If you’re considering a career in investment banking, you’ve probably heard the tales of grueling hours and non-stop work. It’s no secret that investment banking is demanding, but there’s more nuance to it than just late nights and all-nighters. Understanding what affects hours, what to expect, and how you can take steps toward a healthier work-life balance can help you get around in the world of finance. Here’s what you need to know before starting your career in investment banking.

Work-Life Balance in Investment Banking: How Bad Is It Really?

What Does “Work-Life Balance” Look Like in Investment Banking?

In investment banking, “work-life balance” might feel like an oxymoron at times. With client demands, tight deadlines, and the competitive nature of the industry, bankers often work long hours—well beyond the typical 9-to-5. In most cases, you can expect to work between 70 to 100 hours per week, especially in the early years of your career as an analyst or associate. This often includes evenings and weekends, making personal time feel like a luxury. But it’s important to note that things are changing slowly as investment banks recognize the impact of burnout and are taking steps to improve the work-life balance for their employees.

How Many Hours Can You Expect to Work?

The hours you’ll work depend on various factors: your role, the team you’re on, and the culture of the firm. Here’s a quick breakdown of what to expect:

- Role: Analysts and associates, the entry-level roles, tend to work the longest hours, often between 80 and 100 hours a week, with some intense weeks exceeding 100 hours. This can mean 16-hour days, six or seven days a week. As you rise to VP or Managing Director, hours may slightly ease, down to 50-70 hours weekly but with high client-facing demands.

- Type of Team or Group: Not all teams work equally long hours. Mergers & Acquisitions (M&A) and capital markets teams usually work the longest hours due to the time-sensitive nature of deals. Departments like asset management or research can offer a bit more balance, with hours closer to 50-60 per week.

- Deal Flow and Client Demands: The number of deals in the pipeline and client expectations affect how much time you spend working. When a deal is active, expect longer hours, sometimes for weeks at a time. During quieter periods, you may get a break with shorter workweeks.

- Firm Culture: Some firms are known for longer hours, while others prioritize work-life balance more. Boutique firms, for instance, may have fewer hours than large bulge-bracket banks, but this varies by company.

Why Do Investment Bankers Work Such Long Hours?

Investment banking is high-stakes and fast-paced, where time really is money. Here are a few reasons why the hours get so intense:

- Time-Sensitive Transactions: Deals are often time-sensitive, requiring fast turnarounds to stay competitive. Clients expect quick responses, and that urgency drives the extended hours.

- Global Markets: Many investment banks operate across different time zones, meaning work can extend late into the evening or early in the morning.

- Client-Focused Work: Much of the work revolves around client needs, which means bankers are often at the mercy of client schedules, adding unpredictability to the hours.

How to Manage Work-Life Balance in Investment Banking

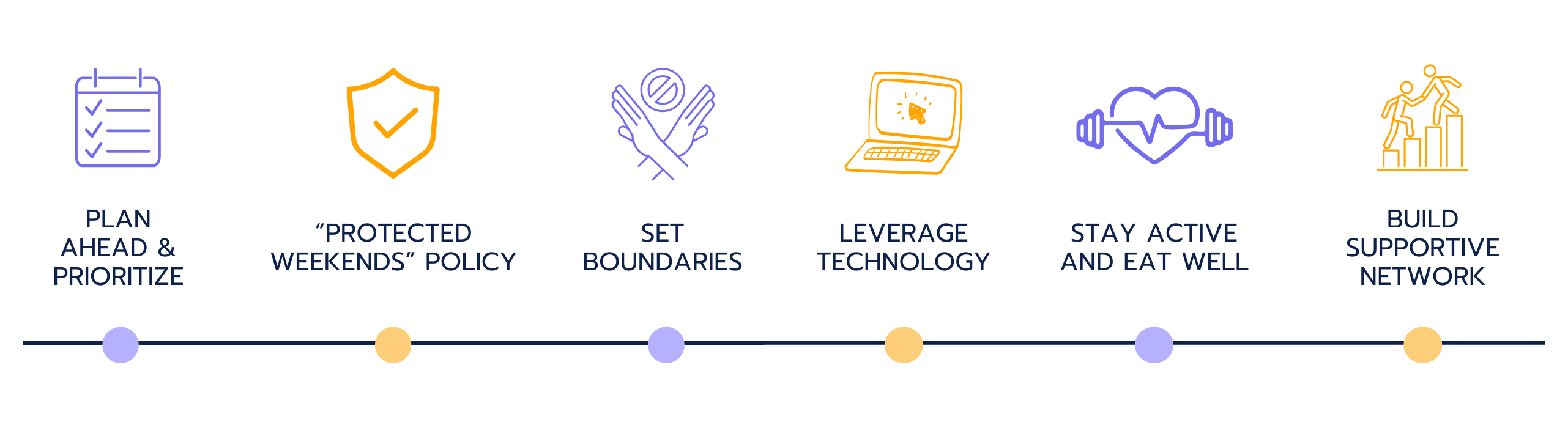

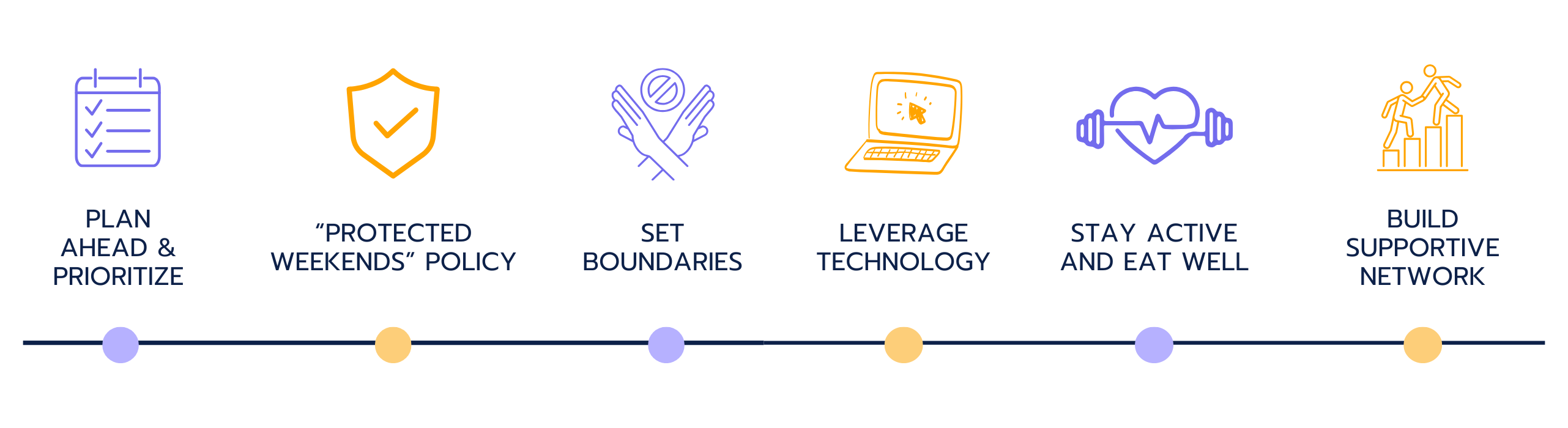

While the hours are long, many analysts and associates have learned techniques to carve out personal time and maintain their energy levels. Here are some tips for managing work-life balance in investment banking:

1. Plan Ahead and Prioritize

Prioritization is your best friend in investment banking. Organize your to-do list and understand what is genuinely urgent. Communicating with your team about your workload can also help manage expectations, especially if you’re juggling multiple tasks. You may also find that organizing your time in blocks for different tasks can make you more efficient.

2. Take Advantage of the “Protected Weekends” Policy

In response to burnout, some investment banks like Goldman Sachs and Morgan Stanley have introduced “protected weekends” policies. These are designated times when analysts and associates are encouraged to take a full 24 hours off from work. Not every firm is strict about enforcing this, but if yours offers it, use it. Step away, recharge, and spend time with friends and family. Many people find that these breaks improve their mental well-being, which in turn enhances their performance at work.

3. Set Boundaries and Stick to Them When Possible

In an industry where client demands are often urgent, setting boundaries can be tricky. However, you may find that politely setting expectations can help reduce interruptions during designated downtime. If possible, communicate with your team about times when you’re offline. While flexibility is important, being clear about when you need time away can help you maintain some control over your schedule.

4. Leverage Technology to Your Advantage

Investment bankers have to manage countless emails, data sources, and analyses, making tools that automate tasks incredibly valuable. Familiarize yourself with Excel shortcuts, data analysis software, and automation tools to reduce the manual workload. For example, there are shortcuts that allow you to create charts, tables, and calculations quickly, saving you valuable time. The more efficient you become, the better you’ll be able to handle your workload within reasonable hours.

5. Stay Physically Active and Eat Well

This one sounds simple, but it’s crucial. When you’re working long hours, it’s easy to neglect your health. Yet physical activity can be a significant energy booster. Even if you only have time for a short walk or quick workout, make an effort to move each day. Similarly, keeping nutritious snacks on hand and drinking water can improve your focus and concentration.

6. Build a Supportive Network

Having a strong support network—both inside and outside the office—can be incredibly valuable. Find mentors who understand the demands of the job and can offer advice, and maintain friendships outside of work to give yourself some non-work-related social interaction. Many banks also have affinity groups or wellness programs designed to foster a sense of community among employees, so explore these options if they’re available.

Are There Signs of Change?

While investment banking hours are still demanding, there are signs of improvement. Banks are increasingly focused on employee wellness, introducing initiatives like mental health programs, work-from-home days, and hiring additional staff to distribute workload more evenly.

Moreover, some boutique firms and newer financial institutions prioritize flexibility and work-life balance, creating more opportunities for bankers to find a rhythm that works for them. If you’re interested in the field but worried about the long hours, researching firms and their policies on work-life balance can help you find a role that aligns with your priorities.

Final Thoughts: Should You Go for a Career in IB?

Investment banking can be intense, no doubt, but for many, the rewards outweigh the sacrifices. The experience you gain in finance, client management, and high-stakes transactions can be invaluable. Many analysts and associates go on to successful careers in finance, consulting, or even entrepreneurship, taking with them the skills and resilience they built in banking.

While the work-life balance may not always be ideal, it’s important to remember that it won’t last forever. Most analysts spend a few years working these demanding hours before moving into more senior roles with slightly more manageable schedules or transitioning to other areas in finance.

If you’re considering investment banking, think about what you want from your career and how you plan to manage the demands. With the right strategies and mindset, you can build a fulfilling career in investment banking without burning out.

Continue to Learn