Russell University - Fresh Attacker on the Online Education Market (McKinsey 1st round)

Russell University, located in the United Kingdom, is one of the oldest and most prestigious universities in the world. They have been educating students for more than two centuries and provide a variety of undergraduate and graduate STEM-focused courses.

In an effort to increase revenues and expand their reach, the university has recently begun offering three online postgraduate qualifications. Despite the quality of teaching and effort spent in developing these courses, the response from students in terms of sign-up rates has been modest. Russel University executives believe they are acting too slowly since other prestigious universities, particularly in the US, have successfully leveraged their brand to offer short and affordable online courses to a variety of people.

Russell University has hired us to determine whether they should acquire Eduline, a well-established platform that offers STEM-related short courses to its subscribers. The university intends to use Eduline to offer courses on a subscription basis and will then issue online certificates to individuals who successfully complete its courses.

Question 1

What factors would you evaluate to determine whether it is a good idea for Russell University to acquire Eduline?

Question 2

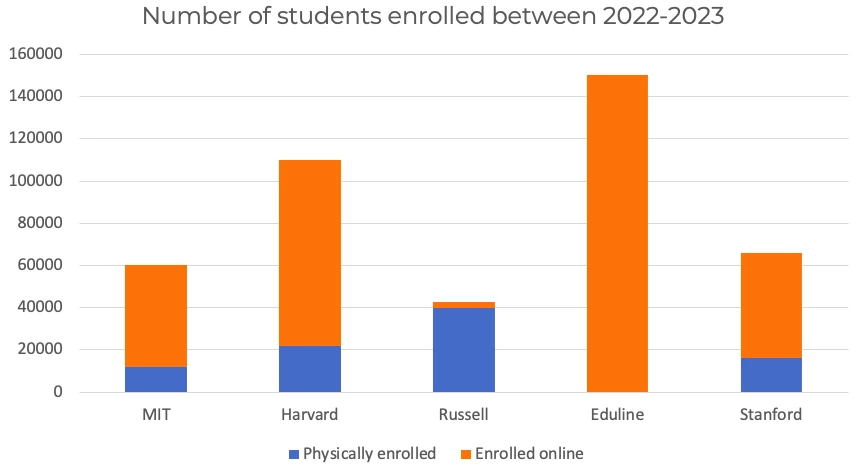

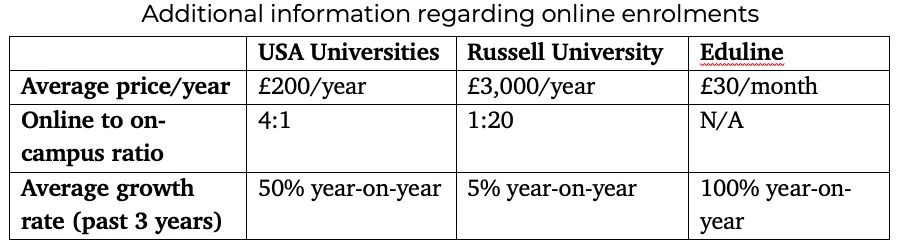

Your colleagues undertook a market analysis to give you a better idea of the competitive landscape (Exhibit 1 and Exhibit 2). What can you conclude from this information?

Question 3

The client would like to do a more thorough financial analysis to help them evaluate how much they should pay to acquire Eduline. Your colleagues came up with the following estimates to help you in your analysis:

- Eduline has an estimated number of 150,000 monthly paying users, and we expect that our brand will grow the user base by 20% year-on-year.

- The cost of integrating the platform with our existing digital infrastructure is £40m.

- There is an additional cost of £500,000/month to maintain the platform and create new and engaging materials.

What is the maximum value Russell University could pay for Eduline and still recover their investment in 3 years?

Question 4

Now that we've considered the financial ramifications, the client wants to know what potential risks are associated with the acquisition of Eduline and what solutions they could implement to mitigate these risks.

Question 5

The client believes they have a comprehensive understanding of the benefits and potential risks of acquiring Eduline. However, they wonder if it would be more prudent to increase the cost of their degrees rather than pursue the Eduline acquisition. UK universities charge two rates for their tuition fees: a government-set home rate of £9,250 per year for British students, and an international rate which they are free to set as they please.

We would like to know much do we need to charge international students to match the expected profitability of acquiring Eduline?

Here is some additional information to help you with your analysis:

- We are only looking to change the pricing of our undergraduate degrees

- The university has 30,000 undergraduate students, out of which 40% are classed as international students

- The expected annual profitability of Eduline is £48m

- We currently charge international students an average of £16,000 per year, and our profit margin on their fees is 50%

Question 6

What would you recommend to the client in light of everything we have analysed?

This case has been developed to reflect some of the recent cases given in McKinsey interviews over the past year - particularly focusing on new, innovative business models that seek to push the candidate's thinking and test their understanding of what problems consulting clients currently face.