Learn the case interview basics, practice with 200+ cases, and benefit from extensive test materials, and interactive self-study tools.

Bookl

12.5k

Times solved

Intermediate

Difficulty

Your client, Bookl, is a publishing company with stable sales in terms of both volume and price.

Its distribution warehouse is reaching maximum capacity. This has lowered its service quality.

The head of Bookl’s distribution department wants to extend the warehouse. The extension will cost $15 m and will NOT increase the company’s revenues.

The CEO wants your company to determine whether the investment is necessary.

Case Comments

I. Background - Part 1

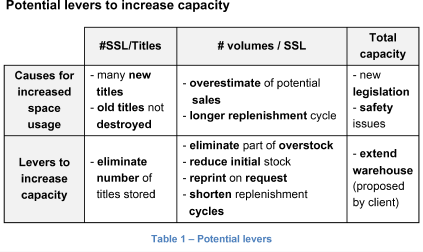

1. Why could the warehouse be reaching its maximum capacity?

I. Background - Part 2

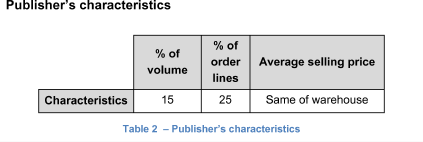

2. How would you determine which publishers Bookl should stop serving?

II. Cost - Part 1

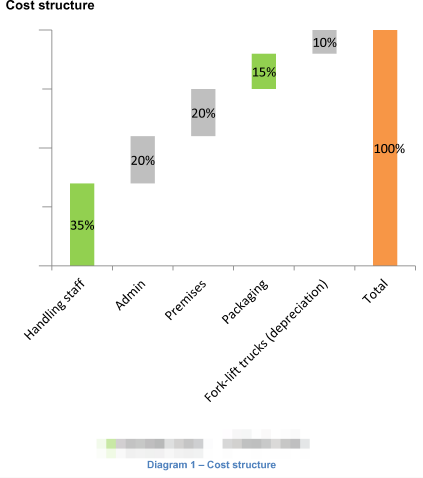

3. If Bookl stops serving a particular publisher, how would you determine the impact of this action on the warehouse’s P&L statement?

II. Cost - Part 2

4. What are the main drivers of the company’s variable costs?

III. Options - Part 1

5. Third-party publishers pay your company 10% of a book’s price. How would you determine which publishers to remove?

III. Options - Part 2

6. If we terminate this publisher, how will it affect our profit?

IV. Conclusion

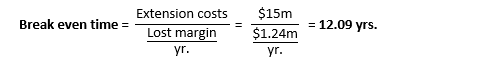

7. Since removing this publisher reduces our profit by $1.24m every year, is it better to remove this publisher or to build the extension?

Video Solution

12.5k

Times solved

Intermediate

Difficulty

Do you have questions on this case? Ask our community!