The investment banking division of BNP Paribas mainly deals in mergers & acquisitions, equity capital markets, and debt markets. If you are a student in your penultimate year or a fresh graduate, you may want to pursue your career in these divisions, and if so, this is where you want to start.

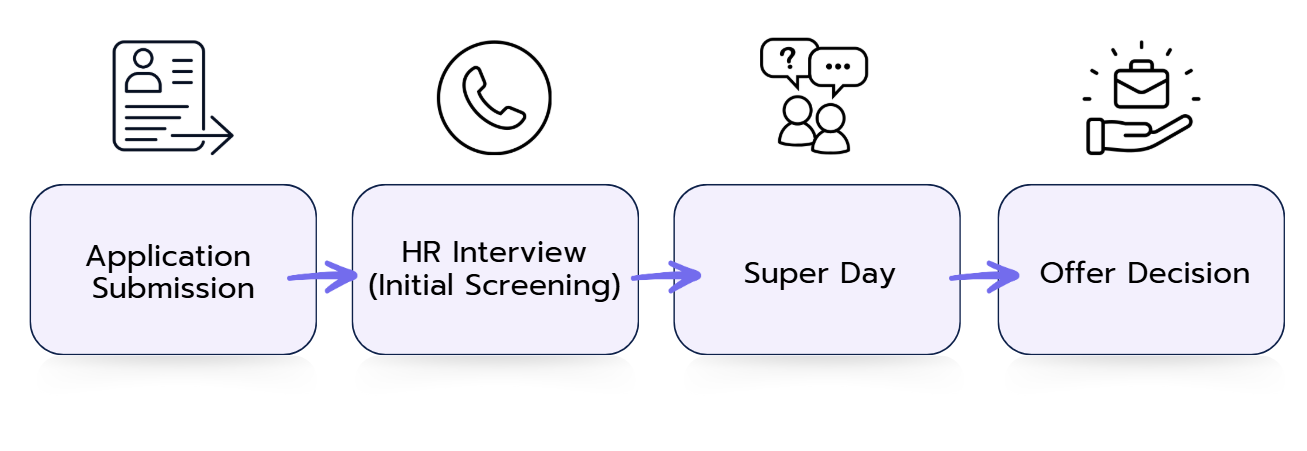

To help you out, we’ll take a look at the complete recruitment process at BNP Paribas, covering the investment banking interview rounds, what you might expect, and how to prepare to get the most out of this opportunity.