Are you considering a career in finance? Then wealth management might be the perfect fit for you! In this field, you'll work on exciting financial strategies, develop tailored solutions and advise high-profile clients. In this article, you'll find everything you need to know about this career path and how to succeed in this competitive industry.

The Ultimate Guide to Your Career in Wealth Management

What Is Wealth Management?

Wealth management is more than just simply investing money — it’s about creating a personalized financial strategy that covers all aspects of a client’s wealth. This includes everything from investment planning and tax optimization to estate planning and risk management. The goal is not just to grow wealth but also to protect it and ensure long-term financial security in a way that aligns with each client’s unique needs and aspirations.

Most clients are wealthy individuals and families, often referred to as High-Net-Worth Individuals (HNWIs) or Ultra-High-Net-Worth Individuals (UHNWIs). However, wealth management isn’t just for private clients — family offices and institutional investors also rely on these services to manage complex financial structures, manage risk and make well-informed, long-term financial decisions.

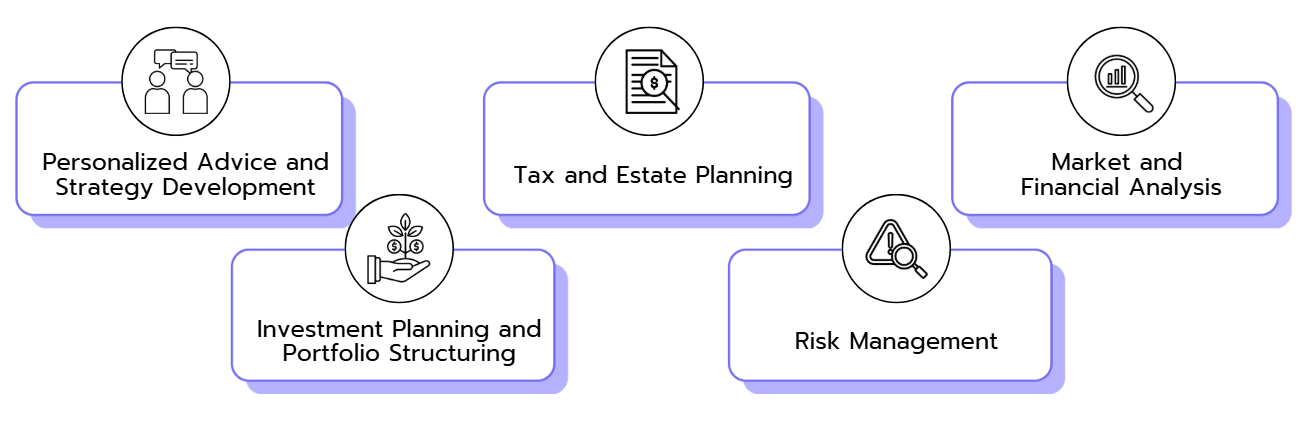

Key Responsibilities in Wealth Management

A career in wealth management is dynamic and goes far beyond traditional investment advice. If you’re considering entering this exciting field, it’s worth taking a closer look at what the job actually involves:

Personalized Advice and Strategy Development

Wealth management is about building strong client relationships. You’ll analyze your clients’ financial situations, understand their goals and create a customized strategy — whether it’s for long-term wealth growth, financial protection, or passing assets to the next generation. Success in this role requires more than just financial expertise — it also demands strong interpersonal skills, as each client has unique priorities and concerns.

Investment Planning and Portfolio Structuring

Naturally, investment management is a key part of the job. You’ll help clients invest their wealth in a way that aligns with their goals, whether they prefer conservative strategies or are open to higher-risk opportunities. A major focus is portfolio diversification — how to spread investments across different asset classes like stocks, real estate, and bonds to balance risk and return.

Tax and Estate Planning

For high-net-worth individuals, wealth management isn’t just about maximizing returns — it’s also about minimizing tax burdens and planning for the future. You’ll learn how to develop strategies that reduce tax liabilities and ensure that wealth is transferred efficiently and fairly to the next generation.

Risk Management

Identifying and managing risks is another crucial aspect of the job. This includes protecting clients from market fluctuations and recommending the right insurance solutions to safeguard their wealth from unexpected events. The goal is to minimize potential losses while still capitalizing on opportunities.

Market and Financial Analysis

Behind the scenes, a lot of research goes into wealth management. You’ll analyze financial markets, evaluate investment opportunities and stay up to date with economic trends. These insights are essential for providing informed recommendations and ensuring clients’ financial strategies remain effective in changing market conditions.

Career Opportunities and Salaries in Wealth Management

Wealth management offers not only exciting career prospects but also highly attractive salaries. The career path in this field is usually well-structured, providing excellent opportunities for growth — though the specifics can vary depending on the size and prestige of the firm. Large banks like UBS, Deutsche Bank, or J.P. Morgan often have well-defined hierarchies with clear promotion steps, while smaller boutique firms tend to have flatter structures and offer faster career progression. However, a typical career path in wealth management, along with the corresponding salary expectations (USA), might look something like this:

| Position | Annual Salary (USD) |

| Analyst / Associate | $80,000 – $120,000 |

| Wealth Manager | $120,000 – $250,000 |

| Senior Wealth Manager | $250,000 – $500,000+ |

| Team Lead / Director | $500,000 – $1,000,000+ |

| Managing Director | $1,000,000+ (often including significant bonuses) |

As an entry-level professional in wealth management, you typically start as an Analyst or Associate. In this role, you support experienced wealth managers by preparing for client meetings, conducting market analysis, and developing financial strategies. Your salary at this level generally ranges between $80,000 and $120,000 per year, depending on location, company size and your qualifications.

With a few years of experience, you can advance to a Wealth Manager position. In this role, you work directly with clients, develop personalized investment strategies and play a crucial role in helping them achieve their long-term financial goals. Salaries for Wealth Managers typically range from $120,000 to $250,000 annually, with performance-based bonuses playing a significant role as they are often tied to the assets managed and the revenue generated.

After several years, you may progress to a Senior Wealth Manager position, managing the finances of High-Net-Worth Individuals (HNWIs) or Ultra-High-Net-Worth Individuals (UHNWIs). Your responsibilities become more complex, extending beyond asset management to include estate planning, tax optimization, and risk management. In this role, you can expect to earn between $250,000 and $500,000 per year, with bonuses making up a substantial part of your compensation.

With further experience and expertise, you may have the opportunity to move into leadership roles such as Team Lead or Director. In these positions, your focus expands from client management to leading a team and strategically growing your department. Salaries for these roles typically range from $500,000 to over $1,000,000, depending on the scope of your responsibilities and the company’s success.

The Most Prestigious Firms in Wealth Management

If you're considering a career in wealth management, it's worth taking a closer look at the industry's leading firms. These banks and financial institutions are not only known for their top-tier services but also offer excellent career opportunities. They provide access to global networks, the chance to work with high-profile clients and competitive salaries. Below is an overview of the five most prestigious wealth management firms:

1. UBS

![]()

UBS is one of the world's largest and most influential wealth management firms. Managing trillions in client assets, the firm provides highly tailored financial solutions for high-net-worth individuals and family offices. UBS stands out for its extensive international presence, exceptional advisory services, and innovative digital tools that make wealth management more accessible for clients worldwide.

2. J.P. Morgan Private Bank

J.P. Morgan, one of the oldest and most prestigious banks in the world, also has an outstanding reputation in wealth management. Its Private Bank division specializes in serving High- and Ultra-High-Net-Worth Individuals, offering comprehensive services in investment planning, estate planning, and philanthropic consulting. Backed by a global network of experts, J.P. Morgan provides tailored financial solutions to its elite clientele.

👉 Interested in a career at J.P. Morgan? Check out our J.P. Morgan Interview Guide for insights into the recruitment process!

3. Credit Suisse

![]()

Another leading Swiss bank in the wealth management space, Credit Suisse is recognized for its tailored financial solutions and expertise in international markets. Despite recent financial and structural challenges, Credit Suisse remains a key player in the global wealth management industry, catering to the complex needs of high-net-worth clients.

4. Morgan Stanley

Morgan Stanley is a leading U.S. investment bank with a strong focus on wealth management. Particularly dominant in the U.S. market, the firm is known for its personalized advisory approach and innovative financial technology solutions.

👉 Want to learn more about getting hired at Morgan Stanley? Check out our Morgan Stanley Interview Guide for key recruiting insights.

5. Deutsche Bank Wealth Management

Deutsche Bank’s wealth management division is also among the top players in the industry. The firm offers a broad range of services, including investment solutions, estate planning, and sustainable investment strategies. Particularly in Europe, Deutsche Bank is a major force in wealth management, recognized for its deep expertise in serving high-net-worth clients.

👉 Interested in joining Deutsche Bank? Read our Deutsche Bank Interview Guide to learn everything you need to know about landing a job at one of the world’s top bulge-bracket banks!

Requirements and Qualifications for a Career in Wealth Management

Succeeding in wealth management requires more than just an interest in finance — it demands the right skills and qualifications. As a future wealth manager, you’ll be working with high-net-worth clients who have unique needs, making the job both challenging and diverse. Below, you’ll find the key hard and soft skills needed for this career, along with the most relevant degrees and certifications.

What Skills Do You Need?

- Strong Financial Knowledge

A deep understanding of financial products, investment strategies, tax planning and estate planning is essential. You should be comfortable with concepts like portfolio management, risk analysis and asset structuring. - Communication Skills

Wealth managers work closely with clients, often building long-term relationships. To earn their trust, you need good listening skills and the ability to explain complex financial topics in a clear and understandable way. - Analytical Thinking

Every client’s financial situation and goals are unique. You must be able to quickly analyze financial data and develop effective strategies while also considering potential risks and unexpected market changes. - Adaptability

Financial markets are constantly evolving and successful wealth managers need to stay ahead of trends and adjust their strategies accordingly to protect and grow their clients’ wealth. - Teamwork

Wealth management is rarely a solo job. You’ll need to collaborate with colleagues and work alongside external experts such as tax advisors and legal professionals to create the best possible solutions for your clients

What Qualifications Do You Need?

Starting a career in wealth management typically requires a strong academic background and a solid understanding of financial concepts. A degree in Business Administration, Economics, Finance, or Banking provides an excellent foundation. However, candidates with backgrounds in Mathematics, Law, or Engineering can also be well-suited for the field—as long as they have a genuine interest in finance.

For those aiming to advance in their careers, a Master’s in Finance or an MBA can be highly beneficial. Many wealth managers choose to pursue these qualifications after gaining a few years of work experience to further specialize in the field. Additionally, industry-recognized certifications like the CFA (Chartered Financial Analyst) or CFP (Certified Financial Planner) are highly valued, especially when working with high-net-worth clients, as they demonstrate expertise and credibility.

Beyond academic credentials, practical experience can be a major advantage. Internships or working student positions in wealth management or related areas such as investment banking can provide valuable insights into the day-to-day work and help build a strong professional network. A basic understanding of tax and legal matters is also essential, as these topics frequently play a key role in wealth planning.

How to Prepare for a Career in Wealth Management

Landing a job in wealth management takes solid preparation, as it is a highly competitive field. One of the most critical steps is preparing for interviews — firms aren’t just looking for technical skills, they also want to see strong motivation and the right personality fit.

Brush Up on Your Financial Knowledge

Interviewers expect you to have a solid understanding of financial fundamentals. Make sure you're familiar with key topics like portfolio management, investment strategies, tax optimization and estate planning. Stay updated on financial news, monitor market trends and prepare to explain complex financial concepts clearly. Additionally, researching the company’s services and business model is essential—you should know what they specialize in and how they stand out from competitors.

Prepare for Case Studies

Many interviews include case studies, where you’ll need to develop a strategy for a hypothetical client scenario — such as how to diversify a portfolio or achieve a specific financial goal. Practicing case studies in advance is key, as they test both your analytical thinking and financial expertise. Work through sample cases and team up with peers to prepare more effectively.

👉 Connect with like-minded finance professionals on our Meeting Board and practice together!

Develop Your Soft Skills

Wealth management is a highly client-focused profession. In interviews, recruiters will assess not just your knowledge, but also your ability to communicate and build trust. Practice explaining complex financial topics in a clear and accessible way. Demonstrating empathy and strong interpersonal skills will make a lasting impression, as these qualities are essential for long-term success in the field.

Research the Company

Recruiters expect you to know who you’re talking to. Research the company’s core business areas, unique strengths and major achievements. Who are their typical clients? What sets them apart from competitors? Showing that you understand the firm’s positioning and values will highlight your genuine interest and make you stand out.

Prepare Strong Answers

Be ready for key interview questions: Why do you want to work in wealth management? What strengths do you bring to the role? How do you handle challenges? These questions almost always come up, so take time to structure your answers with concrete examples. The more specific and authentic your responses, the more memorable you’ll be.

Key Takeaways

Wealth management is an innovative and wide-ranging career path that goes far beyond traditional asset management. As a wealth manager, you won’t just be responsible for investing capital — you’ll also focus on strategic financial planning, tax optimization and estate planning, all tailored to the unique goals of your clients.

The industry offers clear career progression, competitive salaries and exciting challenges, whether you choose to work at a major bank like UBS or J.P. Morgan or at a specialized boutique firm. While a strong academic background in business, finance, or economics is important, soft skills like communication, empathy and teamwork are just as crucial. Gaining practical experience and earning additional qualifications such as the CFA or CFP can give you a significant advantage.

With the right preparation — brushing up on financial knowledge, practicing case studies, and researching potential employers — you can stand out in interviews and build a strong foundation for a successful career in wealth management. So, what are you waiting for? ✨

Continue to Learn