Hello everyone,

I recently came accross a case with an ROI computation (with multi-year cashflows) and was wondering what would be the proper/best method for it, especially how to factor in the time value of money.

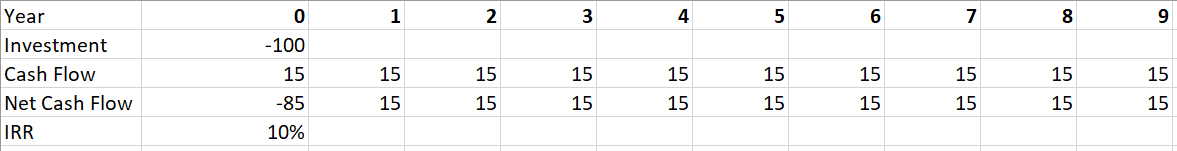

Indeed, here, we had an initial investment of 100MUSD and a cashflow of 15MUSD every year during 10 years (starting year 0).

What would be the best method for computing the ROI :

(i) simply sum up all 10 years cashflows WITHOUT considering time value of money (10 x 15 MUSD - 100MUSD of initial investment), divided by investment (100 MUSD) => 50% ROI ;

(ii) or factoring in the time value of money, by "discounting" the several Cashflows , deriving an NPV and dividing this NPV by initial investment. Here, it means we have to determine the right discount rate for discounting.

Indeed, I would rather go for first approach, but that seems quite "incomplete" since we have multiple years cashflows, and time is not taken into account.

The next step in the case is then to compare several projects and pick the best one. Here, we have 2 projects with same ROI (based on method (i)). However, the timespan of the cashflows are not the same (first project -> cashflows spread over a period of 5 years, second project -> cashflows spread over a period of 10 years). I this case, I would rather go for the 1st project (the sooner the cashflow, the better).

Thank you.

Best,

Clara