Are you interested in a career in tax consulting? If you have a strong affinity for numbers, analytical thinking and tax topics, then this diverse and challenging profession is certainly a good fit for you.

But what exactly does a tax consultant do, and what qualities do you need to start your career? In this article, we provide you with a detailed overview of the activities and responsibilities in tax consulting. We introduce you to the different fields of work as well as areas of application and explain the necessary skills, qualifications, salaries, and career paths. Finally, we will highlight the current future prospects and development trends in the industry.

Table of Contents

- Table of Contents

- Tax Consulting – An Area for Analytical Thinkers

- What Operational Areas Can Be Found in Tax Consulting?

- What Do Tax Consultants Actually Do?

- Consulting Focuses and Specialties in Tax Consulting

- What Fields of Work Are There for Tax Consultants?

- The Most Attractive Consulting Firms for Aspiring Tax Consultants

- Areas of Application for Tax Consultants in Various Organizations

- What Skills and Competencies Do I Need to Become a Tax Consultant?

- Required Qualifications and Career Paths

- What Prerequisites Do I Need to Start in Tax Consulting?

- What Are Possible Career Paths for Aspiring Tax Consultants?

- What Salary Can I Expect as a Tax Consultant?

- Future Prospects and Development Trends in Tax Consulting

Tax Consulting – An Area for Analytical Thinkers

Tax consulting involves the support and consultation of private individuals or companies in tax and business matters. For private individuals, tax consulting focuses on preparing and filing income tax returns, tax planning related to retirement, inheritance, and gift taxes, as well as representation before tax authorities in disputes. The main goal is to utilize all possible tax benefits and minimize the tax burden.

For companies, tax consulting is more complex and comprehensive. It includes preparing tax returns, strategic tax planning involving business process structuring, investment decisions, and international tax issues. Additionally, tax consultants support companies during audits, represent them in tax disputes, and provide business advice to optimize business processes and financial strategies.

Another important aspect involves the employees within a company. Tax consultants play an essential role in ensuring compliance with legal obligations and maximizing potential tax benefits. This includes advising on payroll taxes and social security contributions for employees, ensuring conformity with reporting requirements, providing guidance on tax implications of retirement contributions, and managing taxation related to employee benefits, bonuses, or additional services.

What Operational Areas Can Be Found in Tax Consulting?

The activities of consultants in tax consulting are diverse and cover various areas. Many tax consulting firms offer a wide range of consulting focuses to cater to the individual needs of their clients. Other firms specialize in a particular field or specific industry.

What Do Tax Consultants Actually Do?

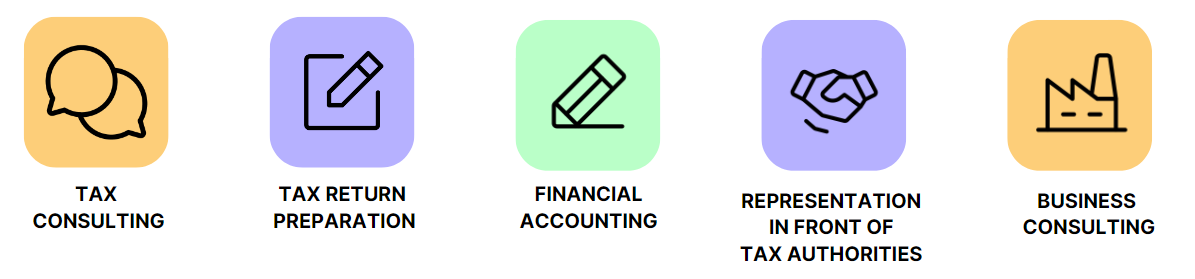

The main areas of tax consulting include a wide range of services for private individuals and companies. Their field of activity extends from the preparation and review of tax returns to advising on tax optimization strategies, representation during audits, and filing appeals. Here is an overview of the main tasks of tax consultants:

➡ Tax Advice

Tax consultants are of great value to private individuals and companies due to their comprehensive expertise and deep understanding of tax law. With their advice, they help their clients optimize and plan their taxes:

-

Tax optimization: Tax consultants develop strategies to minimize their clients' tax burdens.

-

Tax planning: They take on long-term planning to achieve tax advantages. Tax consultants help with corporate tax planning, inheritance and gift tax planning, or asset planning.

-

Advice on tax matters: Tax consultants support their clients in interpreting and applying tax laws and regulations.

➡ Prepare Tax Returns

Tax consultants prepare their clients' tax returns for various practical and legal reasons. On the one hand, tax law is very complex. Errors in the tax return can lead to back payments, fines, or other legal consequences. With the expertise of a tax consultant, the clients' tax burden can be minimized, and legal certainty ensured. There are various types of tax returns that must be filed by both private individuals and companies.

➡ Compile Financial Accounting

Financial accounting in the field of tax consulting involves the systematic recording, monitoring, and evaluation of all financial transactions of a company. The goal is to ensure an accurate and up-to-date representation of the financial situation and business results:

-

Bookkeeping: Tax consultants create and maintain the ongoing bookkeeping for companies.

-

Closing Work: Tax consultants prepare annual financial statements and balance sheets.

➡ Representation in Front of Tax Authorities

Tax consultants play a crucial role in representing their clients in front of tax authorities:

-

Communication with tax offices: Tax consultants handle the submission of tax returns and documents and help clarify questions.

-

Representation during audits: Tax consultants accompany and support their clients during audits and tax inspections.

-

Appeal Procedures: Tax consultants file appeals and represent clients in tax disputes.

➡ Advice on Business Management Issues

Tax consultants not only support their clients in tax matters but also advise them on business management issues:

-

Financial planning and analysis: Tax consultants assist with budget planning and financial strategies.

-

Business formation and structuring: Tax consultants advise their clients on the optimal legal form and structuring from a tax perspective.

-

Succession planning and inheritance planning: Tax consultants provide advice on planning business succession and inheritance.

A tax consultant thus plays a central role in the financial health and compliance of a company or an individual and helps navigate complex tax requirements.

Consulting Focuses and Specialties in Tax Consulting

Tax consultants often offer a variety of services and cover different consulting focuses and specialties to meet the diverse needs of their clients. Firms usually have a team of tax consultants with different specializations to offer comprehensive advice covering all tax aspects. Here are a few subject areas typically offered:

-

Tax consulting

- Business consulting

-

Payroll and personnel management

-

Bookkeeping and financial statements

Some tax consulting firms also focus on specific industries, such as healthcare, construction, or the IT sector, and offer specialized tax consulting services for companies in these areas. Others specialize in particular tax issues, such as international tax consulting, inheritance and gift tax, or corporate restructuring.

What Fields of Work Are There for Tax Consultants?

Tax consultants cover a wide range of services, from preparing tax returns to advising on complex tax issues and representing clients before tax authorities. As a result, there are various fields of application and work areas for aspiring tax consultants. When considering career opportunities in tax consulting, the attractiveness of the company plays a crucial role.

The Most Attractive Consulting Firms for Aspiring Tax Consultants

The appeal of employers for aspiring tax consultants can depend on various factors, including reputation, work culture, training opportunities, compensation, and benefits. Large consulting firms are usually particularly attractive to tax consultants. They offer excellent training, an international environment, good compensation, and exciting projects. These advantages attract many aspiring consultants and provide a solid foundation for a successful career. Here is an overview of the largest consulting firms working in the field of tax consulting:

-

PricewaterhouseCoopers (PwC): PwC is one of the world's largest accounting firms, offering a wide range of tax services for companies and individuals. They offer numerous career opportunities for tax consultants.

-

Deloitte: Deloitte is one of the world's leading auditing and consulting firms, providing comprehensive services, including tax consulting for companies and organizations. With a rich tradition and an extensive global network, Deloitte is one of the Big Four in the industry and enjoys high recognition in the business world.

-

Ernst & Young (EY): EY is one of the world's largest service companies in the fields of auditing, tax consulting, transaction consulting, and business consulting. The company offers attractive career opportunities for aspiring tax consultants. With a global presence in over 150 countries and a team of highly qualified professionals, EY is one of the leading providers in the consulting industry.

-

KPMG: KPMG is a global consulting and auditing firm offering a wide range of services for companies and organizations, including tax consulting. KPMG offers an attractive work environment, exciting career opportunities, and diverse development opportunities for tax consultants, which can contribute to building a successful and fulfilling professional career.

-

BDO International: BDO is a global network of independent auditing and consulting firms with more than 1,900 offices in over 160 countries. The company offers not only tax services but also auditing, consulting, and outsourcing services. With a strong focus on innovation and technological solutions, BDO provides its employees with diverse development opportunities and a dynamic work environment.

Besides large consulting firms, medium-sized and local tax consulting firms can also be attractive employers that offer a more personal work environment and development opportunities. When looking for a company as a tax consultant, you should therefore consider various options and choose those that match your career goals and ideas.

Areas of Application for Tax Consultants in Various Organizations

Tax consultants are in demand in many companies and industries that need support in tax matters. Large corporations, as well as small and medium-sized enterprises, have complex tax requirements that require specialized advice. Startups, freelancers, non-profit organizations, and industries with specific tax requirements also seek support from tax consultants. International companies and inheritance communities need advice on complex international tax issues and wealth succession planning. The services of tax consultants are therefore indispensable for effectively managing and optimizing tax matters.

-

Small and medium-sized enterprises (SMEs): SMEs often need help with tax planning, preparing tax returns, and optimizing their tax strategies.

-

Large companies: Large companies have complex tax requirements and often need specialized advice on international tax issues, transfer pricing, restructuring, and compliance.

-

Startups and entrepreneurs: Startups and entrepreneurs need support in choosing the optimal legal form, tax planning, and compliance with tax regulations during the growth process.

-

Freelancers and self-employed: Freelancers and self-employed individuals need help with bookkeeping, preparing tax returns, and optimizing their income tax situations.

-

Non-profit organizations: Non-profit organizations, such as foundations, associations, and charitable organizations, need tax advice to comply with tax regulations and optimize their tax situations.

-

Industries with specific tax requirements: Some industries have specific tax requirements, such as healthcare, construction, the IT sector, or the financial services sector. Tax consultants with expertise in these areas can offer specialized services.

-

International companies: International companies operating across borders need advice on complex international tax issues, transfer pricing, and compliance with double taxation agreements.

-

Inheritance communities and wealth management: Inheritance communities and wealth management need advice on optimizing their tax situation, wealth succession planning, and compliance with inheritance and gift tax regulations.

Overall, there is a wide range of companies and organizations that use the services of tax consultants to effectively manage and optimize their tax matters.

What Skills and Competencies Do I Need to Become a Tax Consultant?

To be successful in tax consulting, you need a mix of excellent hard and soft skills. These abilities are essential for effectively advising clients and developing your career in this demanding profession.

Expertise

One of the fundamental requirements for tax consultants is in-depth knowledge in various areas. This includes comprehensive knowledge of national and international tax law, industry-specific knowledge, accounting and financial reporting, as well as expertise in specific areas such as VAT, inheritance tax, and corporate tax.

Analytical Skills

Tax consultants need strong analytical skills to make informed decisions and give precise recommendations to their clients. This includes outstanding critical thinking abilities to examine extensive financial data and to identify and evaluate tax implications.

Technological Knowledge

In tax consulting, it is crucial to be familiar with tax software and tools to prepare tax returns and plan tax strategies. Additionally, the use of data analysis tools is essential to thoroughly analyze, interpret, and make well-informed decisions based on financial data.

Communication Skills

Tax consultants should possess excellent communication skills to interact and negotiate successfully with colleagues, clients, and tax authorities. They must be able to explain complex tax concepts clearly and understandably, actively listen to clients' concerns, and provide tailored advice. This builds trust with clients and fosters long-term relationships.

Problem-Solving Skills and Creativity

Tax consultants should have strong problem-solving skills and creativity to effectively address complex tax challenges and develop solutions. They need to respond to the individual needs and goals of their clients and devise innovative approaches to adapt to new developments.

Business Acumen and Strategic Planning

As a tax consultant, strong business acumen and good strategic planning are essential for developing long-term tax strategies. Tax consultants must be able to recognize the financial impacts of business decisions and identify opportunities for tax savings and risk minimization.

A range of core competencies is required to advance your career in tax consulting. Here at PrepLounge, we help you prepare optimally for a successful career in tax consulting.🙂 Work with coaches, prepare for interviews, and use our practice materials like the mental math tool or stress questions to further develop the necessary skills.

Required Qualifications and Career Paths

A career in tax consulting requires not only deep expertise but also practical experience and specific personal interests. Typically, companies expect specific academic degrees and professional experience. Moreover, certain personal interests and skills are highly advantageous. These qualities also assist tax consultants in their professional growth and pursuing further career paths.

What Prerequisites Do I Need to Start in Tax Consulting?

For a successful career as a tax consultant, a combination of practical experience, qualifications, and personal interests is crucial.

Practical Experience and Qualifications:

-

A degree in business administration, business law, tax law, or a similar field is typically required for entry as a tax consultant.

-

Previous experiences, such as internships or working as a student trainee in the field of tax consulting, are advantageous.

-

Alternatively, training as a certified financial economist enables a career start in tax consulting, although this work is usually in public administration.

-

Training as a tax clerk also paves the way to a consulting firm. Tax clerks initially support tax consultants in their work, but with sufficient professional experience, further training, and an additional examination, they can qualify as tax specialists, certified accountants, or even tax advisors.

Relevant Interests:

-

Tax consultants should have a strong interest in tax topics and legal issues.

-

Good numerical understanding and enjoyment of working with numbers are advantageous due to the many complex calculations involved.

-

High willingness to learn and curiosity are important as tax law is constantly changing, requiring continuous knowledge acquisition to stay updated.

What Are Possible Career Paths for Aspiring Tax Consultants?

Junior Tax Consultant:

-

Junior tax consultants are entry-level professionals. Their tasks include preparing tax returns and financial statements, assisting clients, and supporting tax advisors in daily business. Junior tax consultants cannot independently perform tax advisory activities, which require passing the tax advisor exam.

Senior Tax Consultant:

-

Senior tax consultants have several years of professional experience and have passed the tax advisor exam. They are authorized to perform tax advisory activities, take on new responsibilities, and can manage teams and independently support clients.

Tax Manager:

- Becoming a tax manager requires at least five to six years of professional experience. Tax managers take on more responsibility, lead teams, manage larger client bases, and work on special consulting projects.

Senior Tax Manager:

-

Becoming a senior tax manager requires at least seven to ten years of professional experience. Responsibilities increase, including team leadership, working in competence teams, and independent client management. Senior managers are often responsible for client acquisition, along with other company leaders or partners.

Partner/Principal:

-

Partners in a firm are usually leading professionals who have reached the highest career level in tax consulting. They typically have long and successful professional experience and are appointed within a company. They take responsibility for strategic decisions, team leadership, and the individual support of demanding and specific clients to ensure long-term success for both the firm and its clients.

Are you looking for the right consulting area for your career? Check out our articles on individual focus topics:

👉 Financial Consulting: Definition, Opportunities, and Top Firms

👉 What Is Healthcare Consulting?

👉 What Is Public Sector Consulting?

👉 What Is the Difference Between Strategy and Management Consulting?

What Salary Can I Expect as a Tax Consultant?

The salary of tax consultants can vary significantly depending on experience, qualifications, company size, and location. However, tax consultants can expect an attractive salary, especially at renowned consulting firms or large accounting firms, often above average.

- The starting salary for junior tax consultants after graduation can average around 4,166 to 5,833 USD gross per month. Note that these figures can vary significantly and are always determined individually by the company.

- After several years of professional experience and passing the tax advisor exam, the salary for senior tax consultants significantly increases. Initially, the salary averages 5,833 to 10,000 USD gross per month, but with 10-15 years of experience, tax consultants can earn even more.

- For partners or leading positions in tax consulting firms, earnings can be significantly higher, with six-figure amounts and bonuses not uncommon.

So you see, the career path of tax consulting is demanding and challenging, but ultimately, it can be highly rewarding! 😉 If you are interested in the general salary in consulting worldwide, check out our article:

Future Prospects and Development Trends in Tax Consulting

The field of tax consulting is characterized by constant evolution, driven by technological innovations, globalization, and heightened demands for sustainability and compliance. These factors shape the future outlook of this profession, offering both challenges and new opportunities for tax consultants globally.

Technological Integration:

-

Digitization is fundamentally changing tax consulting. Automation and the use of artificial intelligence for repetitive tasks such as data collection and analysis are becoming increasingly important. Tax consultants need to adapt to using tax software and data analysis tools.

Increasing Complexity and Effort:

-

New laws and regulations mean that companies and tax consultants need to invest more time and resources. New regulatory requirements require new audit and reporting processes.

Sustainability:

-

Sustainability's relevance in tax consulting is increasing due to new legal requirements such as the EU-CSRD and the tax implications of initiatives like the ESG carbon border adjustment mechanism. Tax consultants need to support companies in meeting new reporting and audit obligations and integrate the tax aspects of sustainable business practices, such as green supply chains.

The tax consulting industry faces various challenges and opportunities. Technologization can automate and simplify processes like data collection and analysis. Increasing complexity due to new regulatory requirements and the growing importance of sustainability demand more specialized advice and many adjustments. At the same time, these developments offer new opportunities for tax consultants to expand their services and support companies in integrating sustainable practices.

Continue to Learn

What Is Healthcare Consulting?

Explore whether Healthcare Consulting would be the right fit for you!

The Difference Between MBB and the Big Four in Consulting

Ever wondered what the differences between the Big Three and the Big Four are? We will show you.

Top Firms to Start Your Career in Consulting

Learn more about the top consulting firms to work for in 2024!

Overview

- Table of Contents

- Tax Consulting – An Area for Analytical Thinkers

- What Operational Areas Can Be Found in Tax Consulting?

- What Do Tax Consultants Actually Do?

- Consulting Focuses and Specialties in Tax Consulting

- What Fields of Work Are There for Tax Consultants?

- The Most Attractive Consulting Firms for Aspiring Tax Consultants

- Areas of Application for Tax Consultants in Various Organizations

- What Skills and Competencies Do I Need to Become a Tax Consultant?

- Required Qualifications and Career Paths

- What Prerequisites Do I Need to Start in Tax Consulting?

- What Are Possible Career Paths for Aspiring Tax Consultants?

- What Salary Can I Expect as a Tax Consultant?

- Future Prospects and Development Trends in Tax Consulting