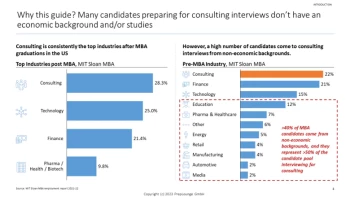

Many candidates preparing for consulting interviews don’t have an economic background, which makes the highly competitive case prep even more uphill. In fact, >40% of MBA candidates come from non-economic backgrounds, and they represent >50% of the candidate pool interviewing for consulting.

I myself was one of them: I went through my McKinsey interviews when I was in my last undergrad year in Architecture. I had no idea of what a break even point was, and the word EBIDTA was just a bunch of letters for me.

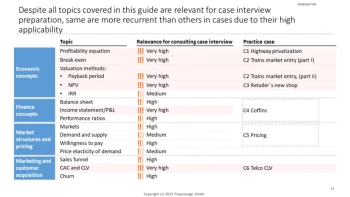

After +4 years of candidate coaching and university teaching, and after having seen hundreds of cases, I realized that the economic-related knowledge needed to master case interviews is not much, and not complex. However, you need to know where to focus! Hence, I created the guide that I wish I could have had, summarizing the most important economic and financial concepts needed to solve consulting cases, hoping to help candidates focus on what matters.