Element Mobile expands into refurbished phones (MBB 2nd round)

Our client, Element Mobile (EM), is the largest German telecommunications provider, with an impressive supply chain comprised of dozens of suppliers, six distribution centres, and hundreds of stores. EM offers a variety of products to its 20 million customers, including sim cards, broadband, phones, and accessories, through its two sales channels, e-commerce and brick-and-mortar stores.

Recently, Element Mobile noticed a decline in the sale of their device bundles. These bundles include a SIM and a phone, which are paid for in 24 equal monthly instalments. Since SIM plans are typically purchased as part of a device bundle, and accessories and broadband packages are usually sold as add-ons, the decline in device bundles has a significant impact on our entire business.

The CEO of Element Mobile believes that this decline is due to a combination of market and consumer preferences, including the reduced discretionary income of consumers and a longer device ownership trend for environmental reasons. The CEO believes that one potential solution to their declining demand is to invest in a phone refurbishing facility that would allow them to offer affordable used devices as part of their phone packages. Such recycling programmes involve the collection, refurbishment, technical inspection, and repackaging of devices.

Case Comments

Question 1:

What factors would you evaluate to determine whether it is a good idea for our client to invest in a phone refurbishing business?

Question 2:

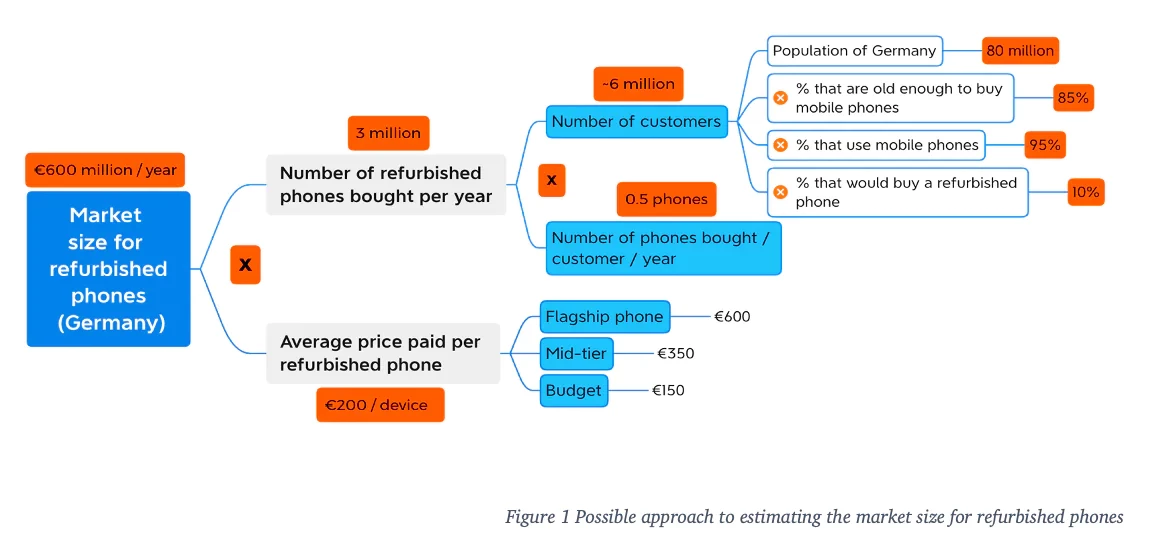

To begin with, we would like to gain a deeper understanding of the demand for refurbished phones in Germany. How would you approximate the market size, in Euros, of this initiative?

Question 3:

The client thinks that the market looks attractive enough for us to consider the opportunity further. We have gathered some data on the expected costs and revenue changes as a result of investing in this facility.

You can assume that:

- The cost of investing in a refurbishing facility amounts to €40m

- We would buy a device for €100 refurbish it for €50 and sell it for €200

- We will sell a SIM contract of €100/year to 25% of the people who buy a device

- You can ignore the variable costs of the SIM plan

- SIM plans last for two years

- Assuming that they will pay for the 2-year contract in advance when they join.

How many customers would we need to reach in order for us to pay back our investment within 2 years?

Question 4:

The client is pleased with your analysis and is considering an investment in this venture. Now that we have a better grasp of the financial aspect, what suggestions do you have for expanding the client's business and increasing their revenue?

Question 5:

Based on everything we have analysed, what would you advise the client?