ClaimSmart: AI for Next-Gen Health Insurance

Our client is a mid-sized health insurance provider called SureHealth with annual revenues of $2.4 billion. The company has experienced a steady rise in administrative claims processing costs and has seen a recent uptick in fraudulent claims. Senior leadership believes that leveraging AI in the claims assessment process could have significant benefits.

They have allocated a budget of $10 million over the next three years to implement AI solutions, but they are uncertain how to prioritize to reduce fraudulent claims and administrative processing costs.

Case Comments

Instructions --> Please read before going through the case

- This case is a typical McKinsey-style case in terms of design, difficulty, and evaluation.

- However, it is also well-suited for candidate-led practice. If you are the interviewer, simply start with the prompt, then stop providing guiding questions unless the candidate gets stuck.

- The case should be completed within 25 minutes. As the interviewer, ensure the discussion stays on track to meet this timeframe and provide guidance and shortcuts if necessary.

- If you are the interviewer, make sure to work through the case yourself beforehand to ensure you’re fully prepared to guide the candidate.

- The case includes very detailed interviewer notes. Please reach out if you want to use a real MBB feedback sheet with some explanations to score the performance realistically.

Further Case Information (for follow-up questions)

If the candidate asks for clarification of the objective and more details on the business model, provide the following information:

- Clarify objective: Invest $10 million into AI to generate a high return in terms of reducing claims processing cost and fraudulent claims

- Learn more about the business model of the company:

- Customers: Primarily small-to-medium businesses (employer-sponsored plans), plus some individual/family policies.

- Revenue and cost model:

- Revenue: Monthly premiums (main driver) and administrative fees for self-insured employer plans.

- Cost: Medical claims (largest expense) and administrative overhead (claims processing, compliance, etc.).

- Distribution channels: Direct online/phone sales and broker networks for employer groups.

- Competitive edge: Emphasis on flexible coverage options, broad provider networks, and customer-centric service.

Q1 - Brainstorming

You arrive at the client site on your first day with the new engagement, get your badge at the reception desk, then enter the elevator to find your team room high up in the building.

A senior employee enters the elevator, looks at your badge and says: “Ah, you must be from the consulting team – my name is Josh, I am the CTO here.” Your pulse goes up and you introduce yourself. “Pleasure to meet you” he replies and immediately proceeds to ask you a question: “Looking forward to the collaboration. Well, actually, what do you think? Considering the entire claims lifecycle – from initial submission to payout - where do you believe AI can have the greatest impact on driving efficiency and reducing fraud?”

In a nutshell, you are asked to brainstorm ideas on AI use cases in the client’s context.

Q2 - Framework

Once the whole team has arrived and settled into their team room, they begin their first problem-solving session of the day in preparation for the upcoming client meeting after lunch. At this point, the Engagement Manager poses the following question:

“What key factors should SureHealth analyze to determine how to prioritize AI investments in order to reduce administrative claims processing costs and minimize fraudulent payouts?”

Q3 - Exhibit Interpretation

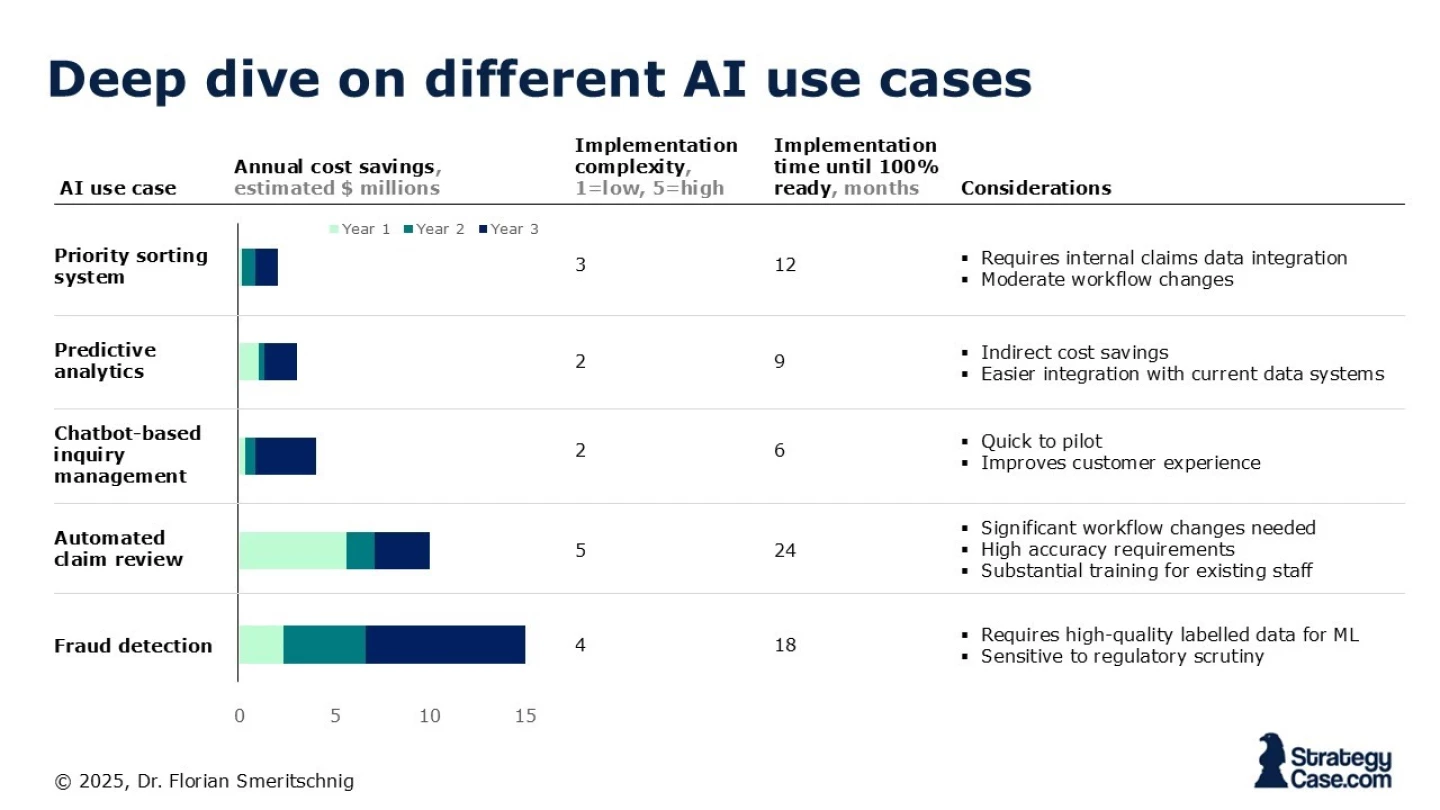

The engagement has progressed and several potential AI use cases have been identified.

Provided with the data from the chart, which AI initiatives should the client prioritize over the next three years to minimize fraud and reduce claims processing costs, given their $10 million budget and implementation constraints?

Q4 - Math Problem

The health insurance provider processes $1.6 billion in total claims each year. Approximately 5% of these claims are fraudulent, resulting in millions of fraudulent payouts annually.

The team and the client have jointly agreed to implement a new AI-driven fraud detection system and focus on this first (due to staff training issues related to the claim review). This newly developed system, which was not on our radar so far, costs $12 million in upfront implementation expenses (thereby exceeding the initially planned budget) and promises to reduce the fraudulent claims rate from 5% to 4.5%.

Assume that after the system is deployed there are $2 million fixed costs and around $0.3m variable costs per year and the fraud reduction benefits will be fully realized starting in the first year of operation.

How long does it take for the company to recoup its $12 million investment, based on these savings?

Q5 - Recommendation

On the night before the final SteerCo meeting, you're in the elevator at 10 PM, finally heading home. As the doors start to close, someone calls out, "Wait for me!" It's Josh, the CTO. He steps in and says, "I’m looking forward to your findings tomorrow. Can you give me a sneak peek of what you’re going to talk about?"

Provide a brief recommendation based on your findings for the 60 second elevator journey.