Paper Print

A printing company is planning to take over another printing company with similar technology and printing machines. The candidate is supposed to evaluate the acquisition by answering a line of questions that are presented in the “suggested approach” section.

I. Analysis – Question 1: What are the benefits in concentration of production? What related risks have to be taken into consideration?

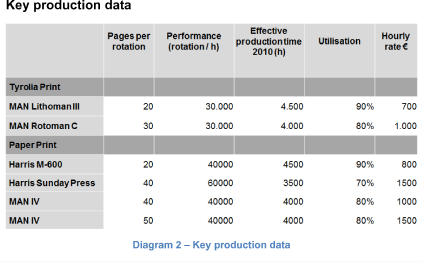

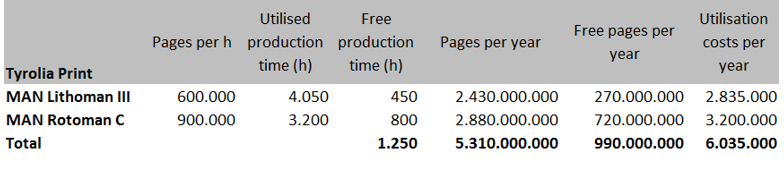

The two companies „Tyrolia Print“ and „Paper Print“ have one production site each and are specialized on rotogravure printing technology (a technology for printing large batches). Overlap of customers is approximately 75%, i.e. 3 out of 4 customers of one company are also customers of the other company. All production machines of both companies are similar and can replace each other. Due to the harsh competitive situation in the industry, excess capacity and small profit margins, Paper Print plans to take over Tyrolia Print. The Tyrolia Print production site would be shut down after the merger and integrated into the Paper Print site.

This case is best presented by taking the candidate through the case question by question. The first part is mostly qualitative and the second part deals with heavy quantitative aspects on mathematics and involves some sort of understanding of financial key figures. Depending on what you or the candidate prefer or want to prepare, you can decide beforehand on what you want to focus on.

This case is provided by PrepLounge Expert Robert Steiner.