General Holding

Our client is a French holding company with annual revenues of about €1 billion.

Their portfolio consists of different companies that are mostly in manufacturing industries such as the oil & gas industry and the automotive industry.They do not have a specific investment focus. They prefer to buy the best companies available that are also related to their existing businesses.

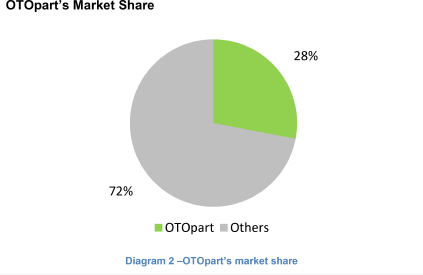

They are thinking about acquiring an auto parts dealer, OTOpart, and want to know whether you think it is a good idea.

Case Comments

Video Solution

Further Questions

If you were OTOpart’s manager, how would you plan to help OTOpart acquire new customers and distribution channels?

This open-ended question tests the interviewee’s creativity.

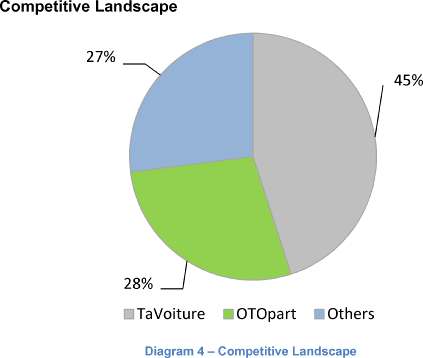

If OTOpart’s main competitor, TaVoiture, aggressively decreases prices in order to gain market share, how would you respond?

This open-ended question tests the interviewee’s creativity.

Note for Interviewer

More questions to be added by you, interviewer!

If the interviewee solves the case very quickly, you can come up with more challenging questions to ask them.