Your client is the CEO of a coffin manufacturing company based in Geneva, Switzerland (Europe).

The company has existed with little changes to the business model for three generations, manufacturing high-quality, hand-crafted coffins, with a highly skilled and specialized labor force. The industry has been recently disrupted by new technologies that no longer need human manufacturing: machines can manufacture faster and cheaper.

Your client needs your help in deciding whether to invest in this technology and transform his business, or remain in the hand-manufactured business for coffins

*Note: On top of this initial question that focuses on the strategy and should be tackled by the candidate with an issue tree, the case includes more questions that can be found in the "Detailed solutions" and "Difficult questions" boxes below, with the correspondent proposed answers.

Case Comments

Question 1 – Structuring

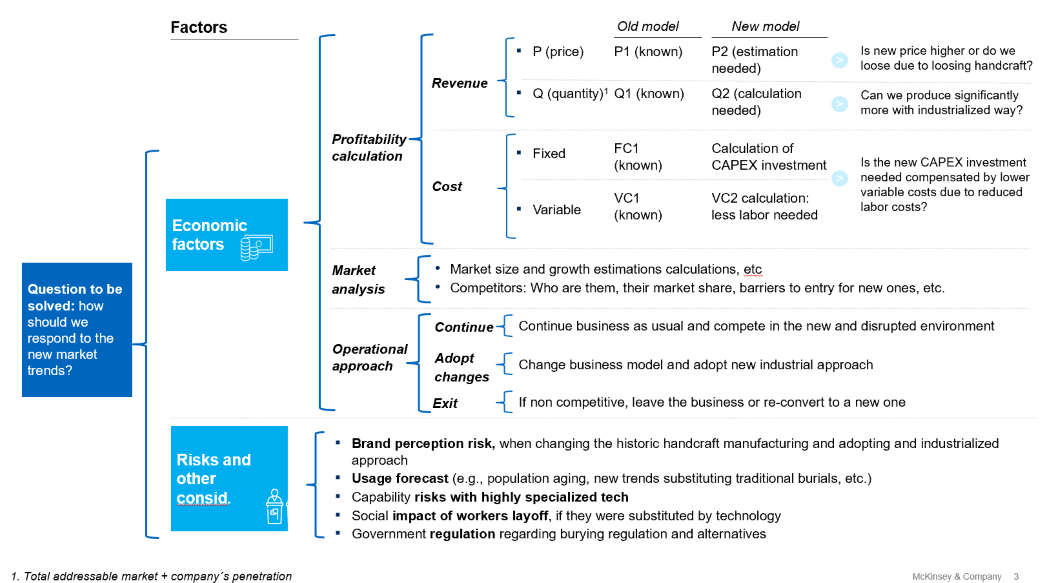

Should your client invest in this technology and transform his business, or remain in the hand-manufactured business for coffins? Which analysis and data would you like to know to help our client?

Suggestion: present as an issue tree or a list

Question 2 – Math

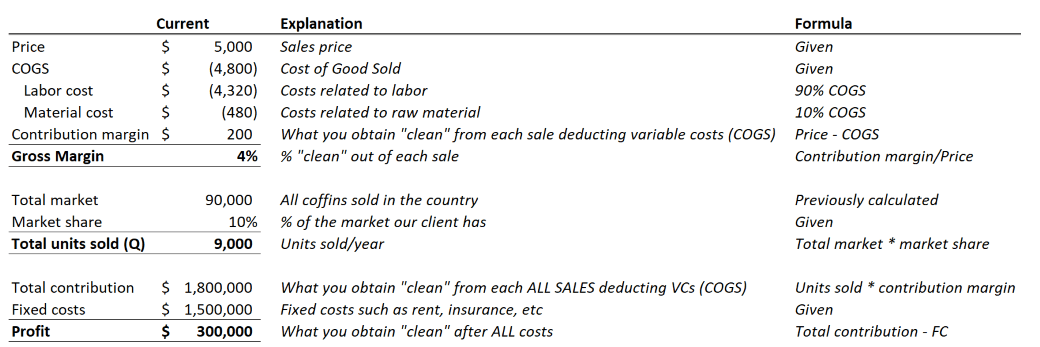

Now that we have structured our problem, let´s start with market estimation. In order to calculate (1) the market size for coffins in Switzerland and (2) our customer´s current production, what data would you need?

Question 3 – Math

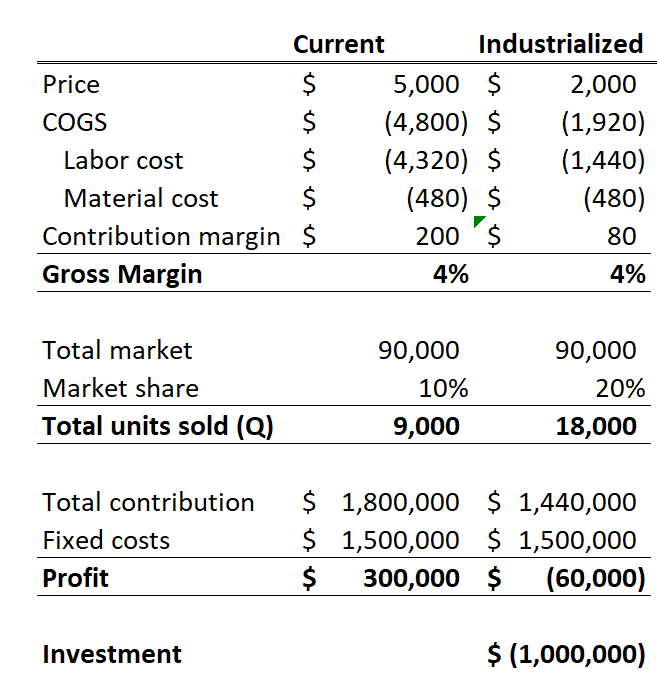

What our client´s business profitability is both with and without the new technology?

Final question – Executive summary

You are the business analyst who worked in this project, and who is currently guiding the client to the ExCom meeting with the partners. In the elevator ride (1 minute), she asks you to provide her a quick note on what the conclusions are.

Further Questions

Extra question I - Value of the business in perpetuity: Now that we know that it´s not worth implementing changes, we would like to understand the value in perpetuity of the business (i.e., what the value is worth if we took into consideration all the future cash flows). What would we need to know about this? What is the perpetuity value?

Note for Interviewer

The candidate must know that we need the discount rate to calculate the value in perpetuity. In this case, the discount rate is 10%.

Extra question II: What would be the value of the company if it were shut down and its assets sold?

Note for Interviewer

Information to be shared with the candidate:

- Book Value of Land: $20,000

- Book Value of Improvements: $80,000

- Years Owned: 48

- Avg. Real Estate Appreciation: 6% per year