Pharma R&D

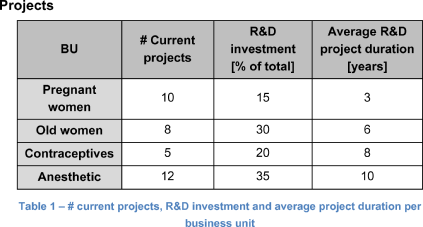

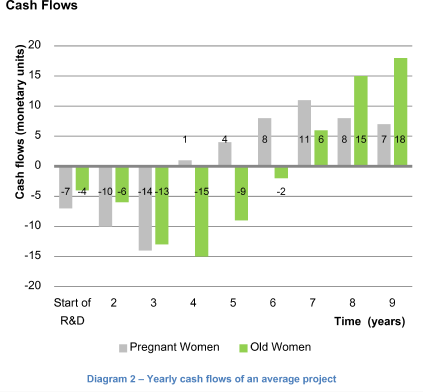

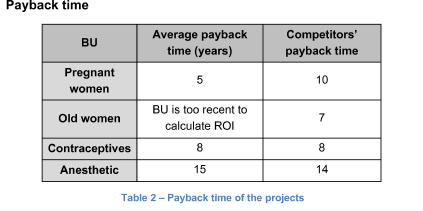

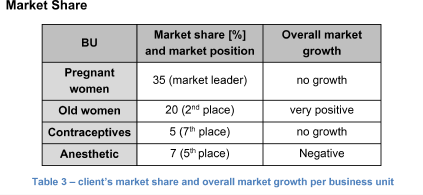

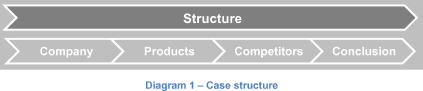

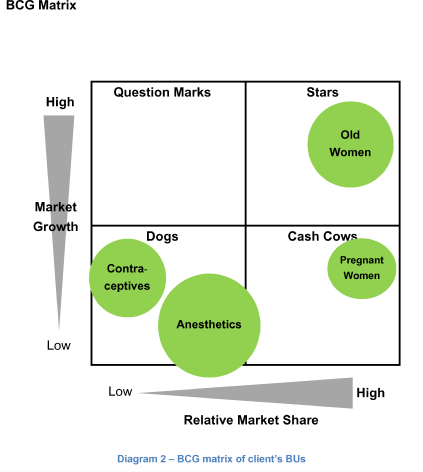

Your client is a pharmaceutical company which is worried about the portfolio optimization of their R&D projects.

They hired us to investigate it and help them make the most return of their R&D investments in the short and mid-term (without totally forgetting the long-term horizon).

How would you go about it and what would you recommend the client to do?

Case Comments

Video Solution

Further Questions

Estimate the market of contraceptives in Europe.

Let the interviewee develop a framework on how to calculate this market. There are many ways, therefore be flexible and open-minded for different approaches.

Estimate the market for medicaments for old women in the U.S.

Let the interviewee develop a framework on how to calculate this market. There are many ways, therefore be flexible and open-minded for different approaches.

Note for Interviewer

More questions to be added by you, interviewer!

At the end of the case, you will have the opportunity to suggest challenging questions about this case (to be asked for instance if the next interviewees solve the case very fast).