Nearshoring - Opportunity study and Business case

Your client is an international Corporate & Investment Bank (CIB). It is France based and has already expanded to Poland (Warsaw), Asia and Americas. Your client now wants to look into the development of the existing hub in Warsaw and is contacting you to help him assess this option. How would you help him?

Case Comments

II. Implementation

Further Questions

1) Why do you think the Bank has a hub in Warsaw?

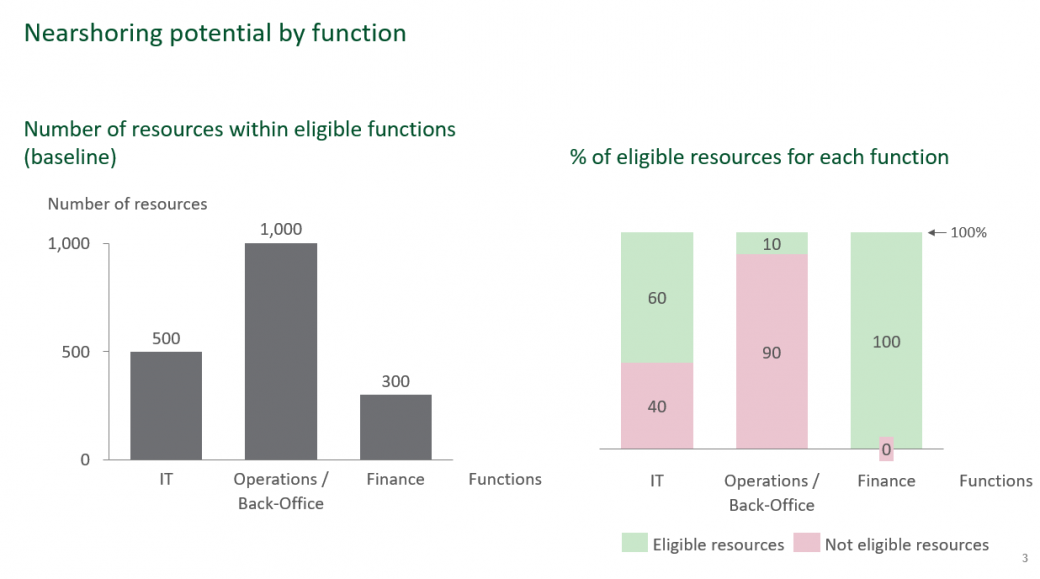

2) What are the most eligible functions for nearshoring in Porto?

3) Do you think that all locations of our client are eligible for nearshoring? What is the location with the highest potential (France, US, Apac)?

4) How to reduce operational risk implied by new staff being onboarded in Warsaw?

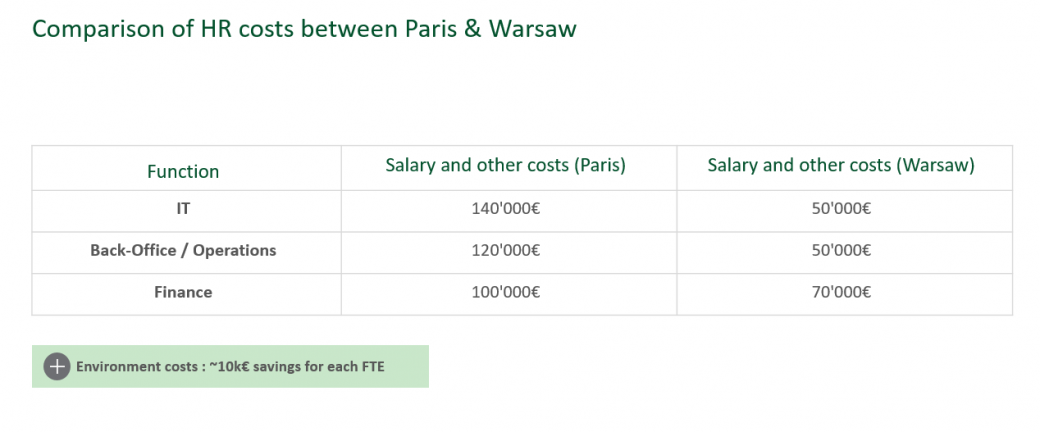

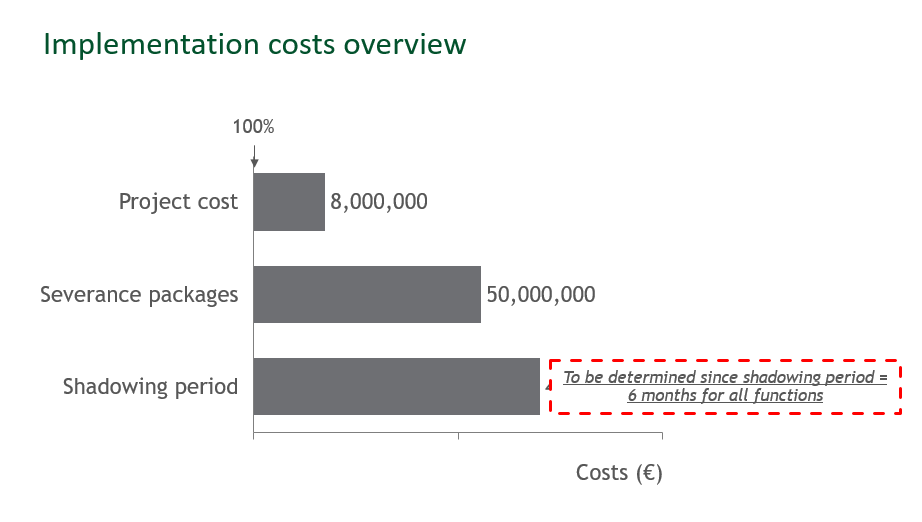

5) What could be the different costs implied by a nearshoring project?

6) What can we do instead of staff lay off?