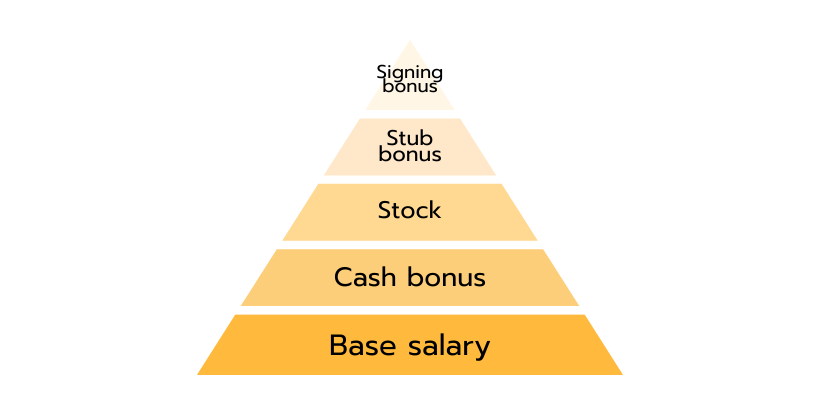

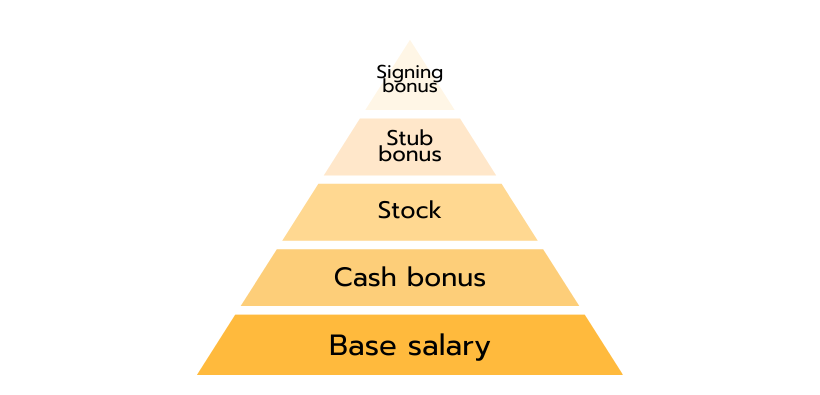

Breaking into investment banking comes with very high income expectations. Typically, an investment banking analyst in Germany earns an average salary of €80,000 per year. With additional pay like bonuses, the total average pay can be €115,000 annually.

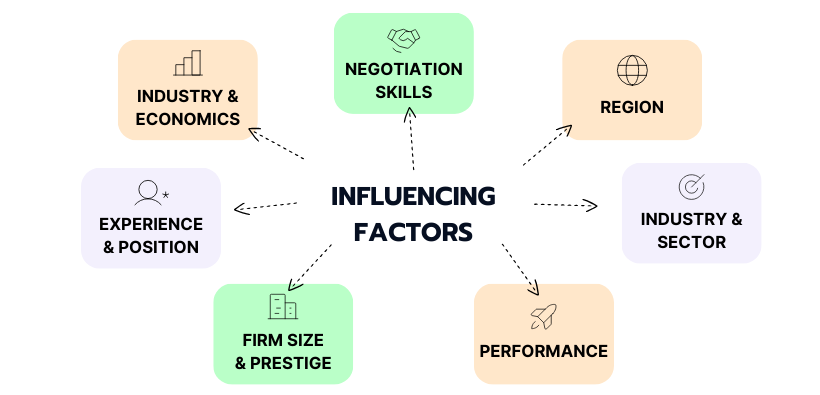

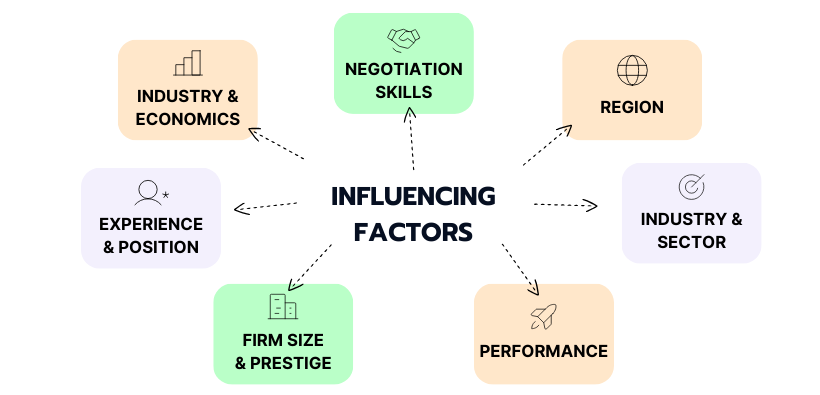

However, the pay isn't fixed. Instead, you could be earning a higher or lower amount depending on factors like region, firm, position, and bonuses. This article will help you understand the nuances of compensation in Germany's IB sector so you can have clearer expectations for your investment banking career.