Options Evaluation: Profitability of Brewing Company Startup

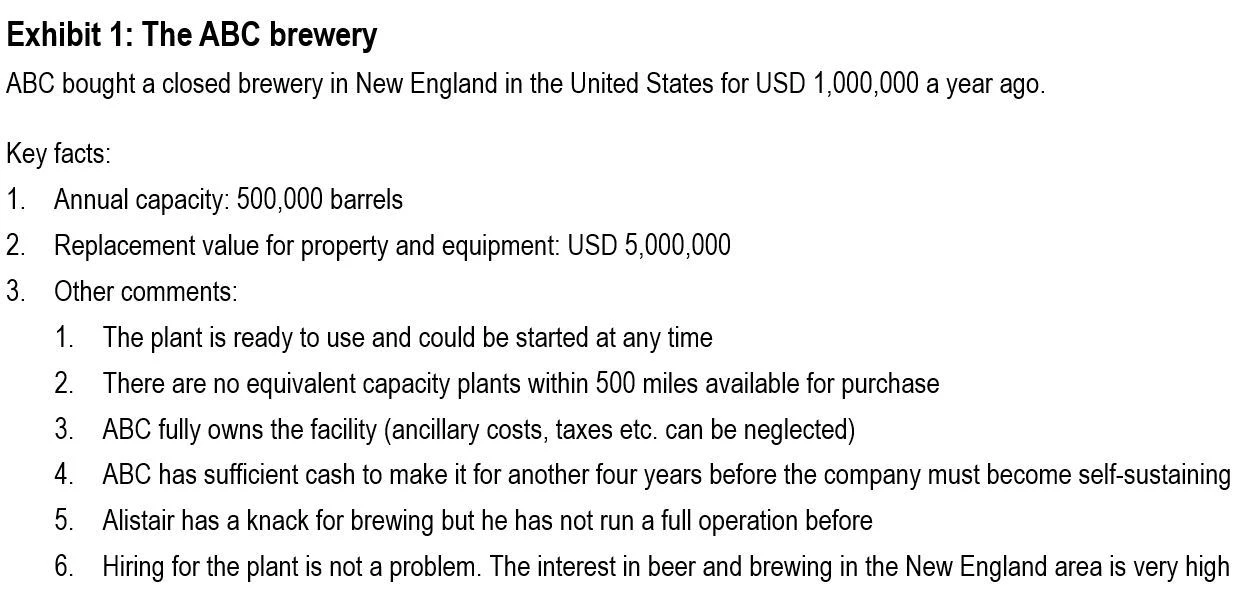

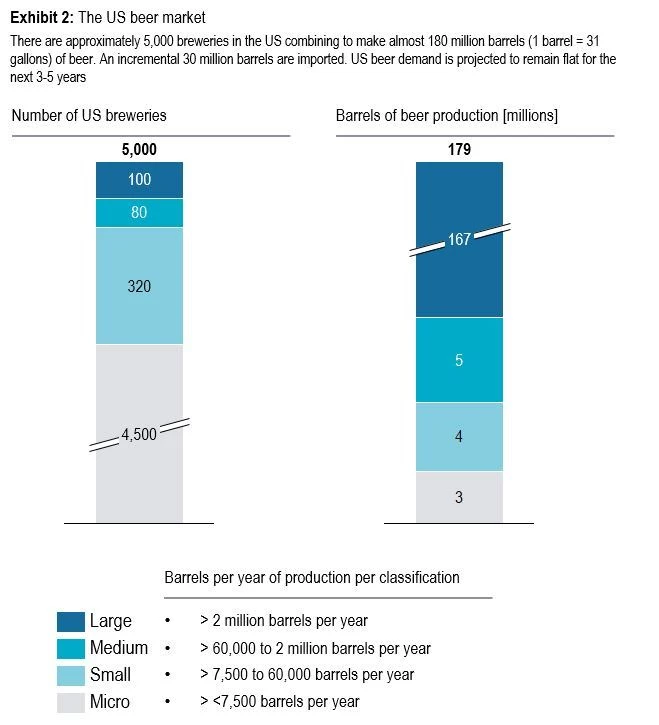

Your client is Alistair, a brew master from the east coast of the United States. He has developed a beer recipe he believes will revolutionize the beer drinking experience in the US. Alistair was able to convince his family and friends to invest in his business idea after letting them taste a sample of his new beer. With the investment money, Alistair founded the Allstar Brewing Company (ABC) and bought himself a mothballed brownfield brewery. This was already one year ago and Alistair has been working on perfecting his recipe since, but he has yet to produce a barrel of beer from the acquired production site. In the meantime, ABC has been approached by two other companies that both submitted a respective offer. Alistair seeks your help in determining the best course of action.

Conceptual Evaluation of Options

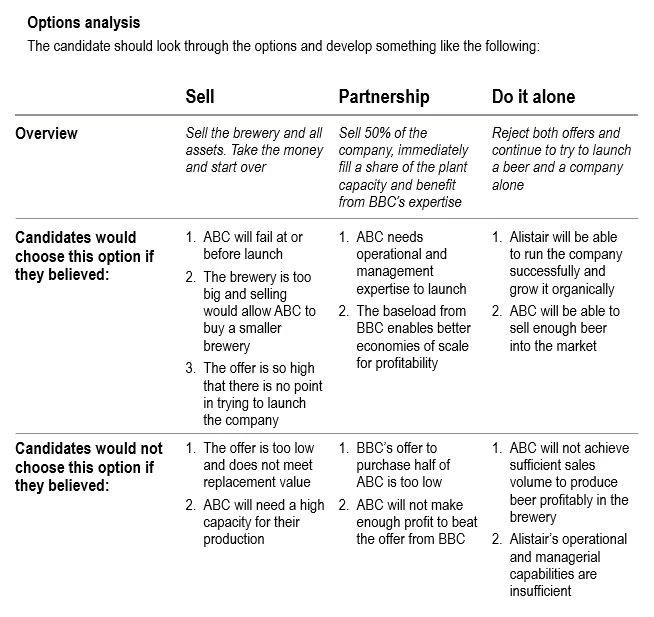

Alistair has asked you to evaluate the two offers ABC received and compare them to the option of ABC launching Alistair's new beer on a standalone basis.

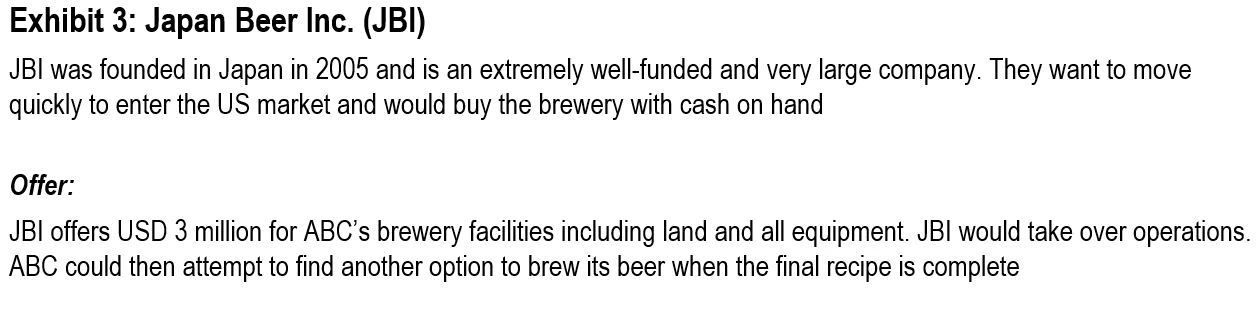

- Sell the plant and all of its assets to Japan Beer Inc. (JBI) that is looking to enter the US market

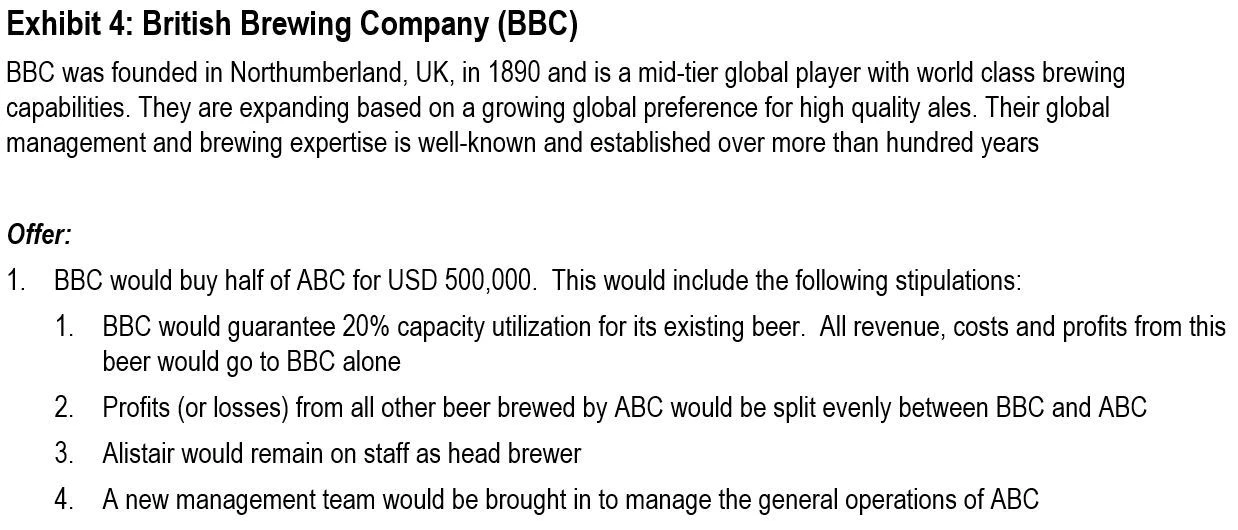

- Partner with British Brewing Company (BBC) who would buy half of the company and use a share of the brewery’s capacity each year to produce their own beer

What are the general factors you would consider for such an evaluation?

Profitability Analysis

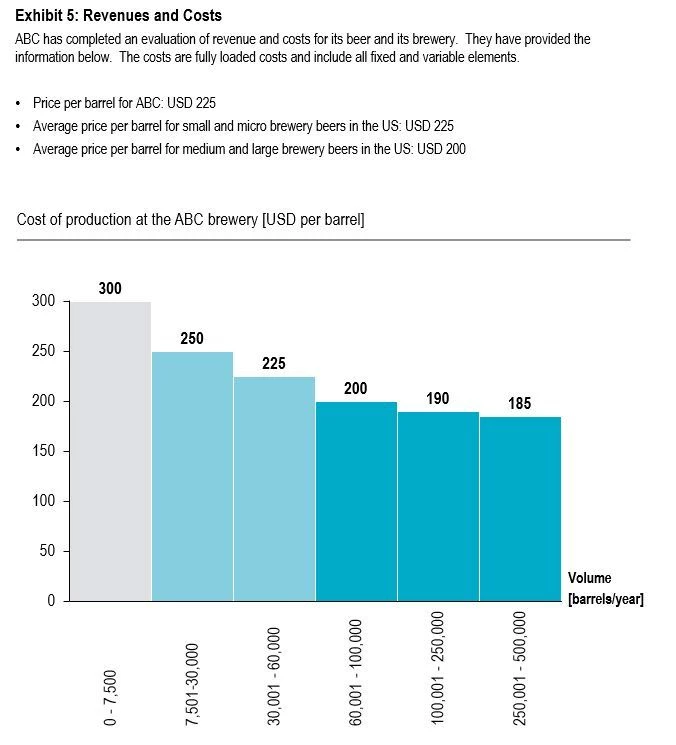

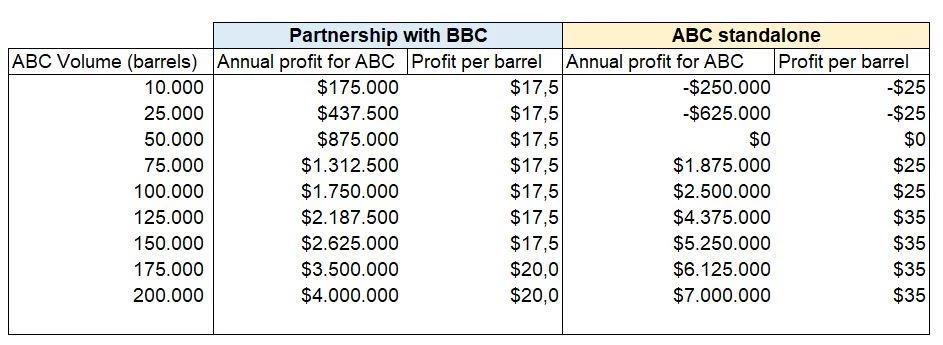

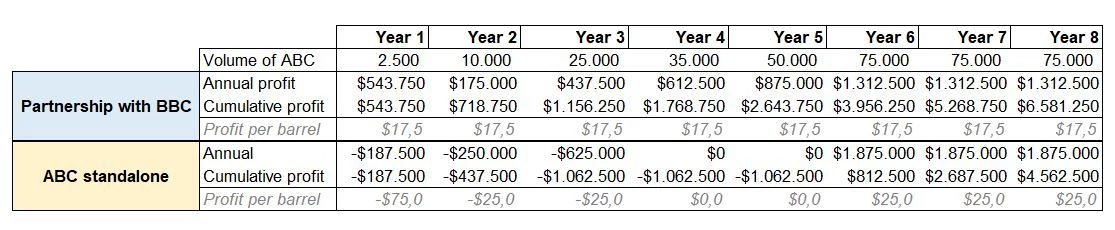

Alistair decided to share with you the details of the two offers that ABC has received. He also spent the last weeks putting together a revenue and cost analysis for his brewery plant. Since he is not a consultant, he is looking to you to provide him guidance on which option to choose to achieve the most profitable outcome.

What would you recommend Alistair to do – sell to JBI, partner with BBC or run ABC alone? Why?