Are you seeking a career in financial consulting? This path presents lucrative earning potential and diverse avenues for professional growth in an attractive, people-focused work environment, with engaging projects and intriguing employers.

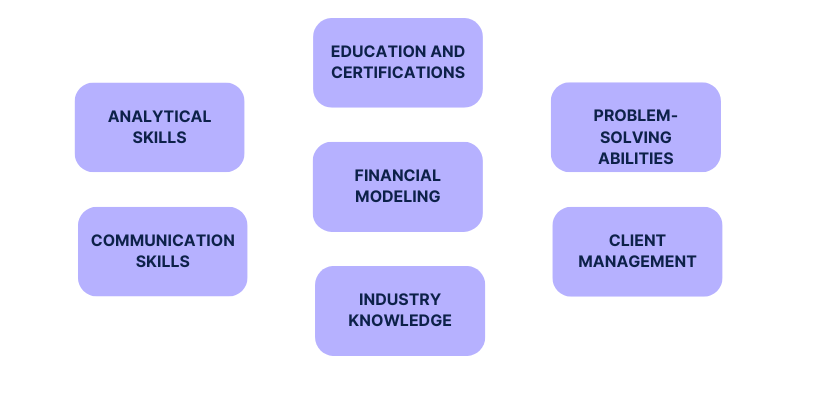

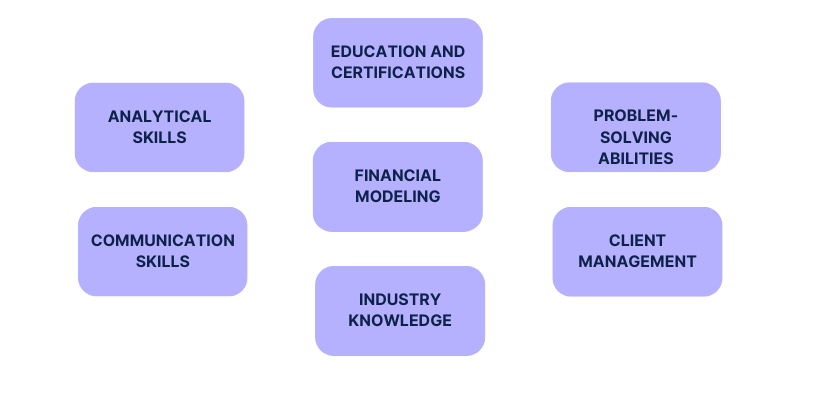

But what exactly do financial consultants do, and what does this career entail? I have the answers! In this article, I'll explore financial consulting, including its definition, potential career paths, skills and experiences, and a detailed analysis of the leading firms in the industry.