a finance job at Wells Fargo, you should have an idea of what to expect when you apply for a position. It will help you prepare to impress the interviewers, avoid being caught off guard, and ensure you pass the interview.

We put together this Wells Fargo interview guide to help you understand their recruitment process and give you proven tips acing the interview. We will also give you an overview of this financial services company and share some sample interview questions. Read on to discover what you need to know to maximize your chances of getting an offer at Wells Fargo.