BCG Final Round: Stadium Naming Rights

Our client is NeuBank, a neobank in the US. A soccer stadium in Ohio is offering exclusive naming rights, and NeuBank is considering bidding for them. The client wants to understand the following:

- If this is a good idea?

- How much they should bid?

- How to make the deal a win-win?

NOTE that this case is very long and is meant for learning casing skills. If you intend to use it for mock practice then focus on very specific segments to complete it in time.

Also check out the video solution at the bottom of this page for a step-by-step work-along and detailed explanantion

Case Comments

Section 1: Clarifying Questions

- The key situation in the case is that NeuBank is looking to acquire naming rights to a stadium, and we need to address several business decisions so naturally we need to establish a solid foundation for the case

- The clarifying questions help set the foundation for the entire case. The candidate is being evaluated on their ability to clarify the situation and ask relevant questions. It's important for the candidate to understand the case at hand, the client's objectives, and the industry context. The recommended approach is to use a blend of commonly known basic frameworks (such as 4Ps and 3Cs) with customized questions specific to the case. These are well-structured frameworks that help ensure all critical aspects are covered and also shows the interviewer that you're taking a systematic approach.

- Note that asking good questions can help in creating a more effective solution. Do not hesitate is asking very silly questions upfront - that is always ok. Do not assume any specific things without confirming with the interviewer

Pause yourself here, write down your own questions for 30-seconds and come back

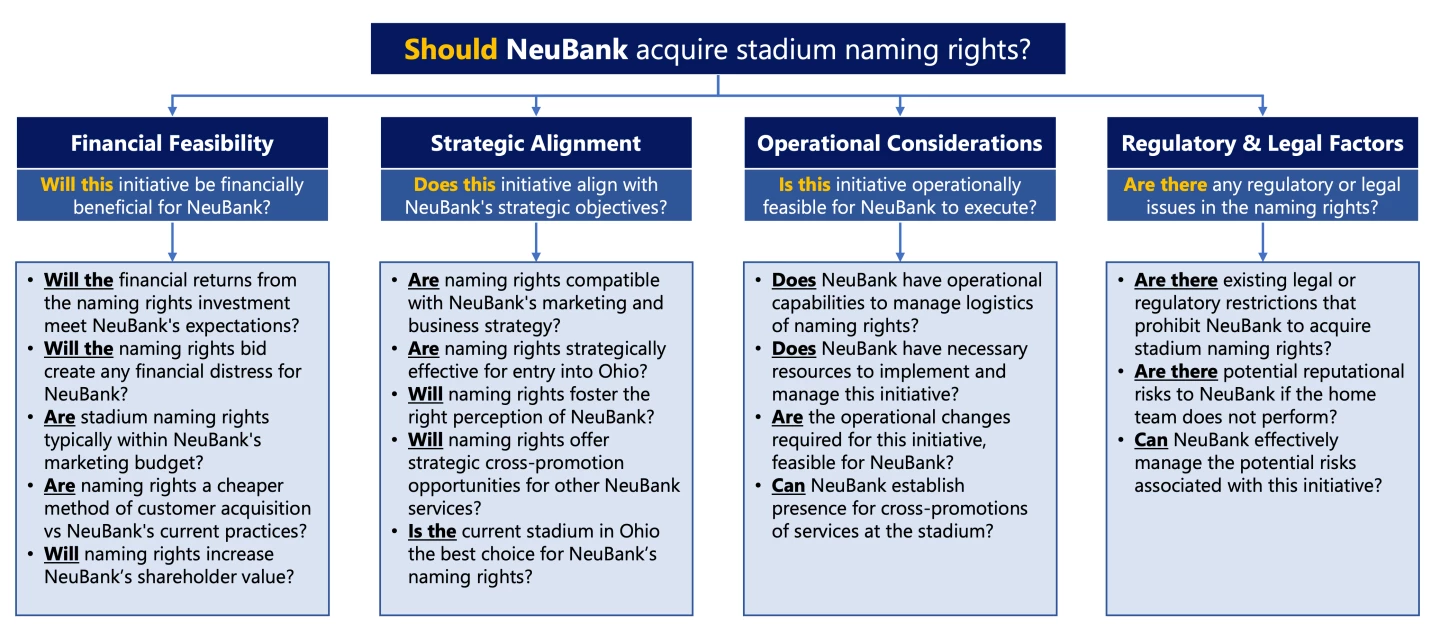

Sample Structure

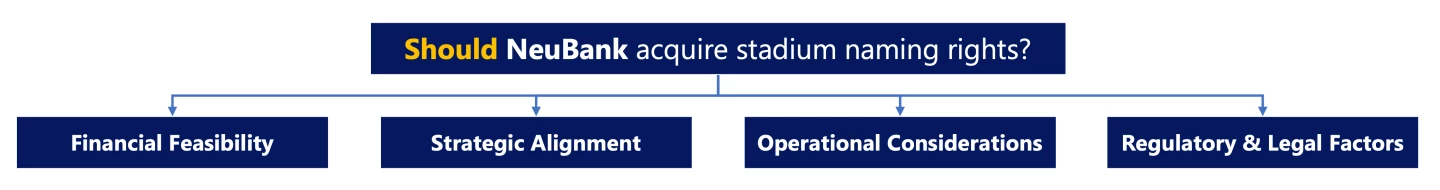

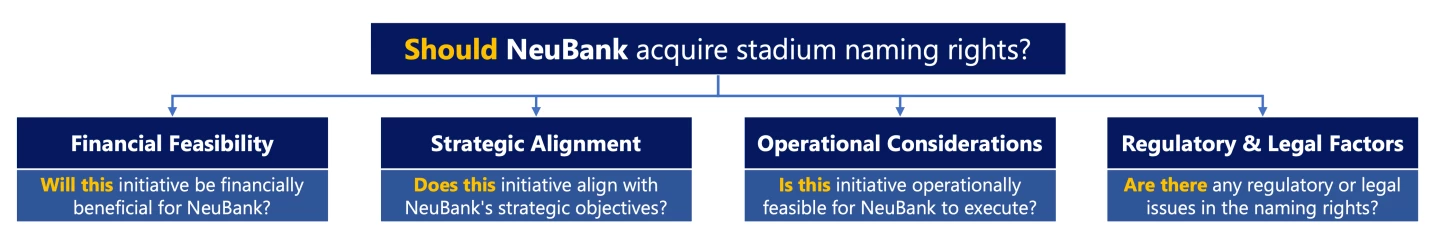

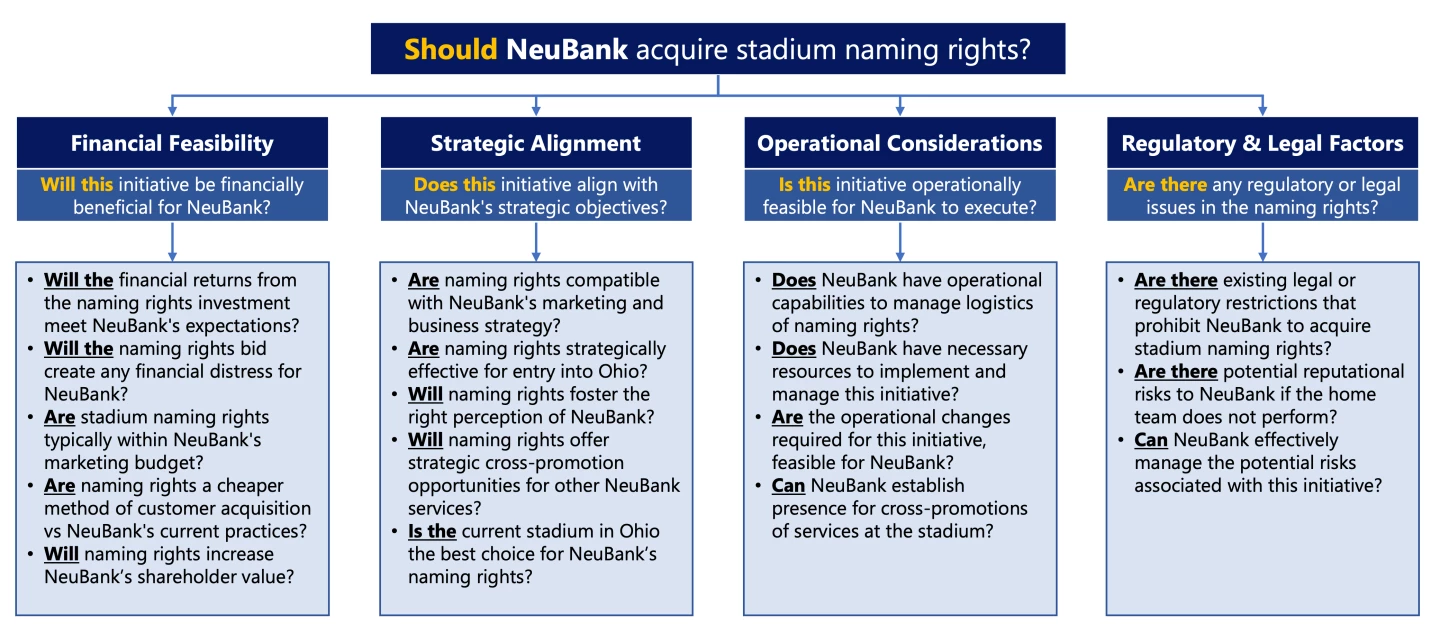

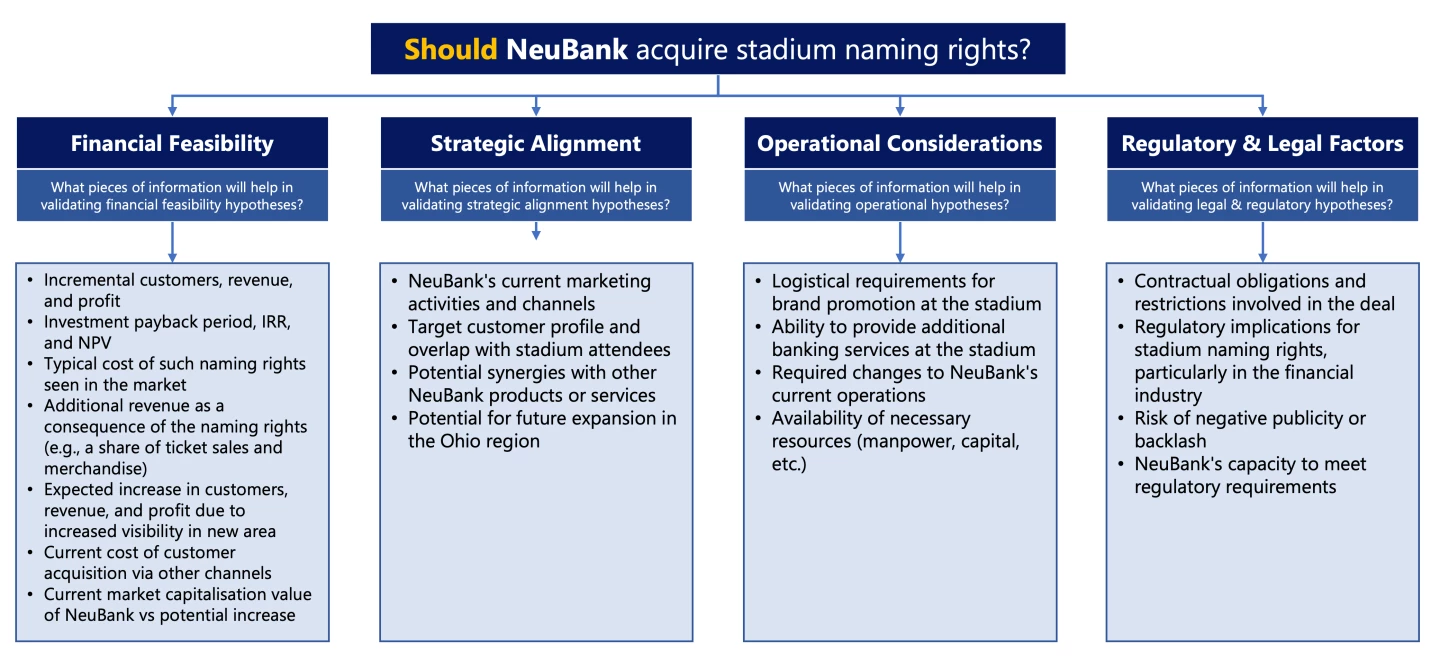

Instructions: Please take a time of 2-3 minutes to draw out your structure/framework. Once you have completed, take another 2 minutes to say it out aloud as if you were explaining it to the interviewer. These time limits are aligned with the expectations during an actual interview. Once you complete this exercise, proceed forward to see a sample framework solution. Your solution does not need to 100% match the sample solution – there is no right/wrong answer. Study the sample and see how you can improve you own solution

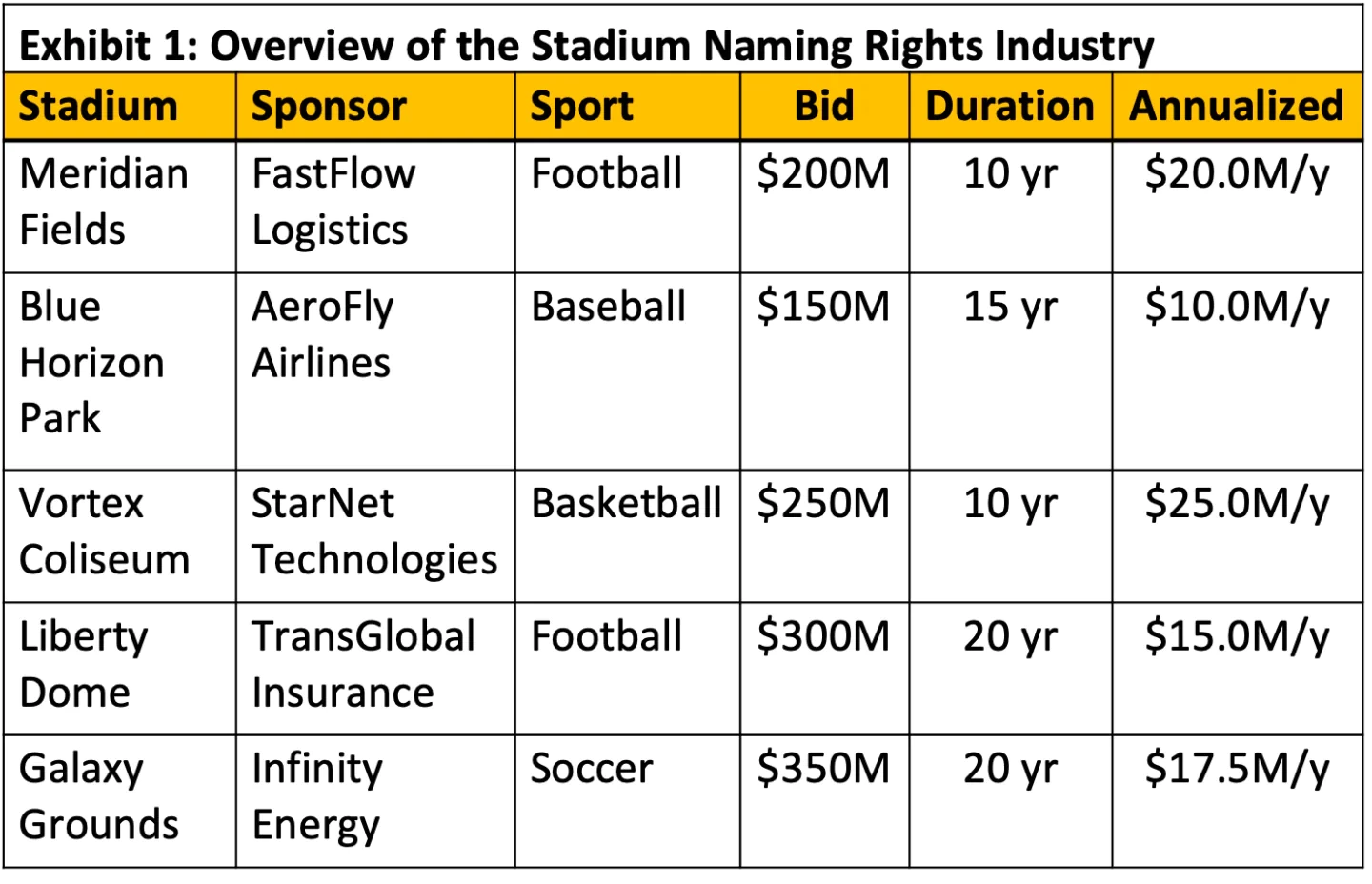

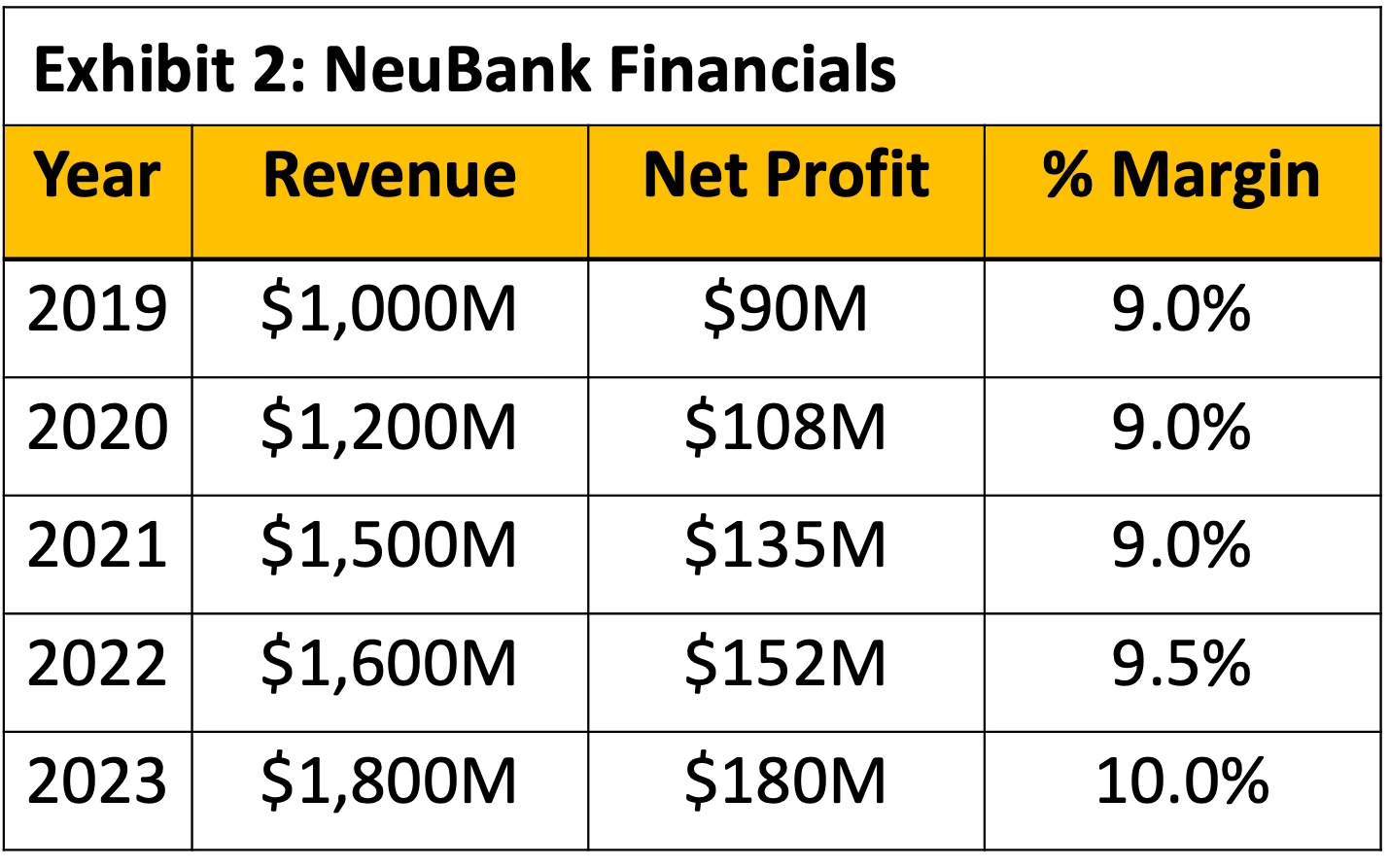

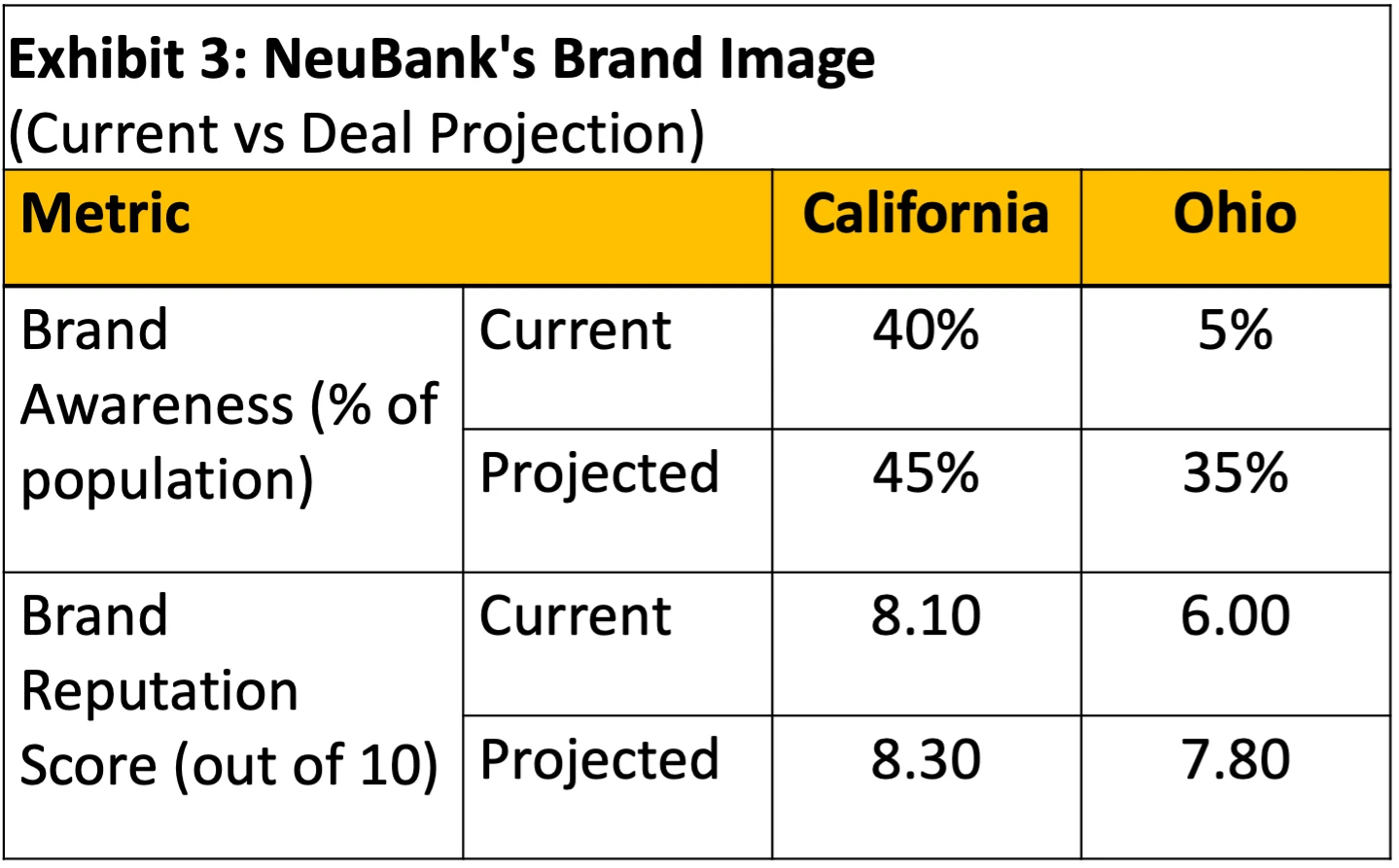

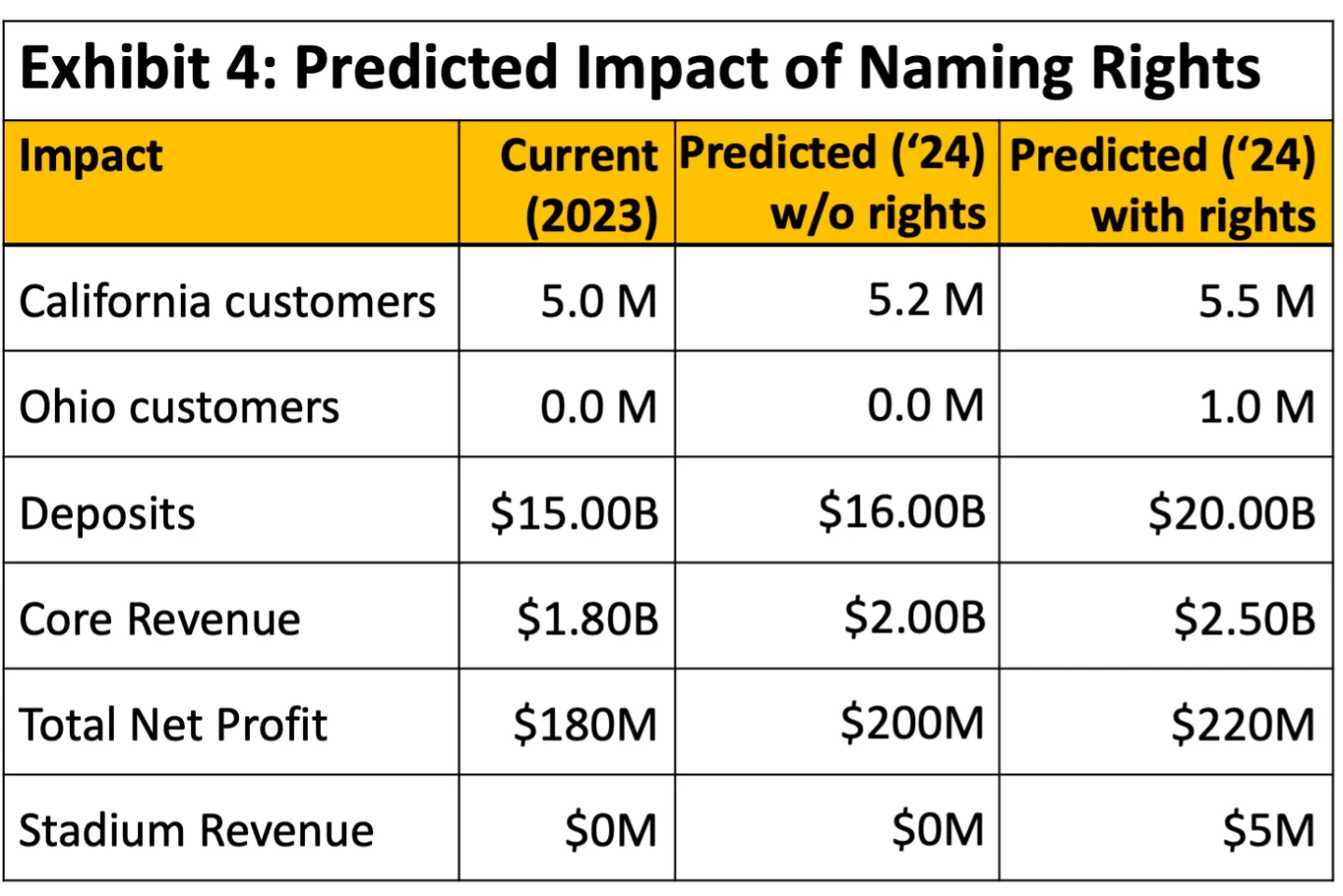

Section 3: Evaluation of the naming rights opportunity

Note: For a candidate-led experience, simply reveal only as many exhibits/information as specifically asked by the candidate and let the candidate explore the information and proceed forward

Section 4: Estimating the bid

Instructions: Take 1 minute to collect your thoughts and write down the approach for estimating the bid. Once you have a firm idea, come back to the case and resume.

Section 5: Brainstorming for a win-win deal

Instructions: Take 1-2 minutes to come up with ideas that will make this deal a win-win. Then come back and resume from here.

Wrapping-up

Instructions: Take 1-2 minutes to come up with your own conclusion

Video Solution

Further Questions

Question 1: How do you think the duration of the deal might affect its value for NeuBank?

Question 2: What are your thoughts on termination and renewal clauses?

Question 3: How should NeuBank approach branding guidelines within the deal?

Question 4: What are your thoughts on performance-based incentives?

Question 5: How would you consider the question of exclusivity in the deal?

Question 6: How might changes in the economic environment affect the deal?

Question 7: What are the potential implications of the sports team's performance on the deal?

Question 8: What should be some other non-financial considerations that NeuBank can discuss with the stadium and add into the deal?

Question 9: How can NeuBank convert this stadium naming rights initiative into a long-term strategic competitive advantage?

Question 10: What can be some cool first-time unique USPs of this naming rights deal?

Question 11: What are the various ways (besides increased customer base) through which NeuBank can monetize the initiative?

Question 12: What are some ways (negotiation points and key terms in the deal) through which NeuBank can lower the bid price?