Market entry: Disrupting the New York - Boston railway industry

Currently, there is only one train company operating the Boston – New York route: AMTRAK. The option of traveling by train between the two metropolis is gaining traffic, particularly in winter times, during which it´s the best way to avoid weather-related delays. Furthermore, it´s the most environmentally friendly of all available options.

Your client is a powerful investor who is assessing business options in the US (with investment sizes averaging 100M$), and has approached you for advice on starting a new train operation company to compete against AMTRAK.

In particular, she wants to start by opening a new service between New York and Boston. Should the investor go ahead and launch the business?

Case Comments

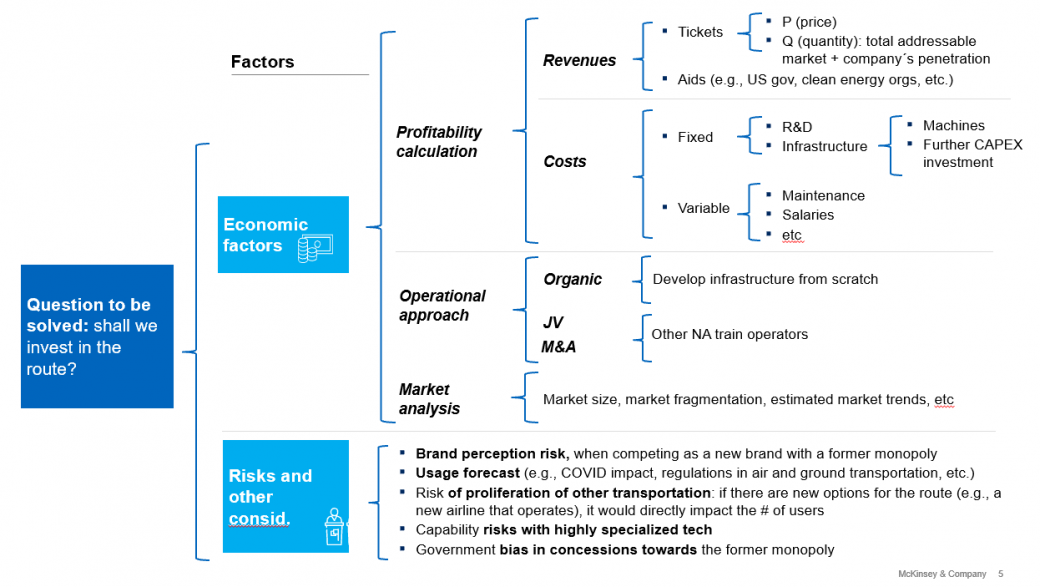

Question 1 – Structuring

Should the investor go ahead and launch the business: a new train connection between New York and Boston?

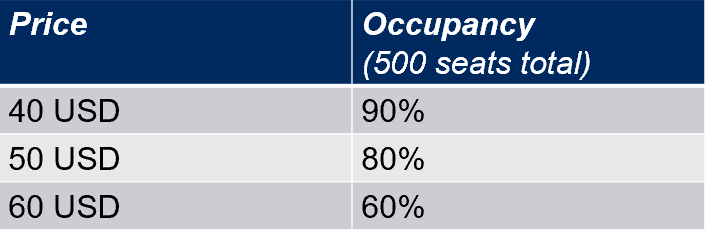

Question 2 – Math

Now that we have structured our problem, let´s help our client to determine profitability for this venture. The first step will be to determine the price for each ticket.

Question 3 – Math

What is the profitability that our client can expect from this venture?

Final question – Executive summary

You are the business analyst who worked in this project, and who is currently guiding the client to the ExCom meeting with the partners. In the elevator ride (1 minute), she asks you to provide her a quick note on what the conclusions are.