Digital Lab at LETA Bank (McK/BCG Digital)

Let’s assume our client is LETA Bank, a large Central European bank with around 3M customers and within the top five banks in the mid-sized European country where it is operating. In a recent benchmarking exercise led by the European banking group that owns the bank, LETA Bank appears to be underperforming relative to competitors in terms of its personal loan sales. Our objective is to support LETA Bank in identifying the root cause of its underperformance and to develop a strategy for addressing it.

The bank recently hired a new CTO who is excited about working with us and whose hypothesis is that the bank is currently lagging behind in terms of its digital assets and products, which makes it fall short of customer expectations, thus leading to lower sales across its product groups and especially in its most popular lending product – the personal loans.

Case Comments

Question 1

What are the factors that you would like to investigate in order to test the CTO’s hypothesis?

Question 2

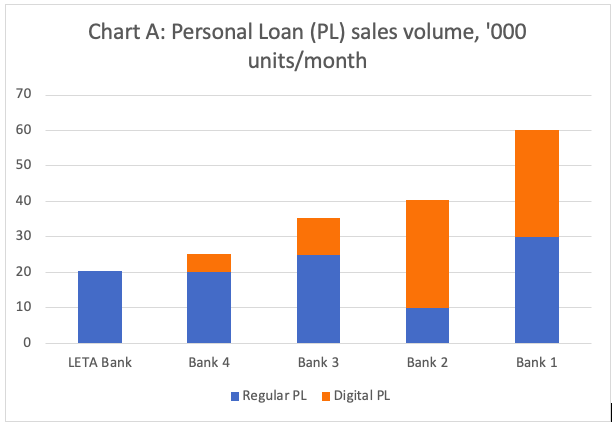

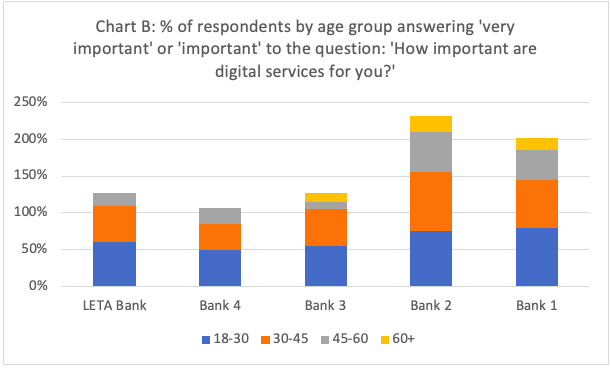

The client shared with us some further data from the benchmarking exercise, looking at the sales of personal loans within the top five banks, as well as results of a customer survey study ran by a different consulting company on the customer preferences for digital services. What are some of the insights that you can draw based on these graphs?

For context, a digital personal loan is a personal loan that is provided online via browser or app. Customers may prefer it because it is faster, more streamlined and does not require them to visit a branch. Some banks in the industry might also have faster pre-approvals for digital personal loans which customers often find attractive.

Question 3

What is the annual profitability increase that LETA Bank is likely to see if it manages to develop and sell enough digital personal loans to match Bank 3 in terms of overall sales volume? Assume that digital personal loans will cannibalize 10% of the current regular personal loans. Also, assume that the profit margin of a regular personal loan is 5% and that of a digital personal loan is 8 percentage points higher.

Question 4

The CTO is very excited about the results of the analysis and for your confirmation of the potential for a digital product. She is keen to set up together with our team a Digital Lab to begin transforming the bank into a digital banking leader in the country.

What she has in mind is an Agile cross-functional team of analysts, designers, data scientists, developers, consultants, etc. focusing on developing from scratch a new digital product for the bank (the digital personal loan), then aiming to scale their practices and digitize other products, with the end goal of digitizing and transforming the bank as a whole.

She is asking what are some of the main implementation areas that the bank should account for in order to launch the Digital Lab and begin the digital transformation?

Question 5

The CTO finds your approach fair and she is keen to request the necessary resources from the banking group that owns the bank. She would need our support though with analysing in how many years would the bank be able to break even considering the estimated cost of starting the Lab is 8M EUR and it will need to be financed from the additional profits? To simplify, assume that the Digital Lab will manage to develop and launch the product within a year. Sales are then likely to start from the following years at a rate of 5,000 units / month and increase by about 50% every year.

Question 6

The CTO is grateful for the analysis conducted and is now preparing for a meeting with other senior stakeholders at the bank. To pre-empt some of the questions she is likely to receive, she is asking you what are some of the risks to consider with this ambitious overhaul of the bank’s image and value proposition?

Question 7

The CTO would like to hear your selling story for the bank’s digital transformation. Could you provide a quick synthesis of your findings and why the bank should go ahead with the digital program?