Learn the case interview basics, practice with 200+ cases, and benefit from extensive test materials, and interactive self-study tools.

Company case by thyssenkrupp Management Consulting

tkMC Case: Portfolio optimization of a holding company

7.0k

Times solved

Intermediate

Difficulty

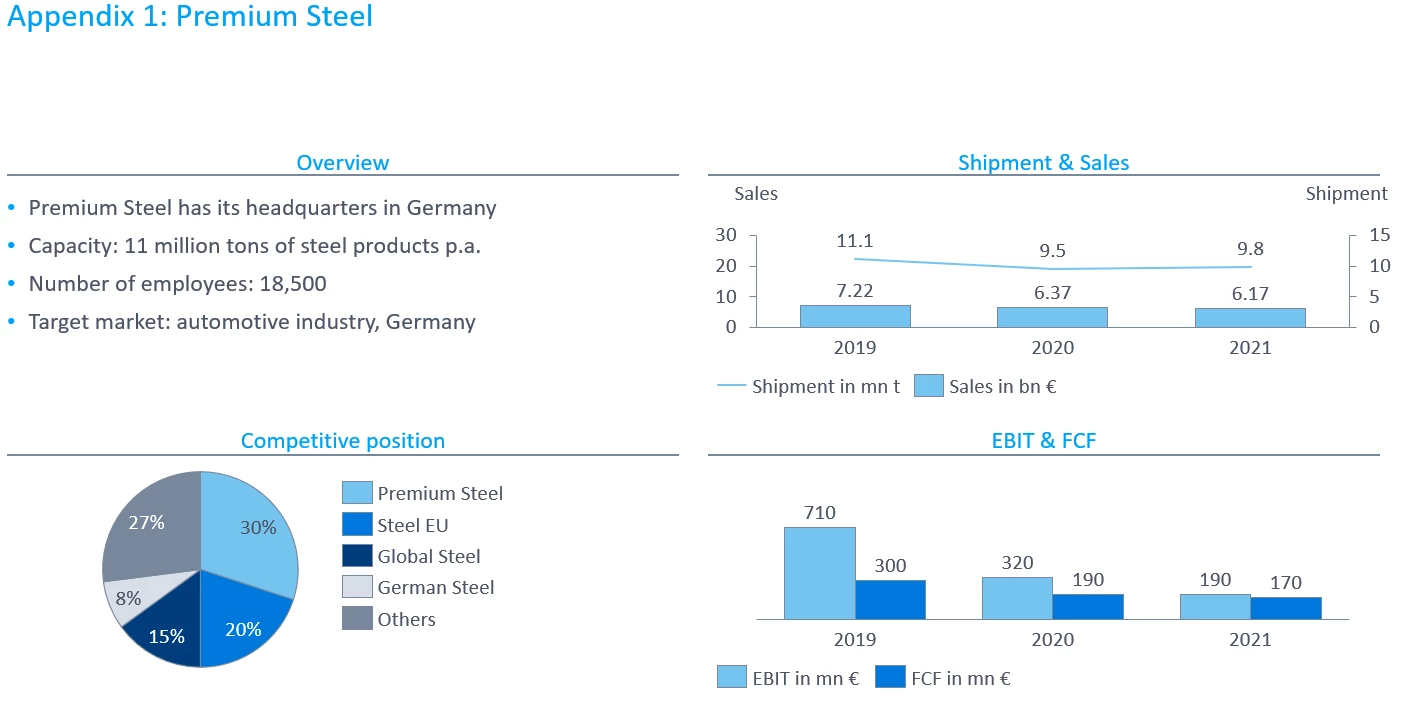

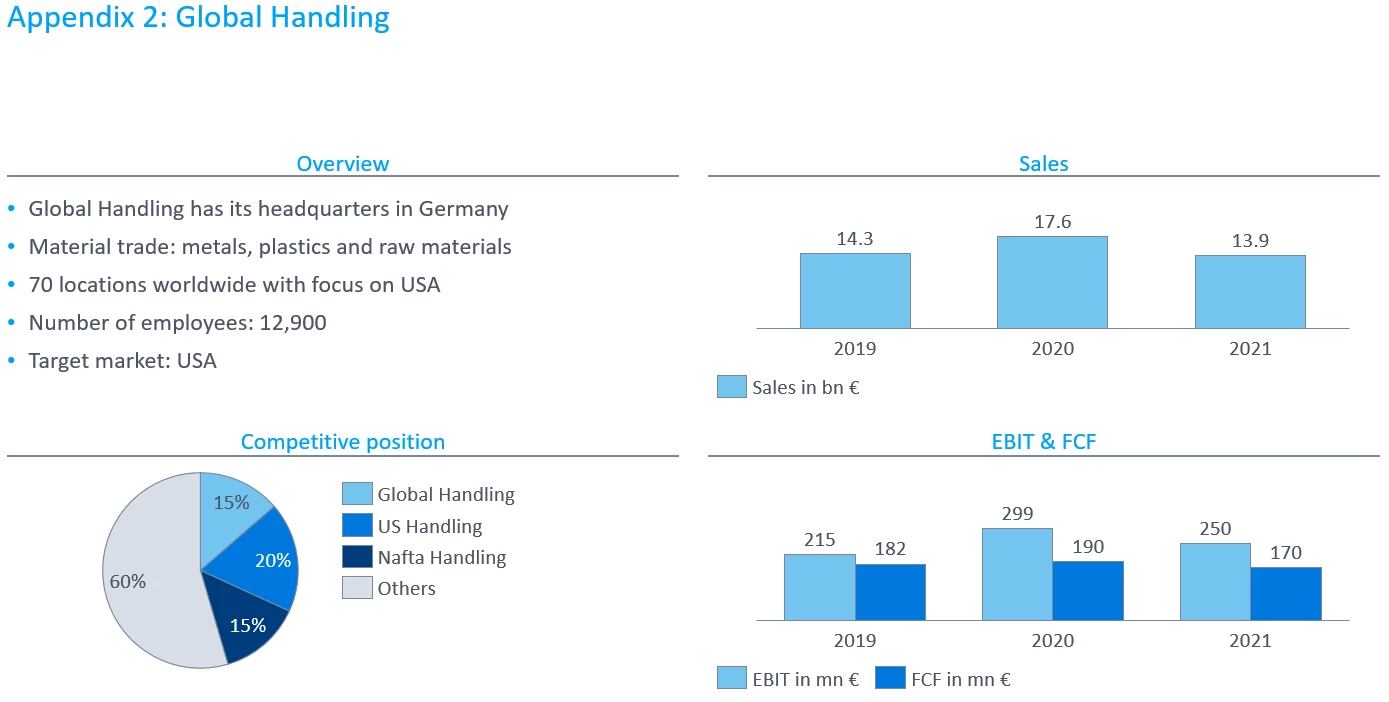

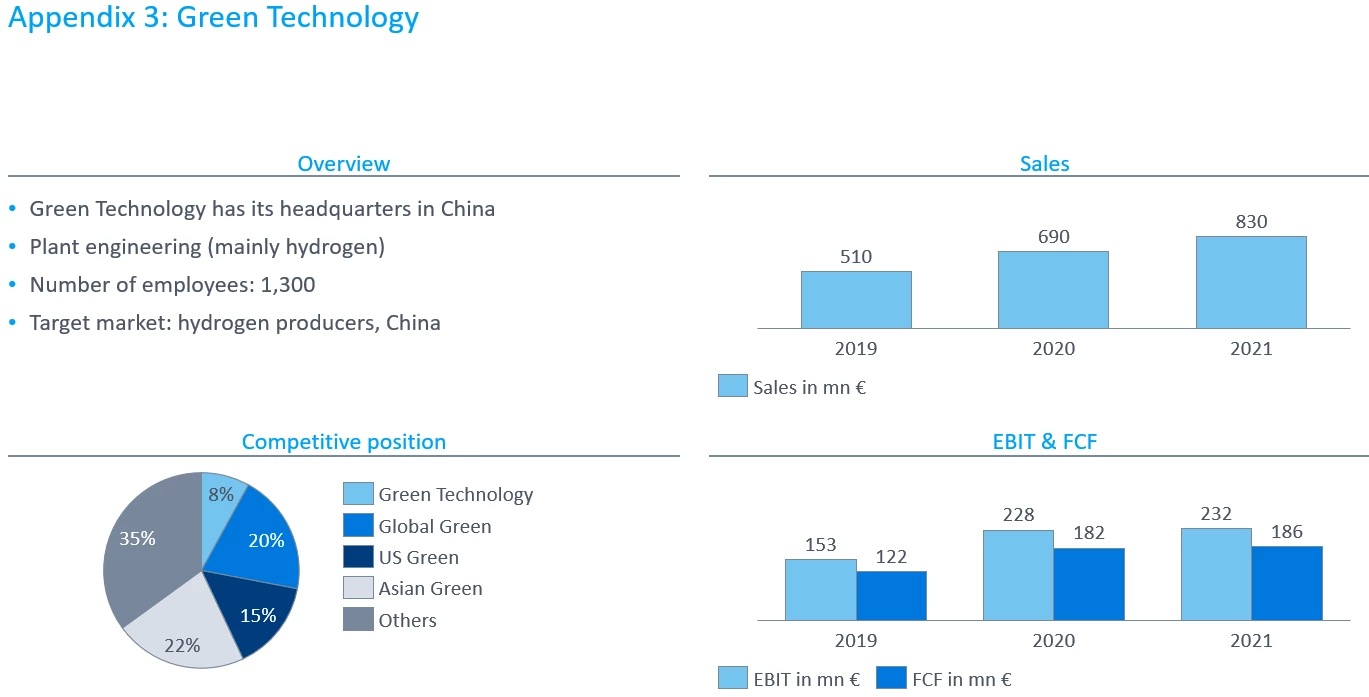

Your client is a holding company that has three larger companies in its portfolio. The successful portfolio has developed very dynamically over the last two years and the companies are facing different challenges. The management takes this situation as an opportunity and wants to carry out a portfolio optimization. As a consultant, you are first asked to carry out a portfolio analysis and then to prepare recommendations for action for the portfolio decisions.

1A. What information about the companies would you be interested in to perform a portfolio analysis?

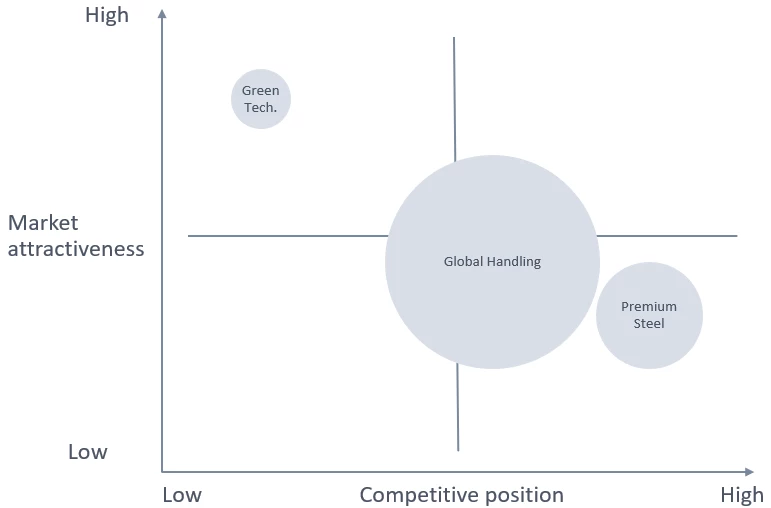

1B. How would you rate the three companies in terms of their market attractiveness and competitive position?

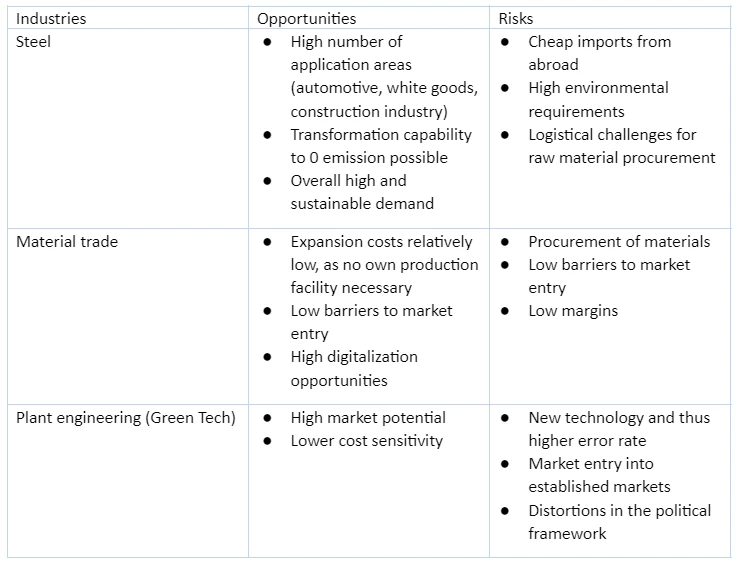

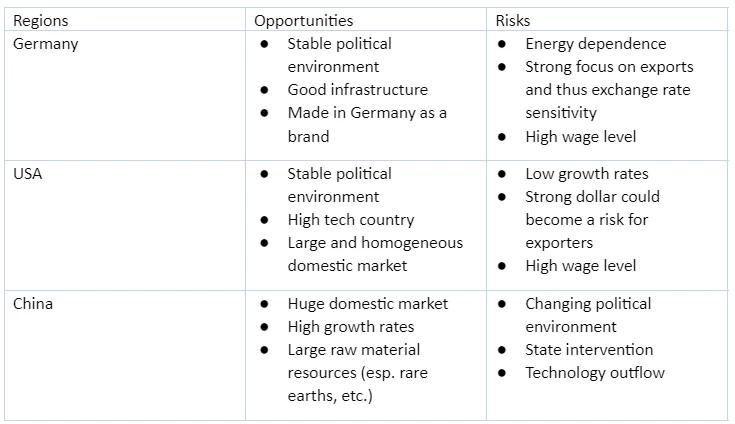

1C. What are key opportunities and risks of the companies' different industries and target markets? (Advanced)

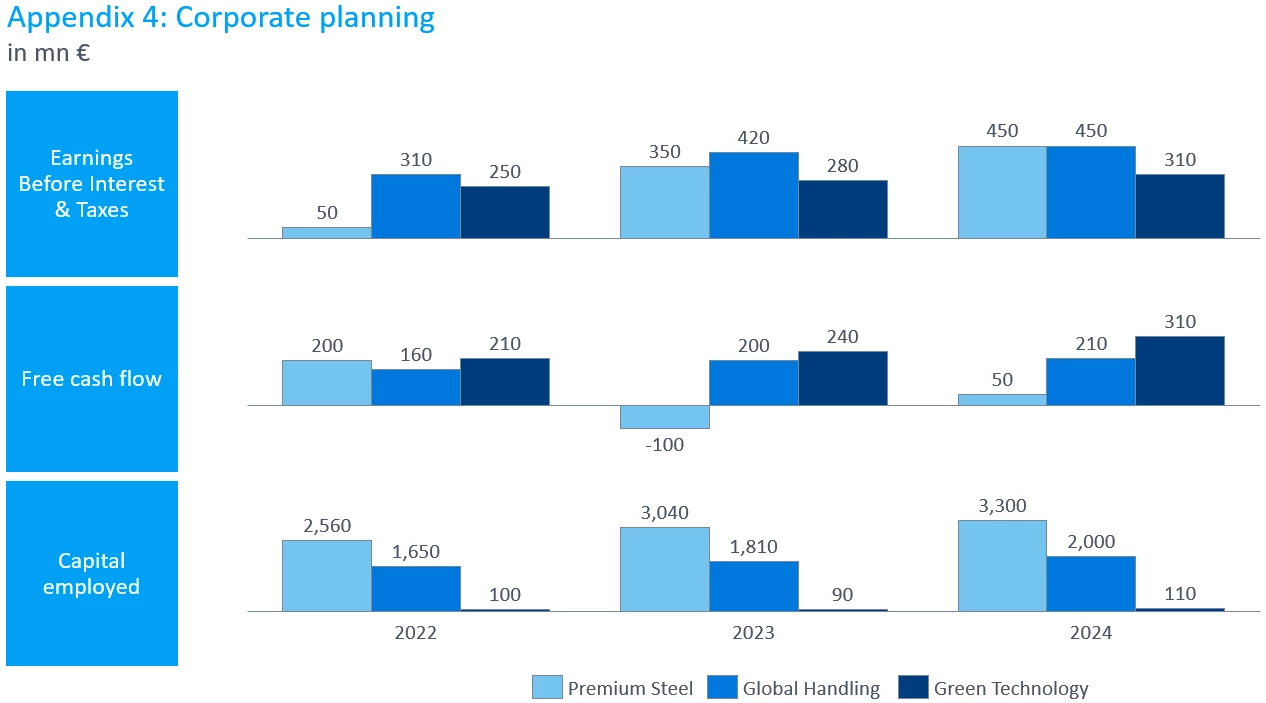

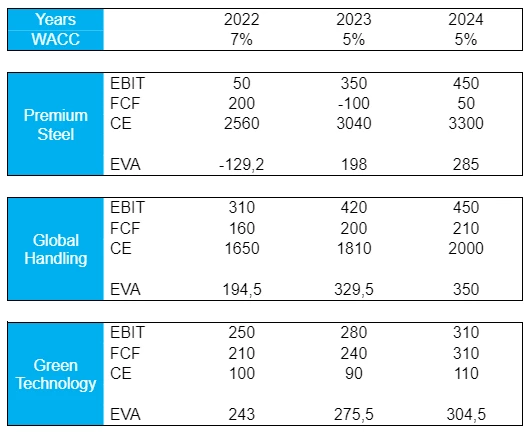

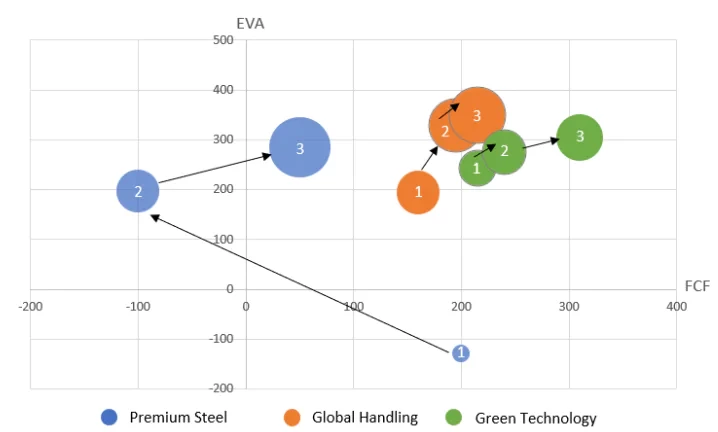

2A. Determine the economic value added (EVA) of each company. How do you assess the companies in terms of their development potential?

2B. Visualize the results together with the companies' cash contribution and draw conclusions.

3. The management board of the holding company would like to have a final presentation. What are your recommendations regarding the individual companies?

7.0k

Times solved

Intermediate

Difficulty

Do you have questions on this case? Ask our community!