If being a venture capitalist is part of your finance career goals, you may wonder if it pays well. Generally, VC analysts in the US get an average total pay of $117K. Some of the lowest paid analysts get a total salary of $60K while the highest paid ones can get up to $200K.

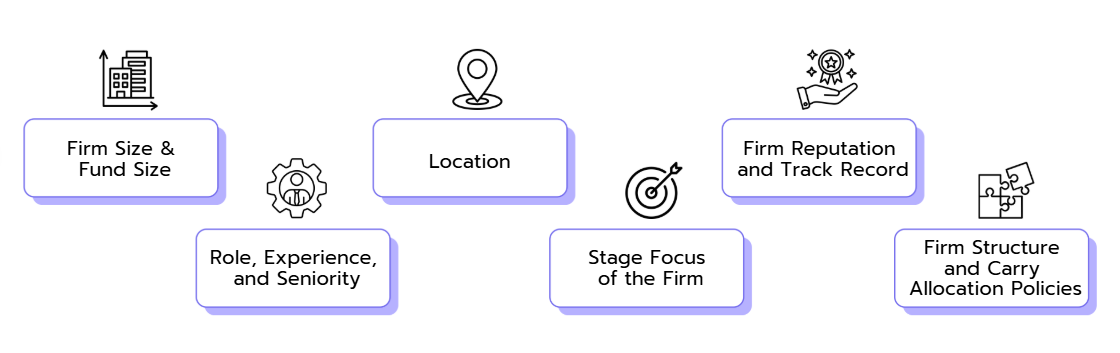

The huge difference in compensation is a result of many factors like the firm size, experience, location, and fund performance. In this guide, we'll walk you through such factors, explain the VC compensation structure, give the average salaries for the top tier venture capital firms, and compare the pay with other careers. Read on to discover your potential salary as a venture capitalist.