Is Deutsche Bank one of your top choices for starting your investment banking career? Getting in isn’t easy, just like with other top investment banks.

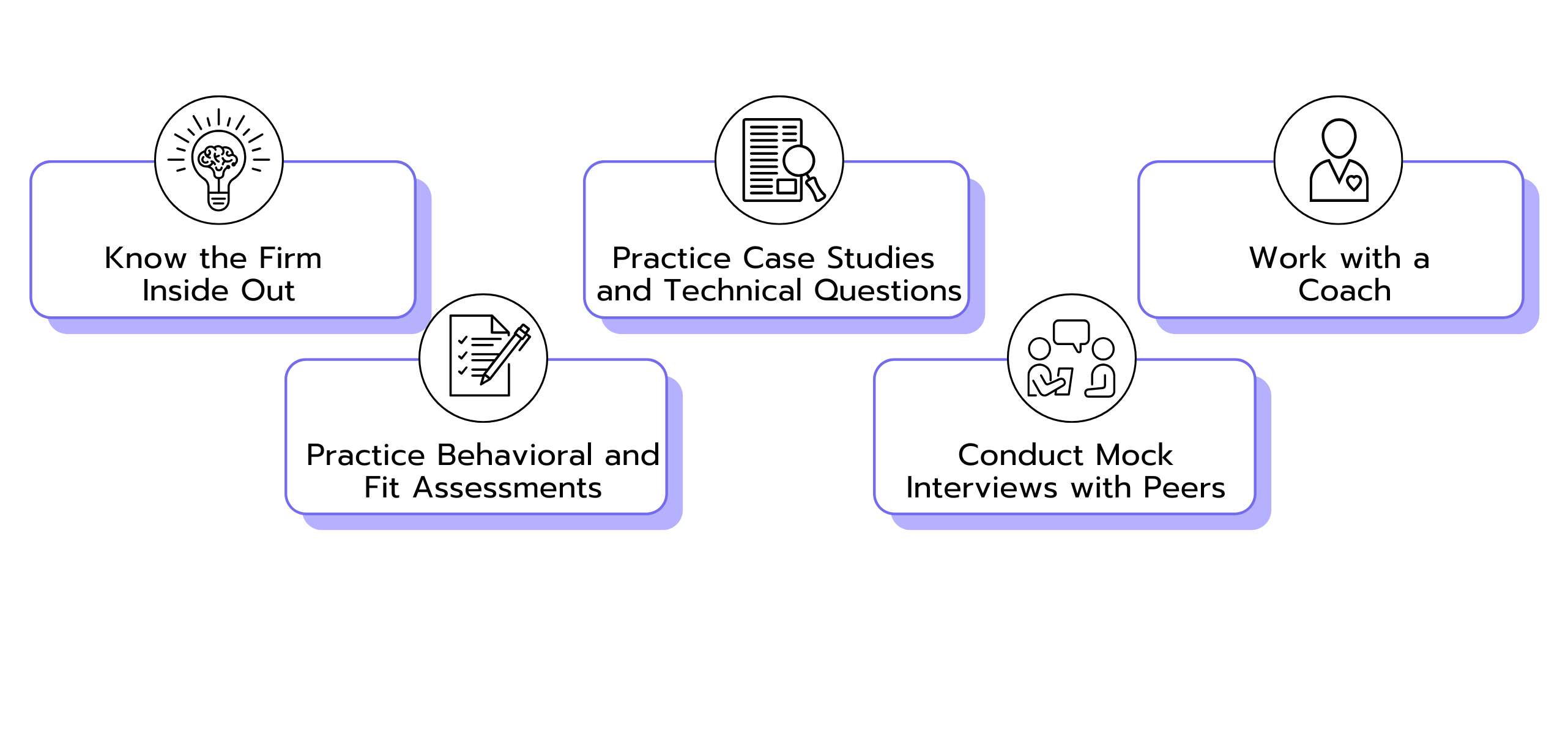

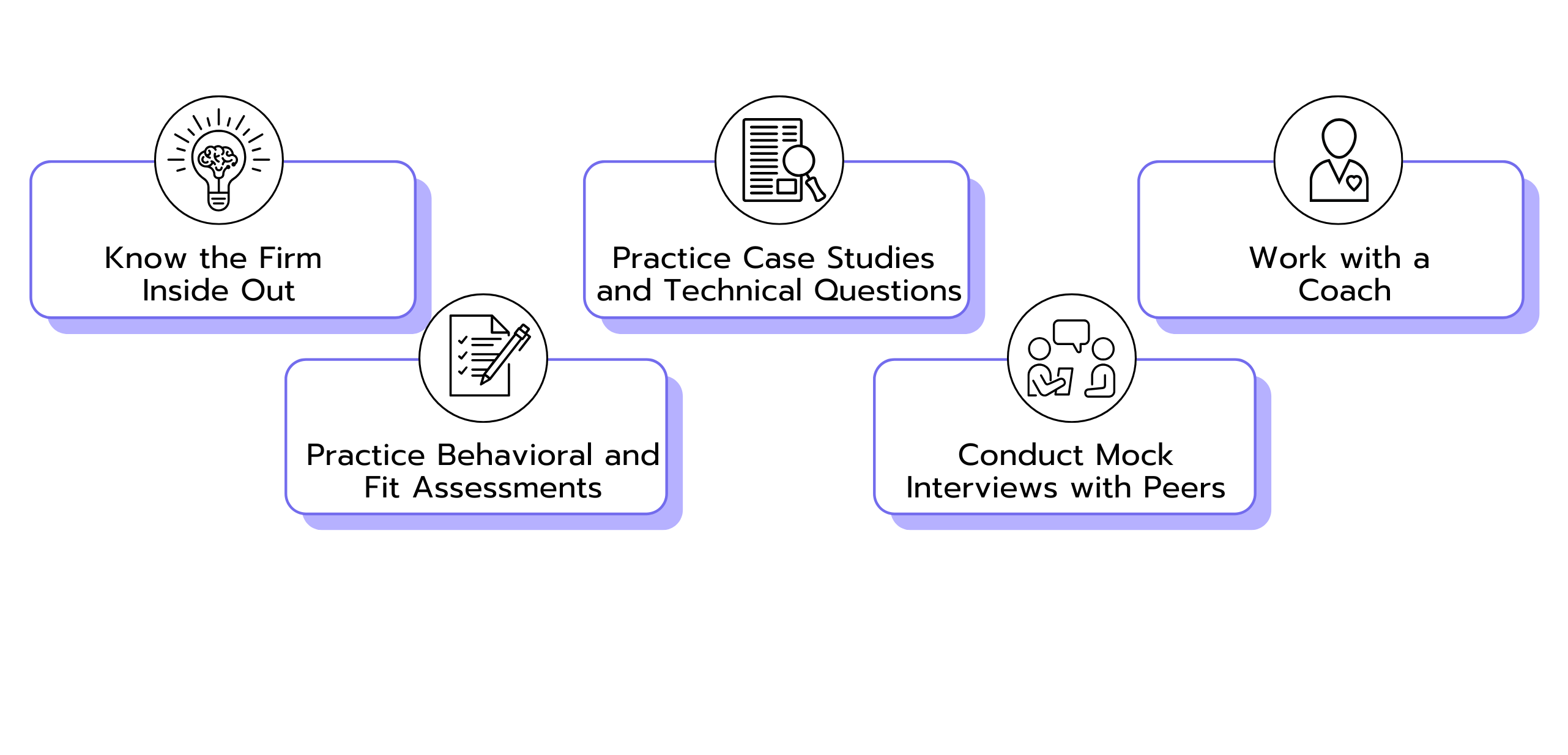

However, you can boost your chances by understanding what makes the firm different from other investment banks, getting familiar with their recruitment process and preparing well for the interviews. This Deutsche Bank interview guide will help you understand what to expect and give you insights for landing your dream job at the firm.