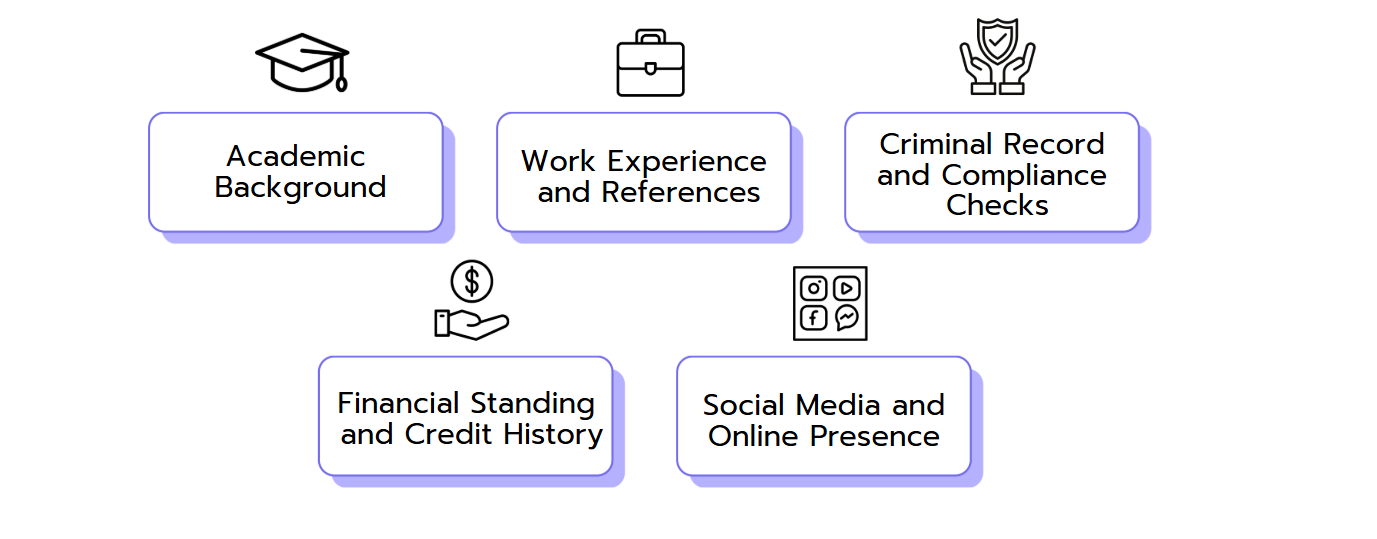

In high-profile industries like consulting and finance, technical skills alone aren’t enough. Companies look for candidates who are reliable, trustworthy, and professional – after all, you’ll be working with sensitive data, large financial transactions, and often directly with important clients. That’s why your academic background, work experience, and personal integrity matter just as much as your analytical skills.

To ensure that candidates meet these standards, many companies conduct a background check before making a final hiring decision. This process verifies the accuracy of your resume, confirms relevant degrees, and checks for any potential red flags in your professional or legal history. Background checks typically take place at the end of the hiring process – once you’re already close to receiving an offer.