E.ON Inhouse Consulting Case: Heating Systems

The European Union pursues the target of lowering the CO₂ emissions of their residents. Therefore, the EU introduced a CO₂ tax to create incentives for consumers to switch to more climate friendly alternatives and stabilize carbon dioxide emissions.

Accordingly, and as E.ON’s strategy focuses on creating a better tomorrow for its customers, E.ON is investing significantly to grow its ‘Customer solutions’ area with climate-friendly solutions, including its heating solutions business.

You have recently joined E.ON Inhouse Consulting and E.ON’s Head of Heating Solutions has hired you to conduct an analysis concerning the European CO₂ tax. Specifically, you are asked to assess whether the EU uses the right tool to steer consumers towards more climate-friendly heating systems.

Task 1: Evaluation of different heating systems on the B2C market

a) Please take some time to think of different heating systems for B2C customers

b) Please cluster these heating systems into two groups (conventional and more climate friendly options)

c) Please name criteria for the evaluation of a new heating system in an investment decision of B2C customers

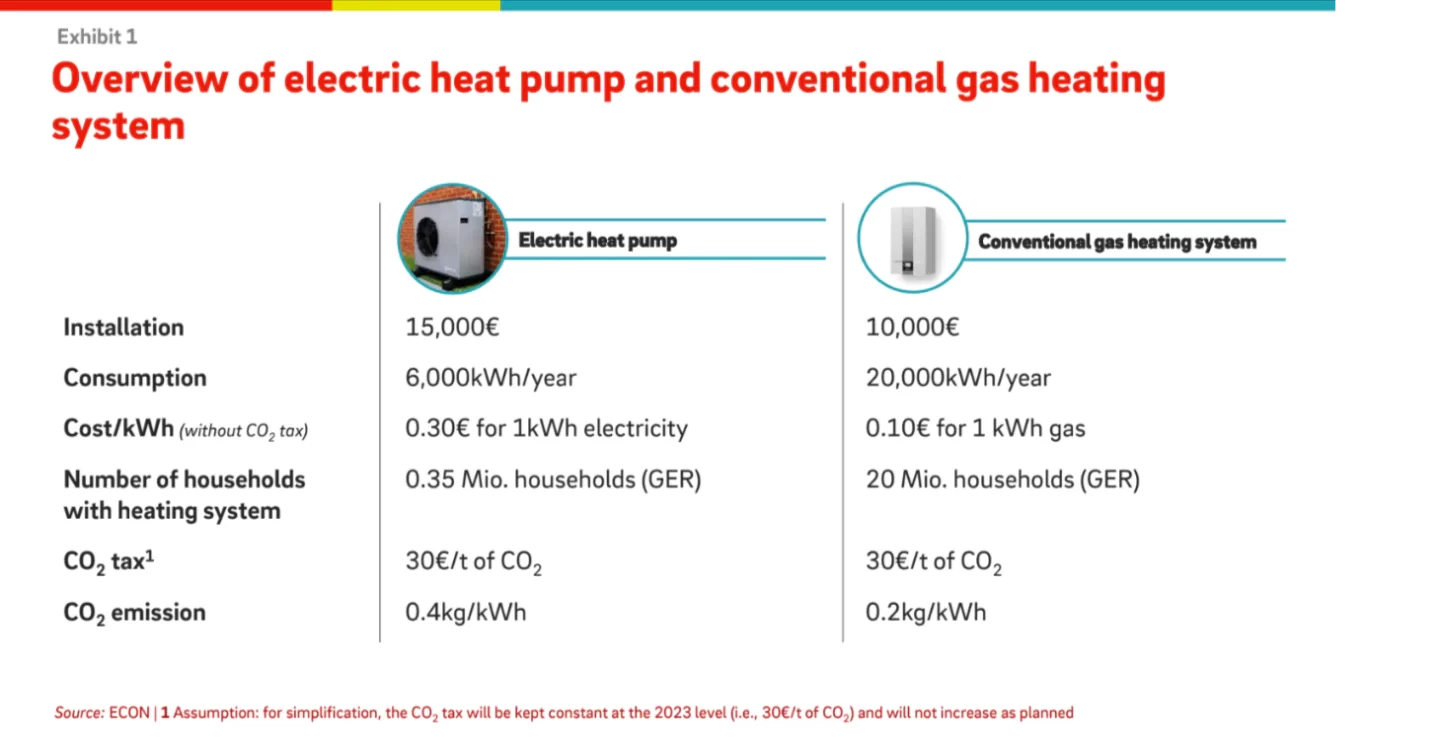

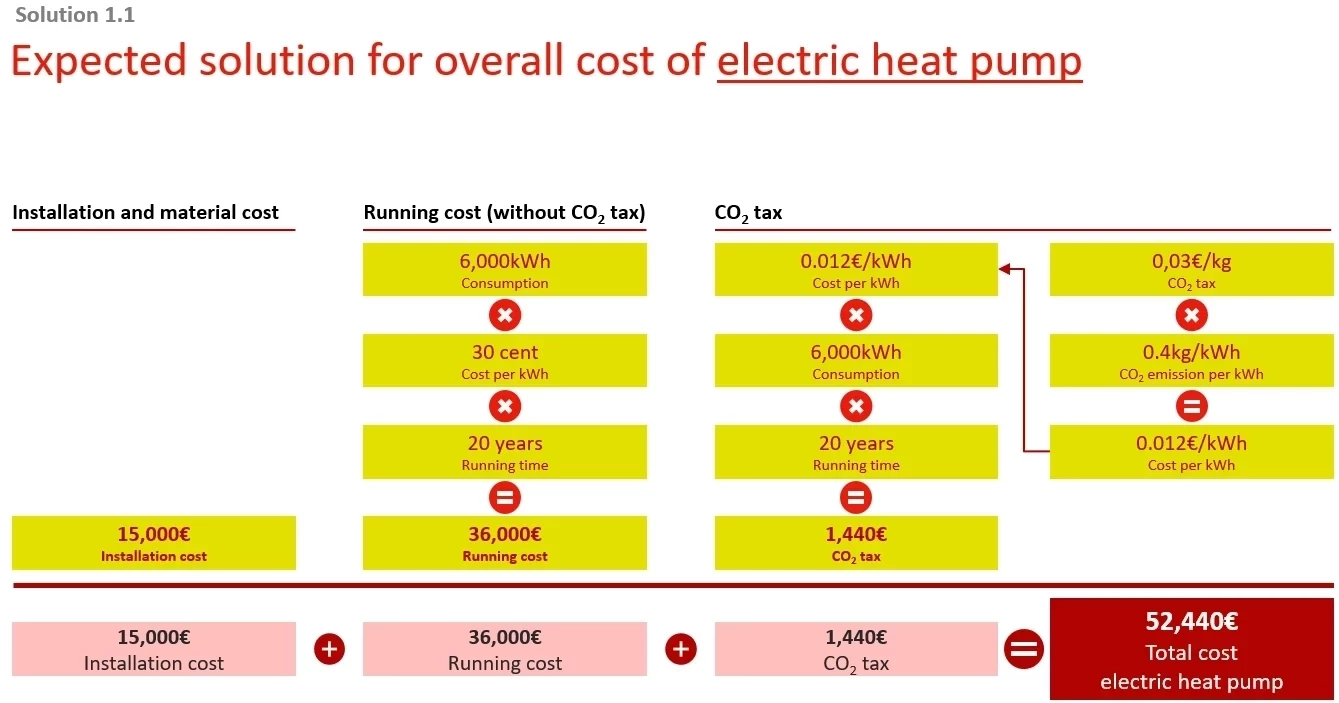

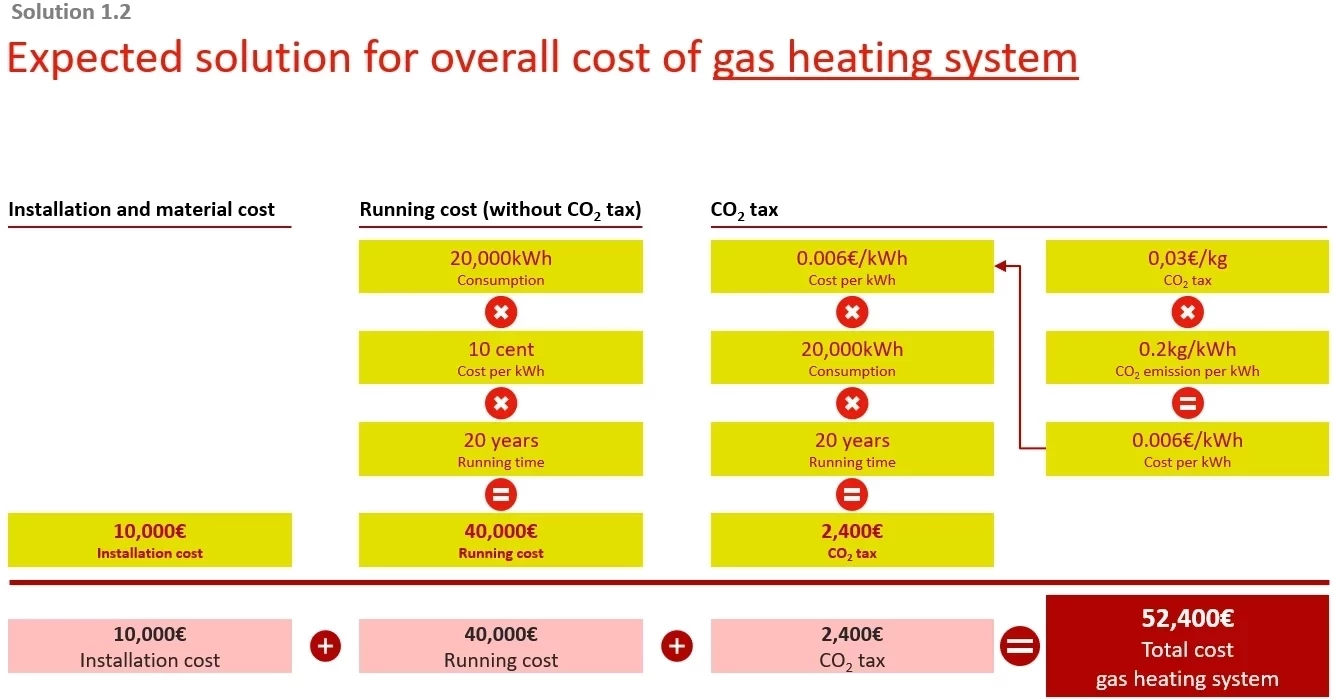

Task 2: Investment decision for a heating system

a) Please take some time to think of the required variables for an investment decision to assess which heating solution is more attractive from a financial perspective

b) Imagine being the house owner of a newly built single-family house in Germany, please evaluate which heating system you would choose

Task 3: Recommendations based on analysis

a) What did we learn from the results of our previous discussion as well as your analysis?

b) Is the CO₂ tax the right tool to incentivize climate-friendly options?

c) How can environmentally friendly heating alternatives become more attractive for B2C customers?

Task 4: Presentation of results

a) Please take some time to prepare a summary of your analysis to present it to the Head of Heating Solutions

b) Please present the key messages of your analysis