Our client, Soy Technologies specializes in soy production and processing.

The client harvests their soybean crops and processes the soybeans to extract the protein and create soybean meals that are later used for animal feed.

Since the demand for soy protein has been steadily increasing in recent years, our client has been looking at more profitable alternatives to create different soybean products, but our client is unsure about the next steps since they would have to entirely change the current processing operations.

The alternatives that our client is currently considering are:

- Producing soy milk which requires 45% of the extracted protein.

- Producing soy concentrate which requires 70% of the extracted protein.

- Producing soy isolate which requires 90% of the extracted protein.

Our team has been asked to assist them in deciding which option would be best.

Case Comments

Question 1:

SoyTechnologies has been approached by a company specialized in sports nutrition. Their proposal is to create a joint venture focused on soy protein products.

The CEO of SoyTechnologies believes that the joint venture is a great idea. However, she is concerned that she does not know anything about sports nutrition.

What do you expect to be the most relevant factors for consumers of sports nutrition products that are plant-based?

Question 2:

The CEO of SoyTechnologies believes that the joint venture is a great idea and is enthusiastic about this opportunity. However, there are many different types of products out there.

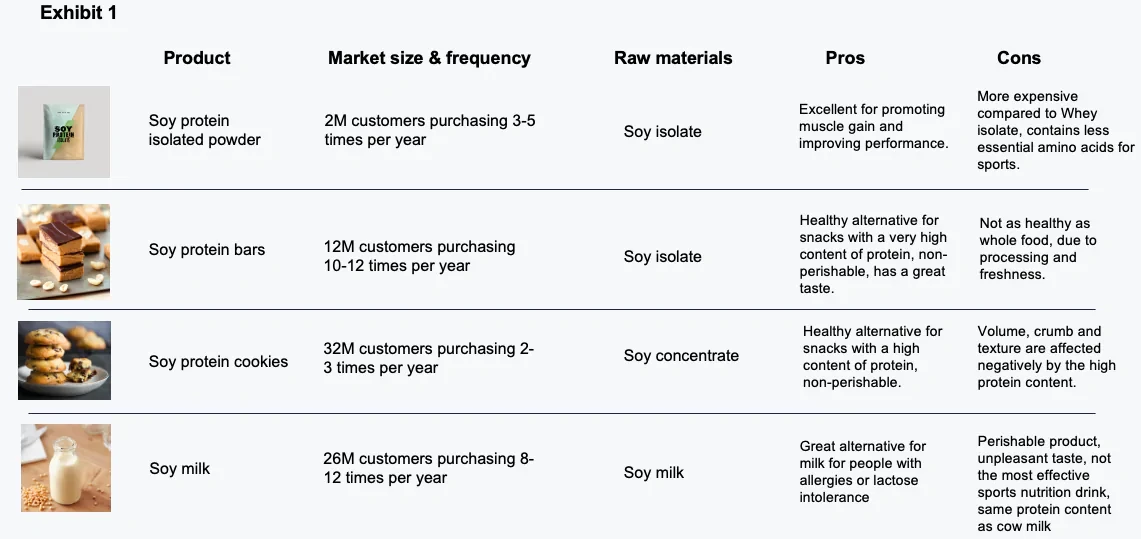

The team has looked at the results of a recent research done in South America and came across the following data (Exhibit 1).

What product should the new Joint Venture focus on?

Question 3:

The CEO of SoyTechnologies is intrigued by the product options and would like to know more about how our profitability would look like if we were to manufacture soy protein bars. We have gathered more data on our current production and the potential demand of the product.

Based on the given data, what profit can the CEO expect from this product?

Additional information:

Soybeans harvested per acre: 2,000kg

Number of acres: 80 acres

Protein Yield: 80%

Weight per pack: 0.5kg

Raw material costs: $20 per box

Harvest costs: $3.12M

Expected sales price: $40 per box

Question 4:

The CEO of SoyTechnologies has decided to move forward with the Joint Venture.

Therefore, she asked our team to calculate how many years it will take for the new established company to break-even?

Data:

Yearly revenue: $10M

Yearly costs: 80%

Building of production facility: $1M

Equipment & machinery costs: $6M

Other costs: $5M

Question 5:

What is your final recommendation for the client?